The USA’ try and rebalance the worldwide economic system to higher serve its pursuits has resulted within the flight of capital in another country.

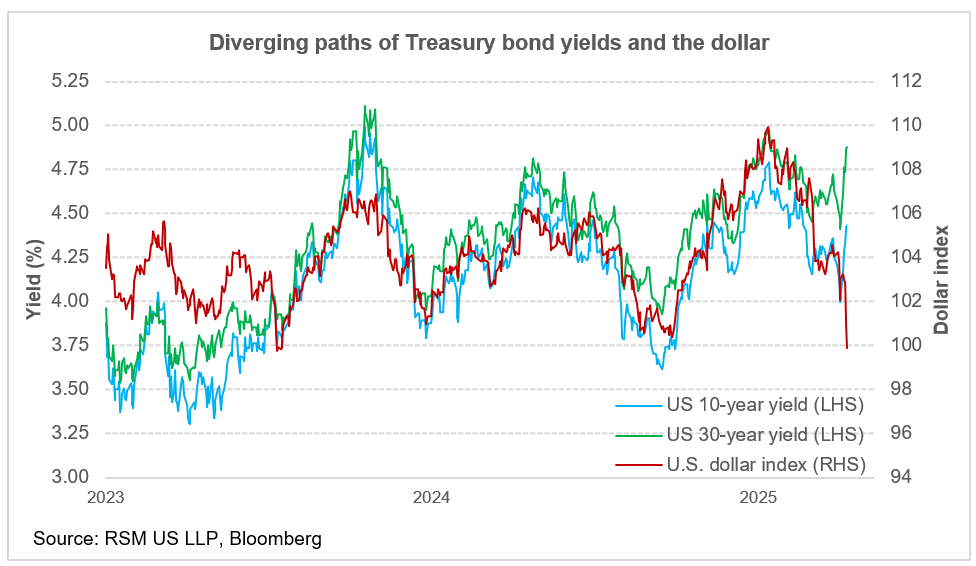

The first consequence of this effort has been a declining greenback and rising Treasury yields on the lengthy finish of the curve, between 10 and 30 years.

Over the previous yr, we’ve got made the case that any coverage that devalued the greenback or sought to finish its standing because the world’s reserve forex would hurt American companies and customers.

Arguments that the greenback is overvalued due to its reserve standing or that it’s in America’s curiosity to end the greenback’s reserve status are faulty.

These concepts, when translated into insurance policies like the brand new tariff regime, are inflicting a basic de-risking amongst giant institutional buyers and world central banks.

The notion that the U.S. might begin a multifront commerce warfare on each its allies and adversaries with none collateral injury to the American economic system and dollar-denominated belongings was at all times misguided.

The stress within the markets is the results of a personal sector steadiness sheet disaster—over-leveraged hedge funds—that’s draining liquidity from the market.

Ought to this proceed, a short-term stabilization program will should be carried out; to keep away from turning this right into a credit score crunch and a liquidity disaster. The Federal Reserve might want to goal monetary stability by offering liquidity to the market and the administration ought to take into account rolling again its tariff regime additional to guard the greenback and restore confidence and credibility in Treasuries.

It should take the subsequent technology to rebuild that confidence within the American economic system and re-establish the credibility of American monetary establishments. There’s priority for this sort of restore; take into account the interval following the abrogation of the Bretton Woods settlement by the Nixon administration in 1973 and the close to collapse of the worldwide monetary system in 2008.

A tipping level

U.S. fairness markets have tumbled just lately, whereas bond and cash markets are contending with the prospect of recession, elevated inflation and the necessity to cowl margin calls.

There’s a rising threat that dollar-denominated belongings will proceed to unwind because the attractiveness of U.S. belongings fades and the security of U.S. investments is put in danger.

Probably the most seen signal of the commerce shock and world disarray is the freefall of worldwide inventory markets.

Because the finish of March, Japan’s Topix index has misplaced 12.3% of its worth whereas Germany’s DAX has misplaced 13%. Canada’s inventory market has fallen by 8.6% since peaking in January and the S&P 500 Index has declined by 12.8% since February.

The shock of instability and the lack of wealth level to a worldwide economic system at a turning level.

Extra pertinently, the correlation between yields and the change price of the greenback has damaged down, leading to seen gaps within the pricing of dollar-denominated belongings like Treasuries.

Underneath such circumstances, the bid-ask unfold for such belongings widens and markets then don’t perform correctly as liquidity dries up.

Value discovery is nonexistent and it creates “air pockets” in markets during which belongings plunge in worth. Within the case of Treasuries, that turmoil sends the yield hovering, making a unfavorable suggestions loop into valuation of the greenback and inflicting it to plummet.

In brief, that’s how capital flees the USA as long-term skeptics of the greenback present its requiem throughout world markets.

Learn extra of RSM’s insights on the worldwide economic system and the center market.

Within the close to time period, we see so-called sizzling cash investments in U.S. monetary belongings being much less enticing.

This decline would happen if U.S. short-term rates of interest had been compelled decrease due to a recession. In the long term, we see the potential lack of confidence in U.S. establishments and a rising reluctance to put money into its economic system.

International direct funding is outlined as a purchase order of 10% of extra of the inventory of a U.S. company, which is extra more likely to be laborious cash versus short-term speculative investments.

Through the restoration from the monetary disaster and notably within the post-pandemic period, FDI has been flowing into U.S. companies, pushing up the greenback.

The energy of the greenback creates the means for U.S. households to eat international items, whereas dampening inflation and producing excessive returns in dollar-denominate investments.

The greenback index has misplaced 9.25% of its worth because the week earlier than the January inauguration.

This is able to not be the primary time that the greenback depreciated due to a lack of confidence within the U.S. authorities.

The latest notable instance was the greenback’s depreciation in runup to the monetary disaster. That decline was adopted by interval of austerity and authorities disfunction that stored the greenback buying and selling between $1.20 and $1.40 towards the euro from 2008 to 2015.

Since 2015, the greenback has benefited from a thriving U.S. economic system that has attracted each sizzling cash investments and international direct funding in U.S. companies. That enhance stored the greenback buying and selling inside a variety centered on a $1.12 common versus the euro.

The greenback was in a position to keep its attractiveness, benefiting from greater U.S. rates of interest in comparison with the opposite developed economies and the attractiveness of U.S. industries.

However that assist is waning, with Europe and the U.Ok. taking the lead by investing in infrastructure and protection.

How lengthy the greenback retains its energy will rely upon what buyers take into consideration the security of a dollar-denominated funding. To that time, the greenback has depreciated towards the euro by 10.9% since Jan. 10, transferring from $1.02 to $1.15 on April 2. These are breaks above its $1.12 equilibrium degree and its 10-year common.

The takeaway

In the long term, and whereas the greenback would ordinarily profit from its safe-haven standing in instances of stress, it has grow to be tougher to imagine that standing will final ceaselessly.

To retain that standing, the American economic system must be keen to be each the patron and lender of final resort even because it negotiates with its commerce companions and confront its adversaries.

The commerce deficit is a perform of home spending and financial savings and never the valuation of the greenback or its world reserve standing.

Neither the commerce deficit nor the greenback’s current spherical of overvaluation is a adequate purpose for the forex reserve standing of the greenback to be sacrificed as a matter of public coverage.

That transfer can be tantamount to the best monetary debacle since U.Ok. Chancellor of the Exchequer Winston Churchill put the U.Ok. again on the gold commonplace in April 1928, leading to a misplaced decade of deflation and unemployment.

The U.S. can’t count on to stay the middle of the worldwide economic system if it chooses to withdraw into fortress America.