At the same time as auto insurance coverage charges degree out, drivers are nonetheless searching for a greater deal.

The speed of U.S. auto insurance coverage premium worth will increase slowed to lower than 2% on the finish of 2024, down from 13% originally of the 12 months. Nonetheless, the proportion of consumers purchasing for insurance coverage 12 months over 12 months jumped to 57% from 49%, based on a brand new J.D. Power 2025 U.S. Insurance Shopping Study.

“Auto insurance coverage charge taking reached multi-decade highs within the first quarter of 2024, which put document numbers of consumers into the market purchasing for lower-priced insurance policies because the 12 months progressed,” stated Stephen Crewdson, managing director of insurance coverage enterprise intelligence at J.D. Energy.

When shoppers hear charges are altering, they begin purchasing. The 57% of consumers reported for 2024 is the very best purchasing charge ever recorded within the 19-year historical past of the research. Buying charges had been larger in Q1 2024, in keeping with record-high insurance coverage charges. As worth will increase slowed all year long, purchasing charges elevated.

“As charge exercise started to fall within the second half of 2024, many consumers had been profitable at discovering lower-priced insurance policies,” Crewdson stated. “That mixture of elevated purchasing and fewer charge taking created a little bit of a snowball impact for a lot of the 12 months, however we’re seeing indicators that purchasing charges are beginning to normalize.”

One-third (33%) of consumers who’re actively purchasing for an auto coverage are hoping to avoid wasting by bundling their auto coverage with a home-owner’s coverage. It’s a plus for insurers, as clients who bundle insurance coverage have longer tenures with their insurer (7 years on common vs. 5.5 amongst those that don’t bundle).

“A probably greater concern for the business proper now could be the elevated curiosity many shoppers are displaying in embedded insurance coverage suppliers, like auto sellers, financing corporations and producers,” Crewdson stated.

Multiple-third (37%) of auto insurance coverage clients say they’re fascinated about embedded insurance coverage bought straight via the auto supplier or producer. Curiosity in embedded insurance policies is highest amongst Generations Y/Z (47%), and those that say their major motive for purchasing their auto coverage is service (48%).

And many shoppers are assured that their driving may earn decrease charges. This 12 months, 17% of insurers provided UBI applications utilizing telematics software program to observe an insured’s driving type and assign charges based mostly on security and mileage metrics. Choices are up from 15% in 2024 however down from 22% in 2023.

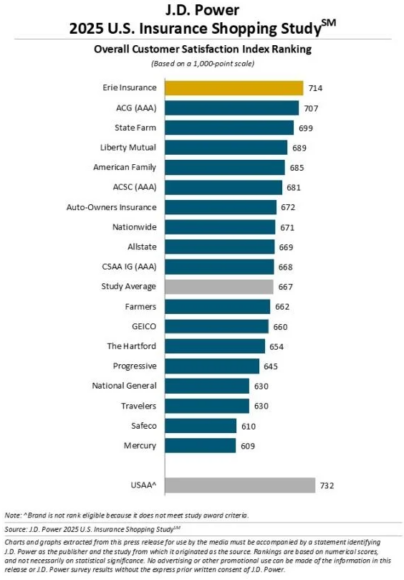

Amongst giant auto insurers, Erie Insurance coverage ranks highest in offering a satisfying buy expertise for the second consecutive 12 months, with a rating of 714 out of a 1,000-point scale. ACG (AAA) (707) ranks second, and State Farm (699) ranks third.

The J.D. Energy U.S. Insurance coverage Buying Research is predicated on responses from 12,720 insurance coverage clients who requested an auto insurance coverage worth quote from a minimum of one aggressive insurer within the earlier six months and captures superior perception into every stage of the purchasing funnel. The research was fielded from April 2024 via January 2025.

Subjects

Trends

Auto

Personal Auto

Pricing Trends

Eager about Auto?

Get automated alerts for this matter.