Ether treasury firm ETHZilla is trying to elevate one other $350 million by way of new convertible bonds, with funds marked for extra Ether purchases and producing yield by way of investments within the ecosystem.

ETHZilla chairman and CEO McAndrew Rudisill stated on Monday that the corporate’s technique is to deploy Ether (ETH) in “cash-flowing property” on the Ethereum community by way of layer-2 protocols and tokenizing real-world property.

“We imagine our enterprise mannequin is extremely scalable, with vital mounted working leverage and recurring constructive money movement.”

A rising variety of digital asset firms are shifting previous merely holding crypto and trying to generate yields by way of energetic participation within the ecosystem, which crypto executives informed Cointelegraph in August, may assist spark a DeFi Summer time 2.0.

ETHZilla is already incomes tokens

The Ether treasury firm has already earned 1.5 million in unnamed tokens, in line with the corporate’s disclosed financials by way of its participation within the ecosystem.

“ETHZilla continues to actively deploy capital throughout the Ethereum ecosystem, strategically supporting a various vary of protocols that drive innovation, long-term community progress, and differentiated yield,” the corporate stated.

It additionally beforehand raised $156.5 million by way of convertible bonds, which, mixed with the recent $350 million, leaves the corporate with over $506 million in its battle chest.

If it makes use of all the elevate for extra Ether purchases, ETHZilla may stack one other 120,000 tokens and add to their stash of 102,000, value greater than $428 million.

ETHZilla, the eighth-largest Ether treasury firm

Previously Life Sciences Corp, a Nasdaq-listed biotechnology firm, it rebranded as ETHZilla Company in July to pivot closely into Ether funding.

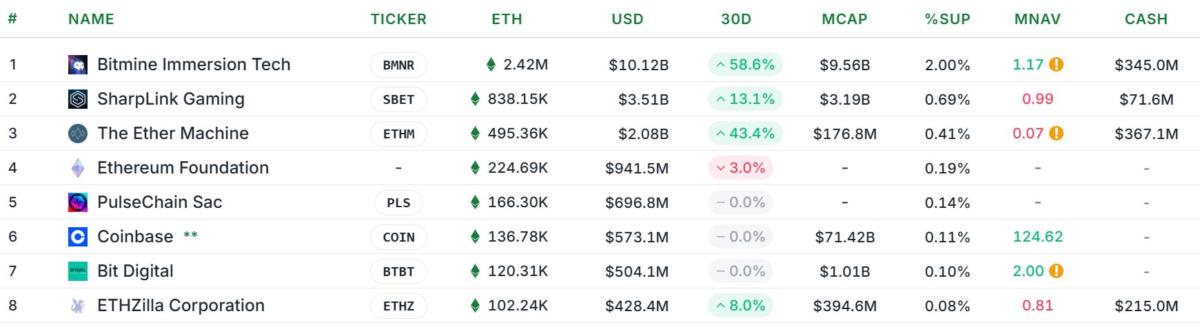

ETHZilla is the eighth largest Ether treasury firm out of 69 listed, which mixed, maintain 5.25 million tokens, value over $22 billion and representing 4.25% of the circulating provide.

Tom Lee’s BitMine Immersion Applied sciences leads the pack with its 2.4 million Ether, whereas Sharplink Gaming is in second with 838,000 tokens.

Inventory value has been making small good points since crypto shift

Based in 2016 as a clinical-stage biotechnology agency, Life Sciences went public in 2020, however since its preliminary public providing, the inventory has plunged by over 99% within the final 5 years.

The sharp decline was attributed primarily to an absence of income, mounting losses and repeated shareholder dilution to lift capital.

Its inventory has since registered a 31% acquire for the 12 months, with its best-performing month coming in August when it rocketed to $10.70.

Within the final buying and selling session, ETHZilla inventory is down 5% within the common session however rose 2% after hours to commerce at $2.45.