What’s Behind the Current Strikes in Gemini Area Station Inventory?

Gemini Area Station (NasdaqGS:GEMI) has caught a number of eyes this week after a dip of simply over 5% in a single day. Whereas there isn’t a main information or clear-cut catalyst driving the transfer, shifts like this have a tendency to make traders interested by what’s behind the motion and whether or not it alerts something greater for the corporate going ahead. With nothing materials within the headlines, it’s an open query if this shift speaks to altering danger perceptions or just the push and pull of the market.

Over the course of the previous yr, Gemini Area Station’s inventory efficiency has been largely flat or trending downward, with the shares seeing a decline of 25% year-to-date. Even wanting again per week, there was a small drop of simply over 1%, reinforcing an image of steadily fading momentum. With no standout occasions or clear income development fueling investor enthusiasm, it’s laborious to pinpoint any surge in confidence simply but.

So, with the value slipping this yr, is Gemini Area Station shaping as much as be a price alternative ready to be unlocked, or is the market already pricing in what lies forward?

Value-to-Gross sales of 23.2x: Is it justified?

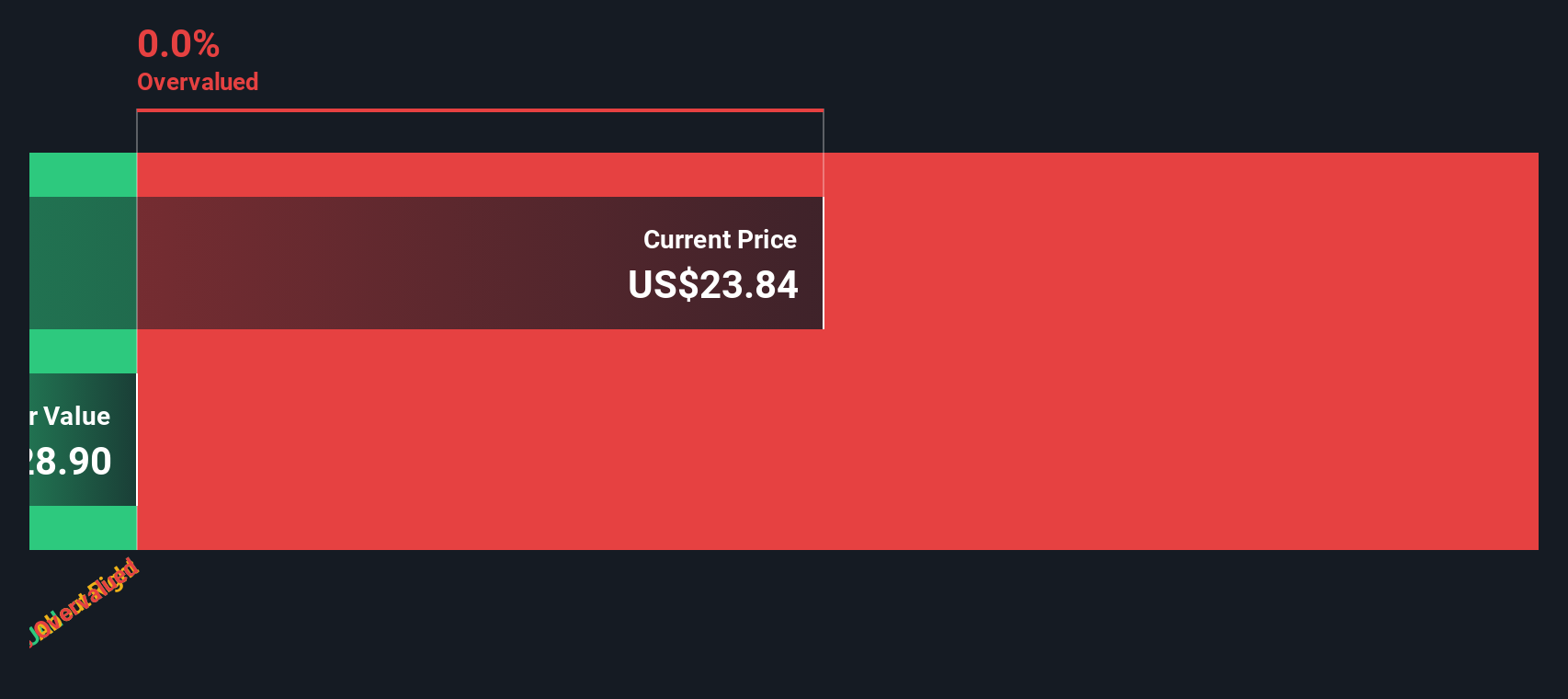

Primarily based on its price-to-sales ratio, Gemini Area Station seems considerably overvalued in comparison with each business friends and the broader US Capital Markets sector.

The worth-to-sales ratio compares an organization’s market capitalization to its complete revenues, serving to traders assess how a lot they’re paying for every greenback of gross sales. This determine is commonly used when corporations are unprofitable, as is the case with Gemini Area Station, since conventional price-to-earnings metrics will not be significant in these situations.

With a price-to-sales a number of of 23.2x, which is considerably greater than each the business common of 4.1x and the peer common of three.2x, the market is pricing Gemini Area Station nicely above comparable corporations regardless of its lack of profitability and comparatively modest income base. Until future income development dramatically accelerates or the corporate demonstrates a transparent path to profitability, this elevated valuation may very well be troublesome to justify.

End result: Honest Worth of $23.84 (OVERVALUED)

See our latest analysis for Gemini Space Station.

Nonetheless, if Gemini surprises with improved profitability or if business developments shift, the present valuation might shortly seem much less stretched than it appears at this time.

Find out about the key risks to this Gemini Space Station narrative.

One other View: What Does a Money Circulation Mannequin Counsel?

Gemini Area Station via the lens of our DCF mannequin, there merely will not be sufficient dependable knowledge to succeed in a conclusion about its true worth proper now. When one strategy comes up clean, this presents a problem for traders.

Look into how the SWS DCF model arrives at its fair value.

Keep up to date when valuation alerts shift by including Gemini Space Station to your watchlist or portfolio. Alternatively, discover our screener to find different corporations that suit your standards.

Construct Your Personal Gemini Area Station Narrative

In the event you see issues in another way or need to study the numbers in your phrases, it’s straightforward to form your personal perspective in just some minutes. Do it your way

An excellent start line to your Gemini Area Station analysis is our evaluation highlighting 1 key reward and 4 important warning signs that might influence your funding determination.

On the lookout for Your Subsequent Profitable Thought?

Why let robust alternatives slip by? See what else may very well be working for you proper now by leaping into these tailor-made inventory shortlists curated by Merely Wall Avenue:

This text by Merely Wall St is common in nature. We offer commentary primarily based on historic knowledge

and analyst forecasts solely utilizing an unbiased methodology and our articles will not be meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your

monetary scenario. We goal to convey you long-term centered evaluation pushed by elementary knowledge.

Notice that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials.

Merely Wall St has no place in any shares talked about.

New: Handle All Your Inventory Portfolios in One Place

We have created the final portfolio companion for inventory traders, and it is free.

• Join a limiteless variety of Portfolios and see your complete in a single foreign money

• Be alerted to new Warning Indicators or Dangers through e-mail or cell

• Monitor the Honest Worth of your shares

Have suggestions on this text? Involved in regards to the content material? Get in touch with us immediately. Alternatively, e-mail editorial-team@simplywallst.com