View Full Picture

Over the previous 12 months Schneider’s market capitalisation has risen by over a 3rd, to round $140bn. It’s not the one maker {of electrical} gear that’s booming (see chart 1). The market worth of Hitachi, a Japanese conglomerate, has tripled for the reason that begin of 2022, thanks partially to the fast enlargement of its power-equipment division. After a troublesome 2023, weighed down by troubles in its wind-turbine division, shares in Siemens Vitality rose by 300% final 12 months, outperforming even these of Nvidia, owing to fast-growing gross sales within the German agency’s grid-technology enterprise. “Electrical energy is a key driver for us,” explains Christian Bruch, its chief govt.

View Full Picture

Scott Strazik, boss of GE Vernova, a power-equipment enterprise that was spun out from the conglomerate final 12 months, sees a “supercycle” within the making. Demand for every little thing from transformers and switchgears to high-voltage transmission cables is being turbocharged. The Worldwide Vitality Company (IEA), an official forecaster, estimates that world funding in grid infrastructure reached practically $400bn in 2024, up from a little bit over $300bn in 2020 and reversing a decline that started in 2017 on the again of slowing demand in China (see chart 2). The IEA forecasts that spending will rise to round $600bn yearly by 2030. What’s behind the surge?

The decarbonisation of electrical energy technology is one issue. Including wind and solar energy, typically in distant areas, requires extending energy traces and investing in {hardware} and software program to assist handle their intermittency. In Britain, the federal government’s ambition to attain a net-zero grid by 2030 has prompted community operators to submit funding proposals amounting to just about $100bn over 5 years. Even in America, the place the incoming president is a climate-change denier, funding in renewable power is predicted to proceed rising within the years forward because of the plummeting price of photo voltaic and wind energy.

Electrical energy’s rising share of power consumption is a second power propelling funding. The IEA forecasts that demand for electrical energy, from each clear and soiled sources, will develop six instances as quick as power general within the decade forward, because it powers a rising share of vehicles, home-heating methods and industrial processes. California alone will want $50bn in electricity-distribution upgrades by 2035 to cost its electrical automobiles (EVs). Mr Strazik of GE Vernova reckons that this shift from “molecules to electrons” is simply getting began.

The world’s whole power wants are additionally persevering with to rise—a 3rd power underpinning rising funding in electrical energy infrastructure. Financial progress, and rising use of air-conditioning, are pushing up demand in growing nations. Goldman Sachs, a financial institution, estimates that India’s grid would require $100bn of funding between 2024 and 2032 as its financial system grows. Rystad, an power consultancy, forecasts that annual grid funding in China will enhance from round $100bn in 2024 to greater than $150bn by 2030.

Spending by tech giants on AI is contributing to rising energy demand, too, flowing via to elevated electrical energy consumption and funding. Some knowledge centres gobble up as a lot power as a nuclear-power plant generates, requiring community operators to improve transformers, energy traces and management gear. To accommodate the expansion of knowledge centres Tokyo Electrical, Japan’s largest energy utility, plans to spend greater than $3bn by 2027 on its infrastructure. The increase in knowledge centres has additionally induced spending by builders on cooling gear and different ancillary electrical gear to rocket.

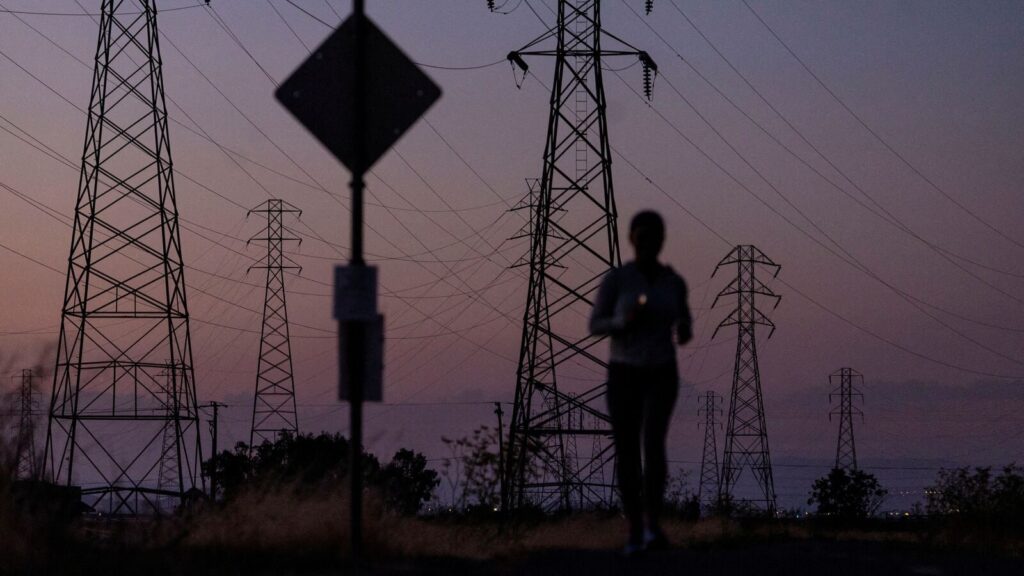

A ultimate power behind the funding surge is grid fortification. Excessive climate occasions, from lethal storms to raging wild fires, are rising extra widespread, inflicting over $100bn in damages worldwide in 2023. Solely abouthalfof that was lined by insurance coverage. In December America’s Division of Vitality supplied a$15bn loanguarantee to PG&E, a Californian energy utility hit onerous by wildfires in recent times, to assist it put money into making its grid extra resilient. Throughout a lot of the wealthy world, electrical energy grids are outdated and creaking. In Europe the infrastructure is over 40 years outdated, on common. “Grid infrastructure was not constructed for resilience however for transmission,” says Mr Bruch of Siemens Vitality.

As investment in grid infrastructure has soared, bottlenecks have emerged within the provide chain. Wooden Mackenzie, one other power consultancy, estimates {that a} world scarcity of transformers has led costs to rise by 60-80percentsince 2020, with ready instances tripling to 5 years or longer. That’s spurring each capital spending and innovation amongst suppliers. Mr Bruch says his agency is investing document quantities to deal with an order backlog that now exceeds €120bn ($124bn). GE Vernova, whose backlog for electrical gear has reached $42bn, has stated it would plough $9bn into capital expenditure and analysis and improvement by 2028. Hitachi’s power enterprise, which additionally has a hefty backlog, has spent $3bn on capital expenditure over the previous three years and plans to spend one other $6bn by 2027, together with $1.5bn in transformers.

Increasing manufacturing capability will go away these corporations uncovered if the electrical energy supercycle seems to be no such factor. Development in EV gross sales has already slowed in lots of wealthy nations. The AI increase might but flip to bust. To reassure shareholders, Andreas Schierenbeck, boss of Hitachi’s power enterprise, says that his firm has been getting huge clients to order capability with upfront funds, and is shifting from customised orders to framework contracts with standardised designs. All this makes future income extra reliable and increasing manufacturing capability much less dangerous.

For now, spending on electrical energy infrastructure reveals no signal of easing, as grid operators grapple with rising energy consumption, a altering technology combine and ageing infrastructure. These pressures will solely enhance, predicts Mr Bruch. “That’s the reason we’re bullish.”

© 2025, The Economist Newspaper Restricted. All rights reserved. From The Economist, printed underneath licence. The unique content material will be discovered on www.economist.com