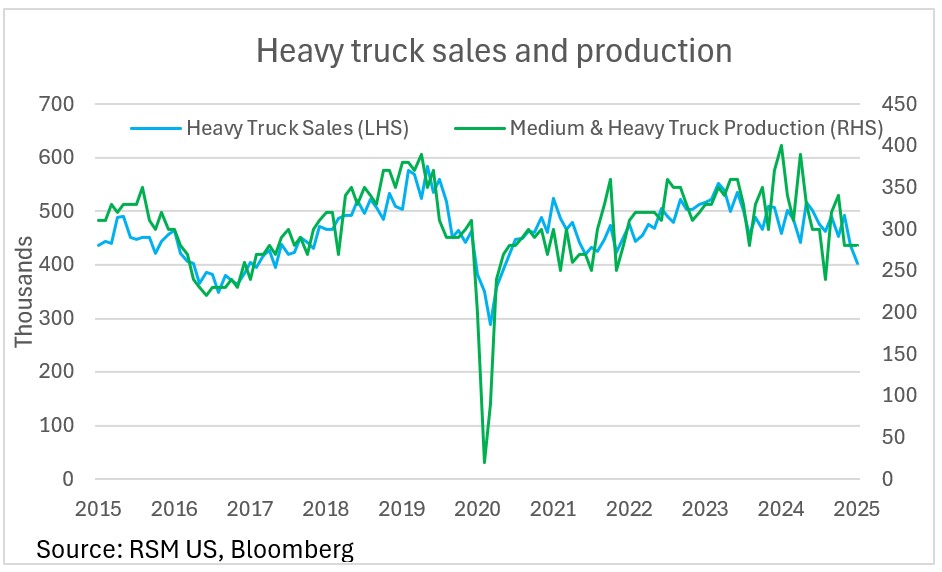

One of many higher barometers of the U.S. financial system is manufacturing and gross sales of heavy vehicles.

This information, to be launched as we speak by the Federal Reserve Financial institution of St. Louis, incorporates vital forward-looking info on industrial manufacturing, housing development and U.S. client demand that’s profoundly cyclical.

Each are slowing forward of the shocks linked to tariffs and what will probably be additional declines in demand by households and industrial ventures, the information reveals.

As for gross sales of autos and lightweight vehicles, which get extra consideration, anticipate April’s information to indicate brisk demand close to 17.2 million autos at an annualized tempo—in comparison with the 15.8 million earlier than the onset of the commerce struggle—when the information is launched early subsequent month.

This energy, although, will solely be momentary as a result of companies and customers have been pulling ahead purchases to keep away from larger commerce taxes. As soon as the tariffs are in place, it will likely be a unique story.

Learn extra of RSM’s insights on the financial system and the center market.