Enterprise reporter, BBC Information

Getty Photographs

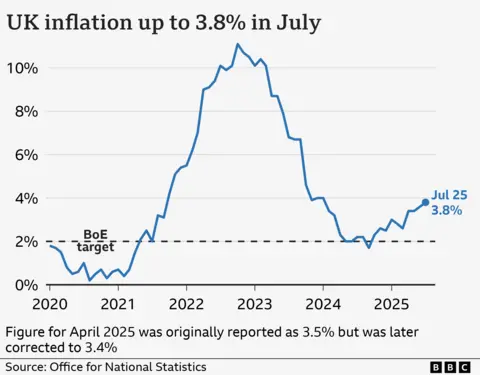

Getty PhotographsCosts within the UK rose by 3.8% within the 12 months to July, pushed primarily by a leap within the worth of air fares and meals.

Meaning inflation is at its highest stage since January 2024 and nonetheless far above the Financial institution of England’s goal of two%, in keeping with the Workplace for Nationwide Statistics (ONS) information.

Whereas the timing of faculty holidays possible induced the leap in air fares, greater meals costs have been pushed by will increase to the price of beef, chocolate and confectionery, on the spot espresso, and contemporary orange juice.

The marginally higher-than-expected improve to inflation strengthens economists’ expectations that the Financial institution of England will gradual the tempo of rate of interest cuts.

July’s rise within the Shopper Costs Index (CPI) measure of inflation compares with an increase of three.6% within the 12 months to June.

The Financial institution’s newest forecast expects inflation to peak at 4% in September.

ONS chief economist Grant Fitzner stated the “hefty” improve of 30.2% in air fares between June and July was the most important leap for that interval because the assortment of month-to-month information started in 2001.

He stated it was “possible because of the timing of this 12 months’s college holidays”.

This 12 months, the gathering day for the ONS information overlapped with the beginning of the college holidays in a means they did not final 12 months.

The worth of petrol and diesel had additionally elevated, in contrast with a drop this time final 12 months, he added.

The price of meals and non-alcoholic drinks rose 4.9% within the 12 months to July, up from 4.5% within the 12 months to June. It was the fourth month in a row during which foods and drinks inflation had risen, bringing costs to their highest since February 2024.

AJ Bell head of economic evaluation Danni Hewson stated the “weekly journey to the native grocery store… provides most of us the best perception into our price of dwelling”.

“With UK farmers highlighting the anticipated influence of a dry summer time on meals manufacturing, many households can be frightened that it may take a substantial period of time earlier than these greater costs unwind.”

‘Price of my weekly store has gone up a lot’

Rising meals and gas costs are “stretching” Michelle Birkenhead’s funds.

However she says budgeting for her household has been the important thing to managing her cash and planning forward for social actions.

“It is so costly,” says Michelle. “It is gone up a lot, it is ridiculous. What used to price us, two years in the past, a weekly store of £100, you are taking a look at £150.”

One other measure of inflation, the Retail Costs Index (RPI) rose to 4.8% within the 12 months to July, up from 4.4% in June. RPI differs from CPI in that it consists of issues like mortgage curiosity funds and buildings insurance coverage.

It’s also used to find out upcoming hikes in prepare fares in England.

This 12 months’s rise within the worth of rail fares of 4.6% was one proportion level above RPI in July 2024, which means that if the identical sample was adopted, fares in 2026 would rise by 5.8%.

Nevertheless, the Division for Transport has stated that no choices have been made but on subsequent 12 months’s fares “however our purpose is that costs stability affordability for each passengers and taxpayers”.

‘Shut name’ on charge reduce

Coverage makers on the Financial institution of England consider inflation and different financial information when deciding what to do about rates of interest.

Earlier this month, they narrowly voted to chop charges to 4%, down from 4.25%, taking charges to their lowest for greater than two years.

Monica George Michail, affiliate economist on the Nationwide Institute of Financial and Social Analysis (Niesr), stated that a number of the current drivers of inflation have been one-off coverage modifications. These modifications embody the April improve to employers’ Nationwide Insurance coverage Contributions and the Nationwide Dwelling Wage rise.

“The Financial institution faces a troublesome balancing act between reducing inflation and boosting a sluggish economic system,” she stated.

Whereas Niesr expects yet another charge reduce this 12 months, Ms Michail added the Financial institution must “stay cautious” if meals costs stay excessive.

Ruth Gregory, deputy chief economist at Capital Economics, stated whereas she additionally expects a charge reduce, in November, that call “can be a detailed name and can depend upon the information launched over the subsequent few months”.

CPI inflation is now predicted to hit 4% in September, which might not usually immediate additional rate of interest cuts.

Nevertheless, on the identical time, the economic system has been struggling to develop and the roles market is unsure, which might normally encourage the Financial institution to chop charges to encourage spending.

Financial institution of England governor Andrew Bailey advised the BBC that this month’s resolution to chop charges at been “finely balanced” and that the long run course of rates of interest was “a bit extra unsure frankly”.

“Rates of interest are nonetheless on a downward path,” he stated. “However any future charge cuts will should be made steadily and punctiliously.”

Reacting to the newest figures, Chancellor Rachel Reeves stated the federal government had “taken the selections wanted to stabilise the general public funds, and we’re a great distance from the double-digit inflation we noticed underneath the earlier authorities”.

However she added: “There’s extra to do to ease the price of dwelling.”

Shadow chancellor Mel Stride stated the information on inflation was “deeply worrying for households”.

“Labour’s selections to tax jobs and ramp up borrowing are pushing up prices and stoking inflation – making on a regular basis necessities costlier.”

Liberal Democrat treasury spokesperson Daisy Cooper stated rising inflation was “grim information for households, pensioners and companies nonetheless combating the cost-of-living disaster”.

She stated the chancellor wanted to take “far bolder motion, beginning with the Liberal Democrat plan to halve vitality payments by 2035”.