Negotiators from China have signaled regular progress towards a peaceable finish to the nation’s many commerce disagreements with the USA, however, beneath the floor, Beijing is quietly girding itself for a long-term financial warfare.

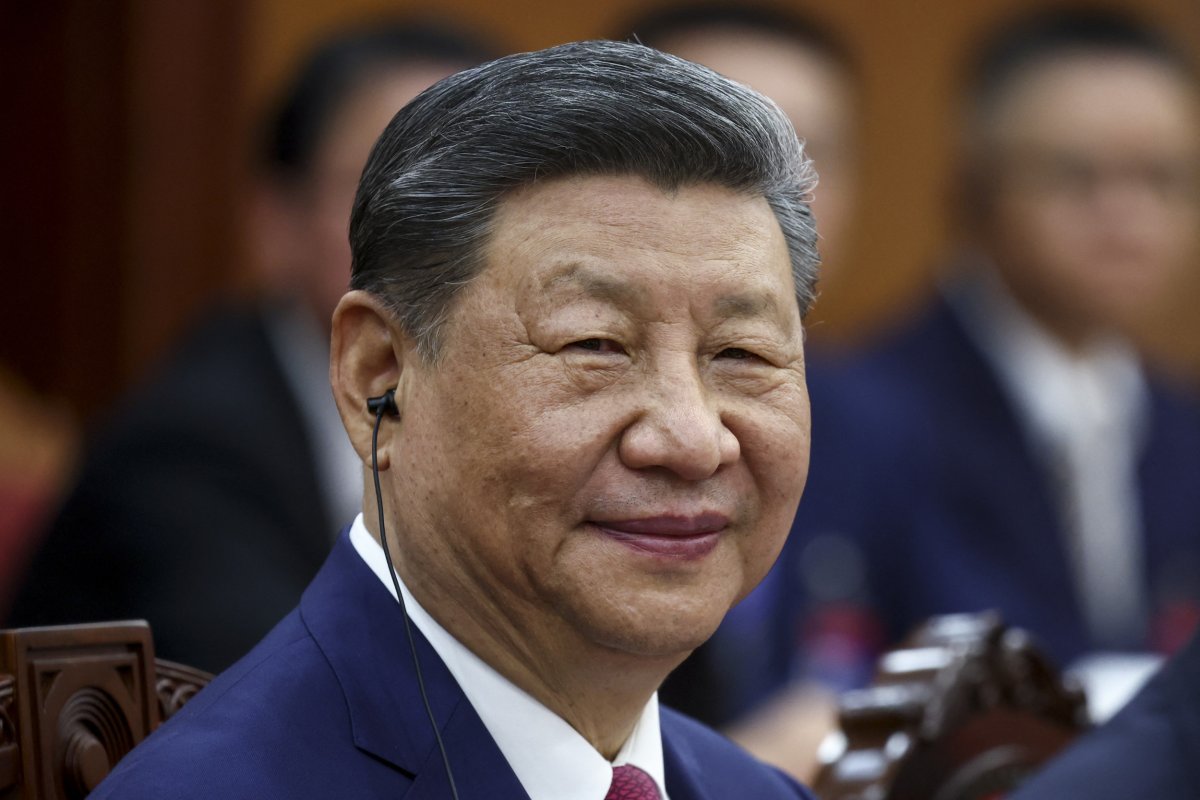

Chinese language chief Xi Jinping could have perceived U.S. President Donald Trump‘s sky-high tariffs as a take a look at of his resolve forward of an anticipated showdown over the way forward for their financial relationship. Certainly, China’s state media hailed this month’s trade talks in Switzerland as a decisive victory that had absolutely justified the choice to retaliate quite than instantly renegotiate.

That Beijing is now additionally waging a story warfare suggests what started as a commerce dispute between the world’s solely true superpowers has become a battle of political wills. And, crucially for Xi, additionally it is about China’s potential to develop its slice of the worldwide manufacturing pie regardless of inner and exterior headwinds.

