MACOM Expertise Options Holdings (MTSI) simply made headlines by launching a chipset aimed toward overcoming one of many hardest challenges in trendy information facilities: extending PCIe and CXL connectivity over optical fiber to 100 meters, whereas consolidating a number of alerts for larger effectivity. For tech traders, this offers recent momentum to the story round disaggregated computing, the place flexibility and excessive efficiency are key benefits. Because the business strikes towards architectures that require huge, quick information switch with low latency, MACOM’s new answer may put it on the forefront in an evolving market.

This announcement comes after a 12 months by which MACOM’s inventory has climbed 30%, carrying strong momentum and outpacing the broader expertise sector. Whereas the share value has been regular over the previous month, supported by the corporate’s regular income development and a collection of product bulletins, a lot of the long-term curiosity stems from robust multi-year returns and MACOM’s potential to emerge at key business inflection factors. With information facilities and cloud suppliers focusing extra on effectivity and scalability, MACOM’s continued innovation could also be contributing to investor confidence and shifting danger perceptions.

After a 12 months of outperformance and with a promising product launch underway, the query turns into: is there an actual shopping for alternative right here, or are markets already factoring sooner or later development MACOM may obtain?

Most Common Narrative: 11.7% Undervalued

Essentially the most broadly adopted narrative at the moment values MACOM as notably undervalued, pointing to a spot between present market value and estimated truthful worth.

Ongoing investments in proprietary, high-value R&D and focused M&A (with $735M in money and a web money place) improve MACOM’s potential to quickly innovate for future optical, RF, and mixed-signal purposes. That is anticipated to additional speed up EPS and free money stream development as rising requirements and programs ramp up in coming years.

What fuels this daring value goal? The narrative depends on development assumptions that considerably exceed right now’s revenue baseline, together with a re-rating sometimes seen with market leaders. Curious how these monetary projections examine to typical sector norms, and which particular metrics affect the truthful worth? See what’s behind the optimistic view and uncover if the market is actually lacking the mark.

End result: Truthful Worth of $149.29 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

Nevertheless, execution points on the RTP fab or unstable information heart markets may shortly shift MACOM’s development outlook and problem the present sense of valuation optimism.

Find out about the key risks to this MACOM Technology Solutions Holdings narrative.

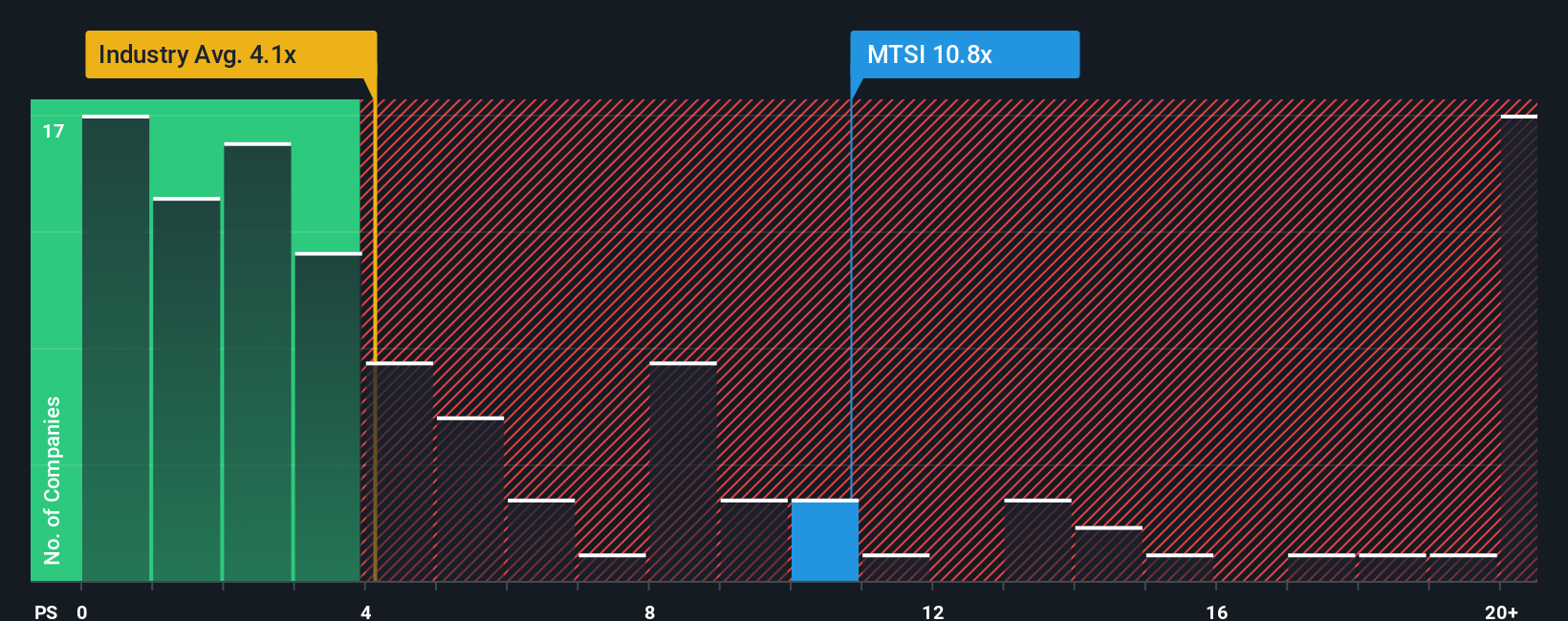

One other View: Costly on Key Ratio In comparison with Friends

There’s a contrasting perspective that makes use of a easy sales-based yardstick as a substitute of development projections. On this foundation, MACOM at the moment appears to be like costly relative to the typical for its U.S. semiconductor business friends. Does this imply the optimistic situation has gotten forward of actuality?

See what the numbers say about this price — find out in our valuation breakdown.

Keep up to date when valuation alerts shift by including MACOM Technology Solutions Holdings to your watchlist or portfolio. Alternatively, discover our screener to find different corporations that suit your standards.

Construct Your Personal MACOM Expertise Options Holdings Narrative

In case you have a unique perspective or need to dig deeper into the numbers your self, you may construct your individual case and private view in just some minutes. Do it your way

An excellent start line is our evaluation highlighting 1 key reward traders are optimistic about relating to MACOM Expertise Options Holdings.

On the lookout for extra funding concepts?

Staying forward means appearing on tomorrow’s developments earlier than the gang. Use these highly effective instruments to uncover standout alternatives and keep away from lacking the following market mover.

- Pinpoint neglected worth as you scan for shares that could be buying and selling beneath their true value by leveraging undervalued stocks based on cash flows in your search.

- Get forward of the curve by recognizing corporations advancing breakthroughs in synthetic intelligence. Begin with AI penny stocks to determine actual AI momentum performs.

- Safe dependable returns by discovering corporations providing sturdy yields and constant funds if you faucet into dividend stocks with yields > 3%.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic information

and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your

monetary state of affairs. We purpose to convey you long-term centered evaluation pushed by elementary information.

Be aware that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials.

Merely Wall St has no place in any shares talked about.

New: Handle All Your Inventory Portfolios in One Place

We have created the final portfolio companion for inventory traders, and it is free.

• Join a limiteless variety of Portfolios and see your whole in a single foreign money

• Be alerted to new Warning Indicators or Dangers by way of e-mail or cell

• Observe the Truthful Worth of your shares

Have suggestions on this text? Involved in regards to the content material? Get in touch with us instantly. Alternatively, e-mail editorial-team@simplywallst.com