Most readers would already remember that Medlive Expertise’s (HKG:2192) inventory elevated considerably by 25% over the previous three months. Provided that inventory costs are normally aligned with an organization’s monetary efficiency within the long-term, we determined to review its monetary indicators extra carefully to see if that they had a hand to play within the latest value transfer. On this article, we determined to give attention to Medlive Technology’s ROE.

Return on fairness or ROE is a key measure used to evaluate how effectively an organization’s administration is using the corporate’s capital. Merely put, it’s used to evaluate the profitability of an organization in relation to its fairness capital.

How To Calculate Return On Fairness?

The method for ROE is:

Return on Fairness = Internet Revenue (from persevering with operations) ÷ Shareholders’ Fairness

So, based mostly on the above method, the ROE for Medlive Expertise is:

6.8% = CN¥330m ÷ CN¥4.9b (Based mostly on the trailing twelve months to December 2024).

The ‘return’ is the quantity earned after tax during the last twelve months. So, which means for each HK$1 of its shareholder’s investments, the corporate generates a revenue of HK$0.07.

See our latest analysis for Medlive Technology

Why Is ROE Necessary For Earnings Development?

Now we have already established that ROE serves as an environment friendly profit-generating gauge for an organization’s future earnings. Relying on how a lot of those earnings the corporate reinvests or “retains”, and the way successfully it does so, we’re then in a position to assess an organization’s earnings progress potential. Assuming every part else stays unchanged, the upper the ROE and revenue retention, the upper the expansion charge of an organization in comparison with corporations that do not essentially bear these traits.

Medlive Expertise’s Earnings Development And 6.8% ROE

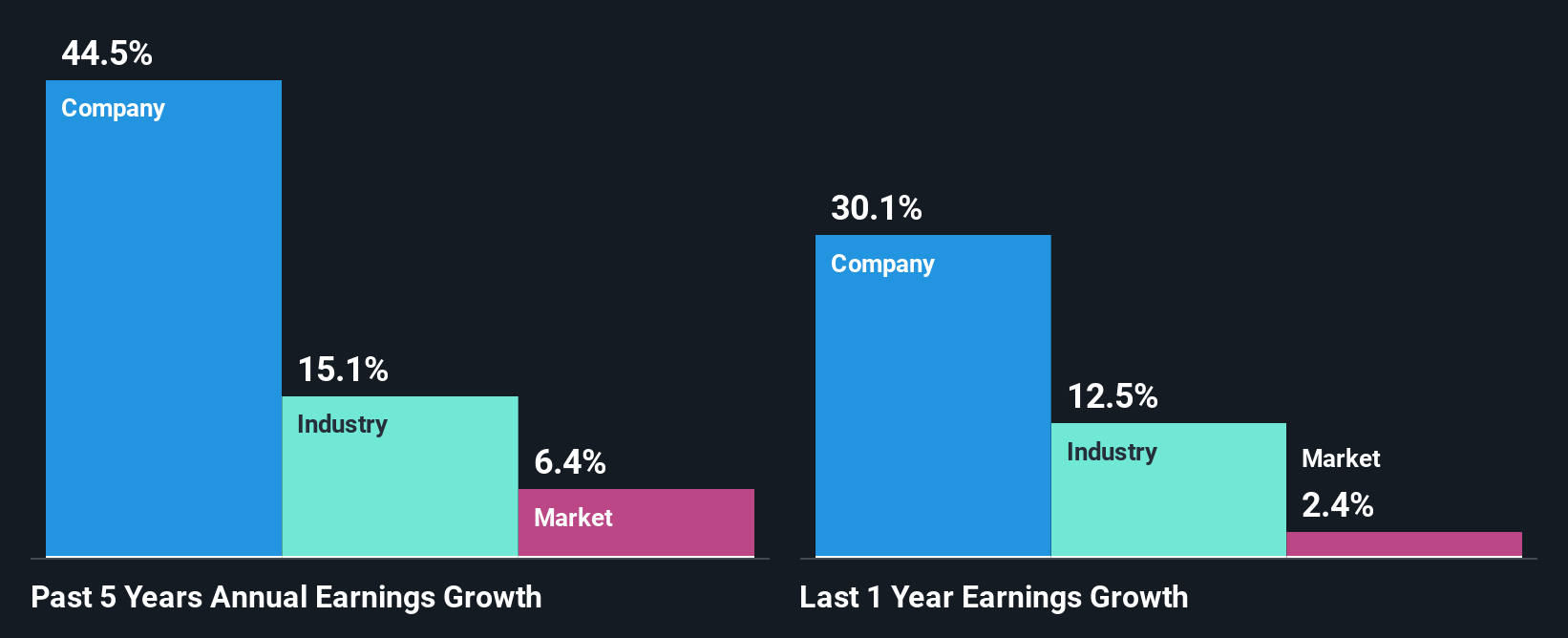

On the face of it, Medlive Expertise’s ROE will not be a lot to speak about. Subsequent, when in comparison with the common trade ROE of 12%, the corporate’s ROE leaves us feeling even much less enthusiastic. Despite this, Medlive Expertise was in a position to develop its web earnings significantly, at a charge of 45% within the final 5 years. So, there is likely to be different facets which might be positively influencing the corporate’s earnings progress. For instance, it’s doable that the corporate’s administration has made some good strategic choices, or that the corporate has a low payout ratio.

As a subsequent step, we in contrast Medlive Expertise’s web earnings progress with the trade, and pleasingly, we discovered that the expansion seen by the corporate is increased than the common trade progress of 15%.

The idea for attaching worth to an organization is, to an excellent extent, tied to its earnings progress. The investor ought to attempt to set up if the anticipated progress or decline in earnings, whichever the case could also be, is priced in. Doing so will assist them set up if the inventory’s future seems to be promising or ominous. If you happen to’re questioning about Medlive Expertise’s’s valuation, try this gauge of its price-to-earnings ratio, as in comparison with its trade.

Is Medlive Expertise Utilizing Its Retained Earnings Successfully?

Medlive Expertise has a major three-year median payout ratio of 59%, which means the corporate solely retains 41% of its earnings. This means that the corporate has been in a position to obtain excessive earnings progress regardless of returning most of its earnings to shareholders.

Moreover, Medlive Expertise has paid dividends over a interval of three years which signifies that the corporate is fairly critical about sharing its earnings with shareholders. Upon finding out the newest analysts’ consensus knowledge, we discovered that the corporate’s future payout ratio is predicted to drop to 38% over the subsequent three years. Regardless of the decrease anticipated payout ratio, the corporate’s ROE will not be anticipated to vary by a lot.

Abstract

On the entire, we do really feel that Medlive Expertise has some optimistic attributes. That’s, fairly a formidable progress in earnings. Nevertheless, the low revenue retention signifies that the corporate’s earnings progress may have been increased, had it been reinvesting a better portion of its earnings. That being so, a research of the newest analyst forecasts present that the corporate is predicted to see a slowdown in its future earnings progress. To know extra concerning the firm’s future earnings progress forecasts check out this free report on analyst forecasts for the company to find out more.

New: Handle All Your Inventory Portfolios in One Place

We have created the final portfolio companion for inventory traders, and it is free.

• Join a vast variety of Portfolios and see your complete in a single foreign money

• Be alerted to new Warning Indicators or Dangers by way of e-mail or cellular

• Observe the Honest Worth of your shares

Have suggestions on this text? Involved concerning the content material? Get in touch with us instantly. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We intention to convey you long-term centered evaluation pushed by elementary knowledge. Observe that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.