“The [U.S.] president mustn’t make a deal of comfort with China. As an alternative, he ought to face up to the enterprise stress, interact Congress, section in everlasting tariffs on Beijing, spend money on our industries, and enlist our allies in deleveraging China’s grip on strategic industrial sectors,” Scott Paul, president of the Alliance for American Manufacturing, or AAM, mentioned in a press assertion after the commerce talks.

ATHIT PERAWONGMETHA/POOL/AFP through Getty Pictures

“China’s manufacturing trade will proceed to develop and develop. The U.S. must compete in an open and aboveboard method. Cooperation results in progress for everybody. The Earth is large enough for China and the U.S. to prosper collectively,” Liu Pengyu, spokesperson for China’s embassy in Washington, D.C., instructed Newsweek.

China is combating again by making an attempt to subject a collective rebuke of Washington over its use of import levies as an financial weapon. Xi visited his Southeast Asian neighbors in April and hosted Latin American and Caribbean leaders in Could to rally allies in opposition to the sweeping U.S. tariffs. Chinese language officers additionally made overtures to Japan and South Korea—two U.S. treaty allies—in a bid to show them in opposition to Trump.

Then, in a flurry of latest strikes in early Could, officers sought to offset the impact of the Trump’s tariffs, which threatened to additional bother an financial system already beset by a property disaster, falling shopper demand and a excessive stage of native authorities debt.

The Folks’s Financial institution of China introduced 10 new measures intended to stabilize financial markets, together with a discount of deposits held in reserve and a decreasing of rates of interest throughout the board. Pan Gongsheng, the central financial institution’s governor, mentioned it might unlock over $130 billion in liquidity for enterprise loans.

Beijing is aware of how one can hit America the place it hurts. As Xi and Trump climbed the escalation ladder final month, the Chinese language authorities sanctioned over two dozen U.S. firms and restricted exports of uncommon earth metals, the mining and refinement of which stay closely concentrated in China. Beijing suspended the restrictions for 90 days as a part of the temporary concessions struck with the White House.

In the meantime, Chinese language producers are increasing alternate export channels to the United States through third markets which can be presently topic to decrease tariffs. The U.S. will crack down on transshipment, however China’s international footprint, which incorporates Chinese language-owned factories registered in third nations, means it will probably shortly turn out to be a recreation of whack-a-mole.

Zero-Sum Recreation

China‘s factories make round a 3rd of all merchandise bought worldwide, in accordance with the United Nations (U.N.). Within the final 15 years, this information level alone has been liable for producing a lot of the nation’s wealth and for the rise of its center class.

The Chinese language authorities has put its financial system on a path to capturing 45 p.c of world manufacturing by 2030, up from simply 6 p.c in 2000, the U.N. tasks; a transfer that may make China richer and subsequently stronger. The identical information makes for stark studying for the USA, nonetheless. Its share of world industrial output is projected to fall to simply 11 p.c by the tip of the last decade, down from 25 p.c over the identical interval.

The lack of jobs at dwelling and financial affect overseas related to this total decline is driving the Trump administration’s technique to revive U.S. manufacturing. However Xi has no motive to easily enable America to reverse its fortunes at China’s expense.

JIM WATSON/AFP through Getty Pictures

China was assured an early win within the new phase of the trade war. Its manufacturing sector’s enduring foothold within the provide chains of myriad shopper merchandise—from low-end perishables to high-end precision instruments—noticed the American public take the primary hit through import taxes on made-in-China items.

The U.S. commerce deficit with China—practically $300 billion—signifies that, for now, American consumers are bearing the brunt of the manufacturing war. Nonetheless, Chinese language manufactures would be the ones to really feel the long-term ache as shopping for from China turns into increasingly prohibitive.

As U.S. customers look elsewhere, Chinese language factories will attempt to redirect their capability, however few new markets can match the buying energy and revenue margins of the U.S. financial system. People who can’t adapt will shut, potentially taking with them millions of jobs that after helped anchor China’s export-driven financial system.

