ECONOMYNEXT – Sri Lanka’s central financial institution has allowed the rupee to usually respect amid broadly deflationary coverage since 2022, permitting the financial exercise to get well shortly, however the rupee has tended to be unstable, amid extensive fluctuations in in a single day liquidity.

As a result of lack of credibility and intentionally fired uncertainty and concern mongering (the trade charge is ‘versatile’, it’s ‘market’ decided), the rupee wobbles on the slightest confidence shock, even when cash will not be printed to really push the rupee down.

All of those have prices to the economic system. The larger the hit to confidence the larger the prices. Up to now trade charge instability has led to downgrades. Because of this the versatile trade, backed by discretionary financial coverage will contribute to the subsequent default.

In nations with trade charge instability – an evil that unfold like wildfire after the IMF’s second modification to its Articles in 1978 – there may be an unwillingness to defend forex with unsterilized interventions to match the outflow of {dollars} with an outflow of rupees from the banking system.

Earlier than the collapse of the Bretton Woods itself, trade depreciation took off within the Nineteen Thirties amongst extra developed nations because the coverage charge and open market operations invented within the Fed unfold like a most cancers and growing nations which had no OMO largely escaped.

In reality within the Sixties when full employment insurance policies took off in superior nations, inflation in different nations which didn’t have aggressive macro-economic coverage have been decrease.

The coverage charge and full employment insurance policies have been the core motive for Sterling crises, the eventual collapse of the greenback which took the Bretton Woods together with it, and the rationale that IMF-backed nations collapsed repeatedly and Argentina collapsed repeatedly regardless of virtually German degree fiscal metrics the 12 months earlier than the disaster.

To the extent of the unwillingness to defend the trade charge with unsterilized interventions – which makes the in a single day charge transfer up (and down) shortly in tandem with outflows (and inflows) – the trade charge instability will worsen.

The extra narrowly interbank charges are focused, for the one coverage charge or mid-corridor charge undermining a hall system, particularly with injections, the extra international reserves will probably be misplaced and the trade charge may even weaken.

Such versatile trade charge regimes have weak credibility, and any confidence shock can destabilize it.

Nothing on this column is meant to indicate that the central financial institution’s noticed coverage of preserving the trade charge at round 300 to the US greenback is a flawed coverage. Removed from it.

It’s a appropriate coverage and the positive factors that the economic system has made to date – together with preserving inflation in verify at very low ranges since 2022 and the flexibility to repay debt and comprise social unrest to date has been a consequence of it.

The issue is that the working framework of the central financial institution, particularly the declared one, involving a 5 % inflation goal and the one coverage charge, in addition to permitting massive volumes of extra liquidity has loaded the cube towards financial and forex stability.

That’s becuase Sri Lanka is attempting to gather reserves and repay debt by an working framework that’s suited to a clear floating regime, not a reserve gathering one.

The Case of Hong Kong

The motion of the rupee when a Trump tariff of 44 % was introduced is a working example.

The Hong Kong trade charge didn’t transfer regardless of a 145 % tax. The distinction is a flawed working framework and concern mongering that the trade charge is versatile and the worth of cash is ‘market decided’.

Shortly earlier than 1981, when rates of interest have been focused and there have been sterilized interventions – Hong Kong modified the financial regime within the wake of the collapse of the Bretton Woods and Sixties Sterling crises – the HK greenback went right into a free fall when a handover to China was introduced.

That was additionally the time that Paul Volker hiked charges and Latin America collapsed.

In Hong Kong this led to the establishing (or re-establishment we are able to say) of a proper forex board association in 1981 after John Greenwood, an funding banker defined why.

The one factor in a free market economic system that shouldn’t be ‘market decided’ is the worth of cash. At a primary degree, inflation focusing on (as lengthy inflation is near or zero) can be a way of not market figuring out cash, however setting a rule for it.

Cash is sort of a weight and measure, like a kilogram or a litre.

Within the classical interval of low inflation and the commercial revolution, cash was protected with a milled edge.

However now with macroeconomists deploying discretionary coverage (learn versatile) to satisfy their insatiable need for inflation, utilizing paper cash, central banks themselves are participating in ‘coin-clipping’ with optimistic inflation focusing on, triggering forex collapses, hunger of individuals in decrease revenue brackets, and defaults.

