If we need to discover a inventory that would multiply over the long run, what are the underlying traits we should always search for? One widespread method is to try to discover a firm with returns on capital employed (ROCE) which might be growing, together with a rising quantity of capital employed. Should you see this, it usually means it is an organization with an amazing enterprise mannequin and loads of worthwhile reinvestment alternatives. So after we checked out NXP Semiconductors (NASDAQ:NXPI) and its development of ROCE, we actually preferred what we noticed.

What Is Return On Capital Employed (ROCE)?

Simply to make clear if you happen to’re not sure, ROCE is a metric for evaluating how a lot pre-tax earnings (in proportion phrases) an organization earns on the capital invested in its enterprise. To calculate this metric for NXP Semiconductors, that is the method:

Return on Capital Employed = Earnings Earlier than Curiosity and Tax (EBIT) ÷ (Whole Belongings – Present Liabilities)

0.16 = US$3.3b ÷ (US$25b – US$4.4b) (Based mostly on the trailing twelve months to June 2025).

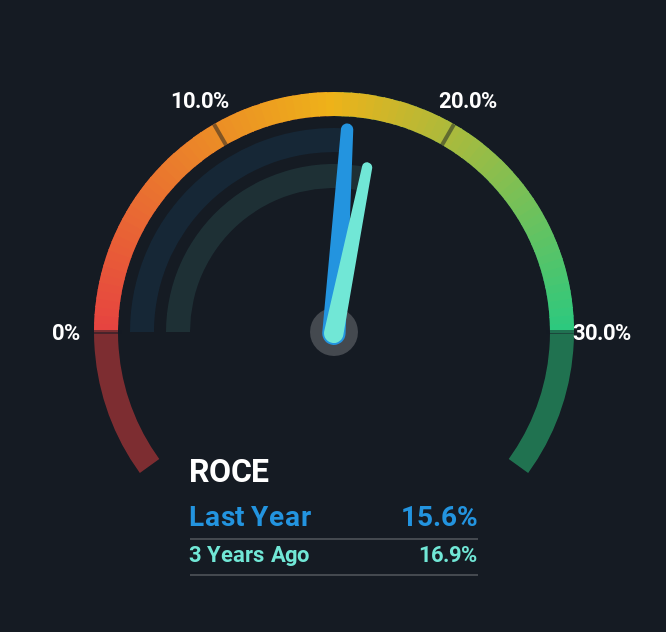

Due to this fact, NXP Semiconductors has an ROCE of 16%. In absolute phrases, that is a passable return, however in comparison with the Semiconductor business common of 9.5% it is significantly better.

View our latest analysis for NXP Semiconductors

Within the above chart we’ve measured NXP Semiconductors’ prior ROCE towards its prior efficiency, however the future is arguably extra vital. If you would like, you possibly can check out the forecasts from the analysts covering NXP Semiconductors for free.

What Can We Inform From NXP Semiconductors’ ROCE Development?

NXP Semiconductors has not disillusioned with their ROCE progress. Extra particularly, whereas the corporate has saved capital employed comparatively flat over the past 5 years, the ROCE has climbed 1,069% in that very same time. So our tackle that is that the enterprise has elevated efficiencies to generate these larger returns, all of the whereas not needing to make any further investments. On that entrance, issues are wanting good so it is price exploring what administration has stated about progress plans going ahead.

The Key Takeaway

In abstract, we’re delighted to see that NXP Semiconductors has been in a position to enhance efficiencies and earn larger charges of return on the identical quantity of capital. And traders appear to anticipate extra of this going ahead, because the inventory has rewarded shareholders with a 99% return over the past 5 years. So given the inventory has confirmed it has promising traits, it is price researching the corporate additional to see if these traits are more likely to persist.

Like most firms, NXP Semiconductors does include some dangers, and we have discovered 2 warning signs that you have to be conscious of.

Whereas NXP Semiconductors is not incomes the very best return, take a look at this free list of companies that are earning high returns on equity with solid balance sheets.

Valuation is advanced, however we’re right here to simplify it.

Uncover if NXP Semiconductors could be undervalued or overvalued with our detailed evaluation, that includes honest worth estimates, potential dangers, dividends, insider trades, and its monetary situation.

Have suggestions on this text? Involved concerning the content material? Get in touch with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We goal to convey you long-term centered evaluation pushed by basic information. Observe that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.