In April, demand within the Chinese language manufacturing trade fell by the most important margin in 16 months, in accordance with official information. Zhao Qinghe, a central authorities statistician, mentioned the decline was because of “drastic modifications within the exterior atmosphere,” within the first signal of ache inflicted by the trade war. The enterprise stimulus measures Beijing rolled out every week later have been meant to assist cushion the blow.

Beijing’s Alternative

China’s aim is to be not solely self-reliant, but additionally relied upon by the world. To attain the previous, it should resolve its lack of domestic consumption, whereas the latter requires it to proceed down the trail of deindustrializing the West.

As a result of China solely consumes about half what it produces, it’s usually accused of exporting its approach out of an overcapacity disaster. Officers deny this.

Liu, China’s embassy spokesperson, mentioned that “China’s participation and management in globalization, in addition to its manufacturing benefits, are the results of financial legal guidelines and the pattern of historical past.”

“Some politicians within the U.S. and the West have as soon as once more overvalued the so-called ‘China overcapacity,'” Liu mentioned, including that the idea of this declare is “utterly untenable.”

“They argue that ‘China’s overcapacity stems from over-investment and big authorities subsidies,’ saying that China’s industrial subsidies are 10 instances these of the U.S. Such declare not solely comprises arbitrary and misguided information, but additionally displays a blatant ‘double commonplace.’ Specialists discovered that this set of comparative information used totally different calibers. If the caliber was the identical, the size of spending on subsidies by the U.S. was a lot larger than that of China,” Liu mentioned.

“Basically, accusing China of ‘overcapacity’ is popping financial ideas right into a weapon for political functions. What’s extreme right here will not be capability, however nervousness. The widening of the U.S. commerce deficit and the unemployment of producing staff are decided by its personal macroeconomic imbalances and modifications in comparative benefits. Merely attributing these issues to the influence of China’s manufacturing capability is ‘treating one’s personal issues by giving others prescription’ and can’t basically resolve the issue. As an alternative, it should hinder international technological progress, hurt the pursuits of world customers, and will set off international financial dangers.”

Jeff Chiu/AP

Confronted with the selection between its decades-long industrial coverage and rebalancing its financial mannequin amid Western financial safety issues, Xi could discover it simpler to double down than to climb down. However for every of its actions, Beijing should depend on an equal and opposite reaction from its largest buying and selling companions, a dynamic that may speed up China’s decoupling from the West.

“It is going to be fast,” in accordance with Alicia Garcia-Herrero, chief economist for the Asia-Pacific on the funding financial institution Natixis.

She instructed Newsweek in a latest interview: “It is just like the pandemic. Abruptly you can’t import from China. What do you do? You produce. How pricey is it going to be? Very a lot within the first yr, then much less within the second yr and fewer within the third yr.”

“These within the new markets will likely be making the most important returns as a result of the demand is humongous. And since the returns will likely be so excessive, everyone will attempt to emulate it, so will probably be very quick.”

“It is just like the economy of warfare—some lose, some acquire. We’re seeing one big market shut, but it surely won’t be life-threatening. Firms can have such an incentive to provide some other place that they’ll do it in a short time,” she added.

The result of the Geneva talks was a brief de-escalation of a wide-ranging cold war that is in fact much bigger than trade. The 90-day pause could also be a grace interval, however not for China; quite it’s a warning to U.S. companies about their backside line if provide chains and capital markets will not be diversified.

Nonetheless the commerce warfare ends, the message from American trade is evident: there could be no going back to the pre-Trump U.S.-China financial relationship.

“The U.S. can’t accept a commodity buying settlement like 2020’s U.S.-China Part One Commerce Deal. China’s financial system advantages from greater than $400 billion in items exports to the U.S., and it has been boosted by unfair practices and market-distorting insurance policies that this can be very unlikely to vary. Beijing’s insurance policies have eroded U.S. manufacturing capability and can proceed to take action, except complete measures are applied,” AAM’s Paul mentioned.