Even a king can rule for a protracted interval with secure cash – as now occurs with the Kings and Emirs of currency-board-like regimes within the Center East. Jordan has no oil by the best way. However unhealthy cash led to the ouster of Iran’s Shah.

This must be a lesson to the federal government of Sri Lanka as preliminary indicators are rising that the identical errors that led to forex collapses, and default of a rustic with out conflict, are going to be repeated.

Sustaining and Trade Price is the Most Easy Coverage

Sustaining a set trade charge and giving long run stability for exporters and buyers is the most straightforward of working frameworks.

Nevertheless, to do this the authorized powers given to central bankers to print cash by open market operations (including fictitious reserves or deposits into banks), and the facility given to financial bureaucrats to normal excessive degree of inflation (and punish thrift) by a coverage charge must be taken away.

Sri Lanka’s central financial institution misplaced its international reserves and in addition misplaced borrowed greenback reserves together with by swaps by attempting to focus on its coverage charge as much as April 2022, because the US Fed did within the Sixties within the run as much as the collapse of the US greenback.

As a result of India allowed the central financial institution to run arrears on Asian Clearing Union balances, the correction within the stability of funds was additional delayed and its reserves moved additional into adverse territory of 4.6 billion {dollars}.

The US issued Roosa bonds to repay the Fed swap debt taken through the Sixties charge cuts. Sri Lanka’s central financial institution ran deflationary coverage in 2023 and 2024 to repay its greenback debt (purchased {dollars} by promoting down its Treasury invoice portfolio).

READ MORE ABOUT ROOSA BONDS HERE

The central financial institution due to this fact has to function an rate of interest regime that permits it to curb home credit score sterilize inflows (mop up liquidity from {dollars} to construct up reserves to a optimistic stability).

The rate of interest must be such that it permits the central financial institution to soak up a few of the financial savings of the general public which it is going to export and purchase international property to construct reserves, lowering home investments.

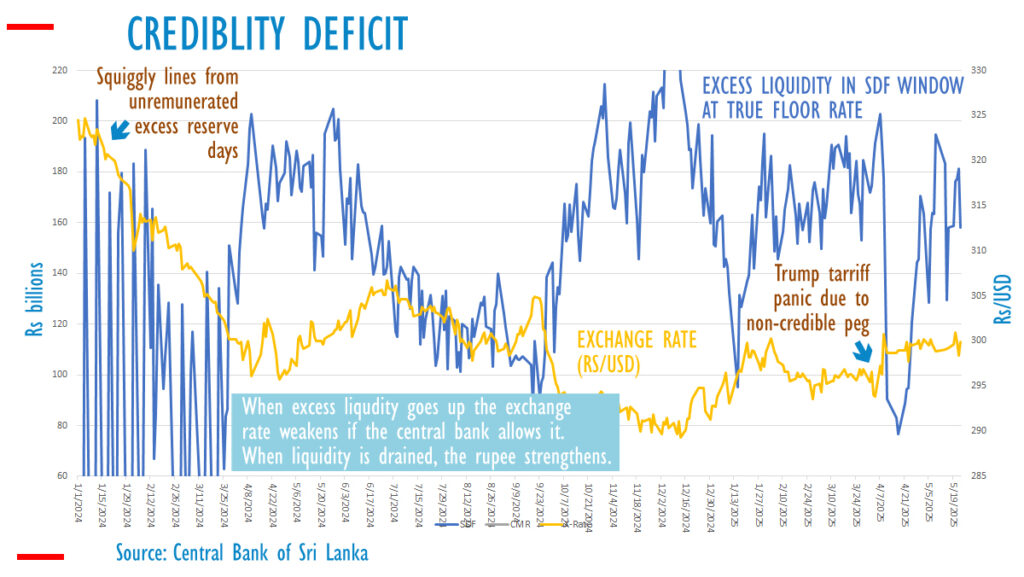

To grasp latest actions within the rupee, it’s vital to know the function extra liquidity performs within the banking system.

If financial coverage deteriorates, because it has achieved up to now, automotive imports will probably be blamed for forex crises by macro-economists utilizing Mercantilist doctrine.

