ECONOMYNEXT – Sri Lanka’s banks have diminished their purchases of Treasury payments contracting their holdings completely since over current months, official information exhibits, as personal credit score picked up.

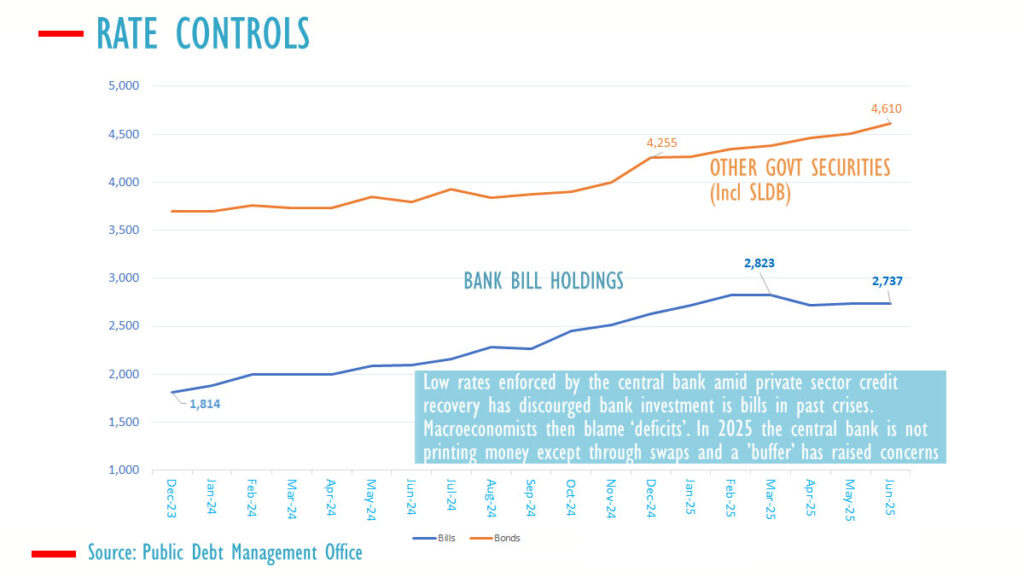

Financial institution holdings of payments peaked in February 2025 at 2,825 billion rupees and has fallen to round 2,737 by July 2025, information printed by the central financial institution present, indicating an absolute discount of 88 billion rupees.

Sri Lanka’s invoice auctions have did not be totally subscribed in current weeks on the reduce off charges provided by the debt workplace, with no takers final week for extra payments provided on faucet.

Sri Lanka’s invoice yields have remained fastened in current weeks, which analysts have dubbed the ‘ramrod price anomaly’ previously. Prior to now the ‘ramrod price anomaly’ has been enforced by way of printing cash.

Nevertheless, banks are nonetheless shopping for bonds that are provided at larger charges.

RELATED : Sri Lanka private credit continues blistering expansion in July with Rs201bn

The fixing of invoice charges and the discouragement of banks from shopping for payments, and have tended to come back earlier than a foreign money disaster even when price range deficits have been diminished by politicians.

The emblematic 12 months was 2018, when the price range deficit was introduced down by then Finance Minister Mangala Samaraweera, charges had been reduce and cash was printed by way of open market operations and swaps to set off a foreign money disaster, larger power and commodity costs and a voter backlash.

On the time the central financial institution additionally jettisoned a ‘payments solely’ coverage and acquired bonds outright, utilizing central financial institution independence given by the Finance Minister.

Satirically, the beginning of ‘central financial institution independence’ within the US in 1951 within the wake of the Fed Treasury Accord was a return to a ‘payments solely coverage,’ in order that market charges could be mirrored in authorities securities, EN’s financial columnist Bellwether says.

“However now it has come to mirror absolute discretion by way of open market operations as advocated by the Worldwide Financial Fund and others, the place just a few state macro-economists have a tendency do the exact opposite to function a political transmission mechanism.”

The primary time Sri Lanka’s central financial institution discouraged financial institution investments in authorities securities was within the 1952/1953 disaster, its first, after working deflationary coverage towards US printing (forward of the Fed Treasury Accord) within the first 12 months or two of its operations.

The central financial institution is no longer printing cash by way of open market operations and is working a scarce reserve regime – although considerations have been raised about inflationary swaps, the only coverage price and ethical suasion – and there are not any foreign exchange shortages.

A so-called ‘fiscal buffer’, within the type of a buffer for oil costs that was constructed by macro-economists within the Gotabaya Rajapaksa administration has additionally drawn considerations as a measure that may hinder market rates of interest and may result in lack of reserves within the quick time period.

Nevertheless, if a scarce reserve regime is operated just for clearing and never funding credit score, the potential for out-of-control personal credit score is vastly diminished as banks will both have to boost deposit charges or delay credit score. (Colombo/Aug11/2025)