Key Factors

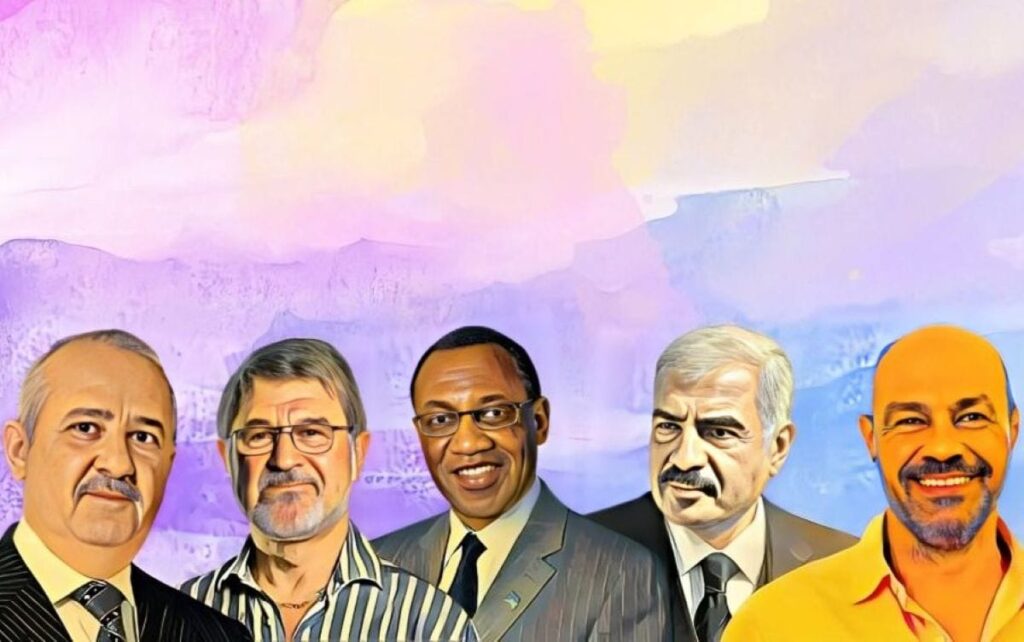

- Anas Sefrioui and Jannie Mouton be a part of Africa’s billionaire ranks with web worths of $1.7B and $1.9B, pushed by actual property and banking beneficial properties.

- Zak Calisto surpasses $1B after increasing Karooooo Ltd. from a vehicle-tracking start-up into a worldwide mobility analytics firm.

- Thom Mpinganjira and Hisham Talaat Moustafa hit $1B as FDH Financial institution and TMG shares soar, boosting Africa’s billionaire depend to 25.

Africa’s billionaire class has grown in 2025, with 5 new names becoming a member of the continent’s wealthiest people, highlighting the resilience of its capital markets regardless of world financial headwinds. These beneficial properties mirror a mix of robust company efficiency, investor confidence, and the management of enterprise figures whose firms have delivered important shareholder worth throughout actual property, banking, and know-how.

Knowledge from Billionaires.Africa exhibits that fairness markets have been a significant driver of non-public wealth this 12 months, pushing a brand new wave of founders and main shareholders previous the $1 billion mark. Earlier within the 12 months, Forbes expanded its Africa wealthy listing from 20 to 22, noting the return of Moroccan actual property entrepreneur Anas Sefrioui and South African investor Jannie Mouton.

Market rally boosts web worths

Sefrioui’s web price jumped to $1.7 billion after Douja Promotion Groupe Addoha, the property group he based, noticed its share worth greater than double. Mouton, in the meantime, reached $1.9 billion as Capitec Financial institution, the place he’s a significant shareholder, posted a pointy rise in inventory value. The billionaire roster grew additional in Could, when South African tech entrepreneur Zak Calisto crossed the $1 billion threshold. Calisto turned his start-up, Karooooo Ltd., a vehicle-tracking enterprise, into a worldwide mobility analytics firm.

August proved to be one other pivotal month. Malawian banker Thom Mpinganjira and Egyptian actual property magnate Hisham Talaat Moustafa each joined the billionaire membership after important will increase available in the market worth of their holdings. Mpinganjira’s leap was pushed by a outstanding 365 % surge in FDH Financial institution Plc’s shares on the Malawi Inventory Trade.

By means of his agency M Growth, he controls a 55 % stake in FDH Monetary Holdings, the mother or father firm of FDH Financial institution, which itself owns 74.05 % of the financial institution. This oblique holding of greater than 2.81 billion shares, round 40.73 % of FDH Financial institution’s fairness, rose in worth from MWK416.6 billion ($240.5 million) in January to MWK1.94 trillion ($1.12 billion) by August. FDH Financial institution’s market capitalization reached MWK4.76 trillion ($2 billion), making it Malawi’s most precious publicly traded firm.

In Egypt, Moustafa, chairman and largest shareholder of Talaat Moustafa Group (TMG), the nation’s largest actual property developer, surpassed the $1 billion mark as TMG shares rebounded. Between July 30 and August 11, the market worth of his 43.5 % stake elevated by EGP 3.49 billion ($72 million), reaching EGP 50.27 billion ($1.04 billion), securing his place amongst Africa’s wealthiest.

Fairness markets gasoline wealth creation

The rise of those new billionaires comes amid a broader story of progress throughout Africa. “The expansion story in Africa total is promising, with millionaire inhabitants set to rise 65 % within the subsequent decade, fueled by robust progress in key sectors corresponding to fintech, eco-tourism, enterprise course of outsourcing, software program improvement, uncommon metals mining, inexperienced tech, media and leisure, and wealth administration,” stated Raymond Nel, Senior Advisor at Henley & Partners. He additionally cautioned that forex depreciation and underperforming inventory markets in some areas have restricted the expansion of Africa’s wealth relative to world benchmarks, with whole investable wealth on the continent at roughly $2.5 trillion.

Even towards these headwinds, Africa’s fairness markets have proved to be engines of unprecedented wealth creation in 2025. The emergence of Sefrioui, Mouton, Calisto, Mpinganjira, and Moustafa as billionaires has boosted the continent’s billionaire depend to 25, a milestone that displays not solely particular person achievements but additionally the deepening maturity and world integration of Africa’s capital markets. The 12 months’s beneficial properties have strengthened the notion that, regardless of volatility, Africa’s wealth trajectory stays upward, pushed by visionary entrepreneurs whose firms are shaping the continent’s financial future.