They may conveniently neglect that automotive imports have been banned from 2020 to 2022 when the worst disaster in historical past occurred and that the 2018 forex collapse occurred after gold imports have been banned and restrictions have been additionally positioned on automobile LCs.

The Function of Interbank Extra Liquidity

To grasp why trade charges are unstable, it’s vital to know the function performed by interbank extra liquidity and of a reserve gathering central financial institution to defend the rupee towards the liquidity and drive brief time period charges up.

The flexibility of the banking system to create extra greenback outflows out of line with imports, rests on the supply of extra liquidity within the interbank market, to present loans with.

When rates of interest are greater than is required to maintain financial savings and investments in stability or banks are unwilling to present funding credit score and companies are unwilling to borrow and make investments anyway after a forex collapse destroys client demand, outflows of {dollars} are lower than inflows and the trade charge comes below strengthening stress.

That’s the reason charges are hiked to kill home credit score and restore confidence within the forex below an Worldwide Financial Fund program after a credit score bubble is fired.

Cash is printed cash (charge cuts are enforced) below the exact same working framework prescribed by the company for five % inflation or to focus on potential output.

Bear in mind macro-economists – particularly from the Sixties to 1970 and – don’t consider stability drives development or funding however that inflation or ‘worth stress’ does.

This perception was revived by the Fed in 2000 within the course of of making the housing bubble and later within the ‘normalizing’ the plentiful reserve regime as an alternative of ‘normalizing’ financial coverage (i.e a return to a scarce reserve regime) with devastating penalties on budgets of many nations together with the US.

Charges are raised in nations like Sri Lanka to save lots of the ‘economic system’ after a forex disaster, however to save lots of the rupee and the central financial institution from earlier charge cuts.

After credit score contracts (one could name that debt deflation) the central financial institution is ready to purchase {dollars} with newly created cash, to re-build reserves, which then builds up as ‘extra liquidity’ in cash markets.

Liquidity Lure

If there may be unwillingness by banks to lend as a result of fears of unhealthy loans, there may be personal sector sterilization or a liquidity entice. After Sri Lanka’s final disaster many banks – particularly international ones – didn’t lend. Because of this, there was round 130 billion rupees of everlasting extra liquidity which was not going out as loans.

The central financial institution purchased a number of billion {dollars} and the liquidity was mopped up with Treasury invoice gross sales – banks purchased securities beforehand held by the central financial institution as an alternative of giving loans to clients to generate imports and a present account deficit.

In a floating trade charge, there aren’t any greenback purchases or gross sales and no trade charge to anchor cash development to. So the inflation goal serves on the anchor.

The acquisition of {dollars} by Sri Lanka’s central financial institution, in addition to the sale of {dollars} to cease a fall within the forex from a spike in credit score, exhibits that there isn’t any floating trade charge and that the forex is pegged in a single type or the opposite.

The IMF has referred to as it an ‘different managed’ regime.

RELATED : IMF classifies Sri Lanka’s exchange regime as ‘other managed’

With out some form of pegged regime, it’s completely inconceivable for the central financial institution to construct reserves – it’s potential for the Treasury to take action – and meet IMF targets.

This build-up of liquidity (mainly newly created rupee optimistic balances within the accounts of exporters or remittance households or tourism operations that are regularly transferred to different clients as they buy items and companies) tends to scale back brief time period charges.

Rates of interest will due to this fact transfer in the direction of the decrease ground of the coverage hall.

The surplus liquidity ultimately turns into imports, both by the recipients of {dollars} shopping for imported items like gas or meals, or the cash being loaned for funding initiatives (for the reason that nation has a internet financial savings charge) which can generate imports like constructing supplies or equipment.

The central financial institution will then must promote the {dollars} to cease the forex from falling, except the liquidity is mopped as much as forestall the mortgage being made within the first place.

Till personal credit score picks up, the liquidity from financial savings of the individuals purchased by the central financial institution will not be used up very quick. That’s the reason, below versatile inflation focusing on, the forex begins to break down once more about 18 to 24 months after the top of the earlier forex collapse.

When credit score or imports come, if the central financial institution then sells the {dollars} to take care of a set trade charge, the liquidity will probably be extinguished simply as in the event that they have been extinguished by a sale of its securities portfolio.

Rates of interest may even go up and banks will curtail credit score and the system will come again into stability with hardly any disturbance to the system and minor adjustments to rates of interest.

If the central financial institution sells its Treasuries inventory into this liquidity there will probably be a gentle surplus within the stability of funds and the trade charge won’t come below upward stress.

What if the central financial institution doesn’t absolutely defend the trade charge at a set charge when the rupee comes below upward stress?

Let’s say when credit score slowed, and let’s say in January or February and the rupee got here below upward stress, if the central financial institution didn’t absolutely defend rupee and purchase {dollars}, the rupee would respect.

Then importers will at first delay paying off import payments and attempt to promote their items and get some cash and in addition repay their import credit, snug within the information that there could be no rapid fall of the rupee and it’s higher to attend for some extra appreciation earlier than shopping for {dollars}.

This may create additional upward stress on the rupee and end in extra {dollars} being purchased by the central financial institution.

Banks can also run adverse open positions, additional promote {dollars} of their open positioning and worsening the strengthening forces. Macroeconomists could name it ‘speculative behaviour’, however it’s a regular response to the versatile trade charge that the IMF, the they themselves promote.

If banks didn’t promote down their open positions, they stand to make losses because the rupee strengthens. It’s a regular consequence of the ‘versatile’ trade or to present it the proper title. non-credible peg.

There’s a roughly inverse relationship between international property of banks and the trade charge.

Exporters will ultimately delay promoting {dollars} and begin to take packing credit score to fund exports with rates of interest additionally falling.

When there may be ample home credit score to make use of up the liquidity, the trade charge will flip.

What occurs if the central financial institution doesn’t absolutely defend the trade charge when it comes below downward stress?

If the central financial institution doesn’t absolutely defend the trade charge, when extra liquidity is used up in credit score, importers will begin to cowl shortly, exporters will maintain again a bit extra hoping for a greater charge, and the trade charge will swing in the other way.

Banks may even cowl their adverse NOP positions in a bid to make some earnings because the rupee falls below the versatile trade charge.

To the extent that the central financial institution intervenes and sells {dollars}, liquidity will cut back and rates of interest will go up. If the central financial institution injects cash to maintain charges from hitting the ceiling charges shortly, the entire drama will proceed for an extended interval.

The correction could ultimately come from rising 3 or 12-month Treasuries yields that are excessive sufficient to delay personal credit score. As a result of so-called ‘transmission mechanism’, there could also be will increase in long run charges as effectively.

As will be seen there was completely no motive for long term charges to go up, that are decided by various factors. Nevertheless below a bureaucratic ‘transmission mechanism’ the whole yield curve will transfer.

Nevertheless, all that’s vital for a correction if there was a set trade charge, is for brief time period charges to extend and liquidity to fall.

Who advantages from the shortage of a reputable trade charge regime?

With the versatile trade charge, ‘age-of-inflation’ macroeconomists and the Worldwide Financial Fund can fulfill their doctrinal or ideological needs that are in vogue at this time second.

Bear in mind, the IMF was created for the precise reverse objective.

Apart from satisfying the doctrinal itch, banks will profit from the risky trade charge.

The volatility makes banks quote huge spreads for importers and exporters. They can’t be blamed for asking for large spreads since no person can predict whether or not the central financial institution will intervene or not as liquidity is used up in credit score.

Banks additionally revenue by altering their internet open positions and financing their place with open market operations or the surplus liquidity.

When the forex is allowed to weaken, they’ll use open market operations and run optimistic open positions for instance even when they didn’t have some extra liquidity themselves because the central financial institution tries to function a single coverage charge with liquidity injections.

Banks additionally revenue from promoting hedging devices to importers and in addition exporters because of the non – credible ‘different managed’ regime.

Banks may also revenue by giving credit score to exporters who need to delay conversions.

The central financial institution may also make ‘earnings’ if the trade charge appreciates when international property are adverse, simply as banks with adverse NOPs can generate income by masking on the strongest place.

As soon as international property are optimistic, depreciation brings earnings and appreciation brings losses.

Who loses from the risky trade charge?

Whereas exporters and importers can to some extent play a ready sport, remittance households normally can not. They get slammed if the trade charge appreciates just for a short while after which weakens once more.

If the daddy’s or mom’s remitted wage is transformed when the central financial institution’s versatile trade charge is robust, they get much less {dollars}. However two weeks later, once they attempt to purchase gas, the petrol or diesel could have gone up.

Whereas most companies are fast to lift costs to take care of margins, costs come again down solely as a result of competitors over an extended interval.

As well as, most of the people could lose as a result of importers must hold wider margins to cowl themselves towards trade charge swings. Exporters who depend upon imported inputs from others can also endure the identical destiny.

Up and down actions within the trade charge, nonetheless extensive, is healthier than everlasting depreciation, it should be made clear.

Exporters may also lose out as a result of there’s a timing distinction between the time a worth is agreed upon and delivered. Typically exporters additionally give credit score to win enterprise.

Working Prices in Worldwide Commerce

If the trade appreciates when {dollars} are transformed, and a part of the bills are in rupees (wages, utilities, and transport prices), exporter margins can get hammered. It should be famous that in lately of world provide chains margins are skinny.

When the trade charge is secure, importers would not have to make use of home credit score to finance their shares. They’ll use provider’s credit score and delay cost till the inventory is offered and get monetary savings and promote their merchandise at a lower cost to shoppers, lowering value of doing enterprise.

Nevertheless, if the trade charge is risky, they must borrow and repay the import payments as early as potential.

Because of this the commercial revolution thrived in mounted trade charges. Because of this East Asian mounted trade charges supplied the backdrop for an export growth and provide chains.

Whereas a versatile trade charge satisfies the newest ideology of the IMF and brings earnings to banks, it provides prices to worldwide commerce and harms shoppers.

Nations that repair trade charges for lengthy intervals – by restraining financial coverage or operating deflationary coverage – then again expertise excessive ranges of home stability, capital inflows and completely low rates of interest, in addition to in-migration.

In a democratic nation, the place the sovereignty of the individuals is expressed by parliament, the central financial institution’s potential to create financial and financial instability should be restrained by the parliament.

Lies and Deception

That Sri Lanka’s central financial institution will not be allowed to print cash by its new financial regulation is an outright and foolish lie, unfold by macro-economists.

It was definitively proved within the final quarter of 2024 that the central financial institution can print as a lot cash because it likes, and hold them sloshing across the banking system.

The central financial institution is allowed to conduct open market operations and purchase bonds from banks and print cash. It issues little whether or not the central banks purchase securities outright, or they’re renewed time period or in a single day.

It’s by this mechanism that the central financial institution prevented charges from hitting the ceiling and weakened the forex within the final quarter of 2024 and triggered reserve losses.

So long as parliament doesn’t constrain its potential to have interaction in inflationary open market operations, below a reputable low inflation anchor – or an exterior anchor which is straightforward for the parliament to watch as was within the classical interval – the central financial institution can print as a lot cash because it likes and create x % inflation and exterior bother.

Until the central financial institution reduces its home property portfolio, its potential to gather reserves will probably be restricted to curiosity coupons it will get for its bond portfolio, and any inflation it creates by increasing reserve cash.

As had been talked about earlier, buyers at the moment are jumpy after one default. Sovereign bond yield jumped after the Trump tariffs. This exhibits how straightforward it’s to lose market entry for a rustic that has illiquid bonds even when Sri Lanka will get it.

There was no elementary change within the financial framework since aggressive macro-economic coverage led to a peacetime default in Sri Lanka when exterior circumstances have been comparatively benign.

In reality, what has occurred is that the post-war coverage errors, revolving the mid-corridor charge and rejecting a bills-only coverage to have interaction in yield curve focusing on going past in a single day mis-targeting of charges have been legislated.

RELATED : Sri Lanka has to reform soft-peg to avoid monetary instability, default: Bellwether

The mid hall charge which was casual up to now, has been printed in a gazette and the 5 % annual rise in value of dwelling has additionally been given authorized impact.

It’s unlucky, to not point out foolish for a rustic with a 30 % financial savings charge (even when that isn’t strictly appropriate) to default externally as a result of mistargeting charges by embracing statistics and rejecting economics and legal guidelines of nature. (Colombo/June15/2025)