Australia’s embrace of distant work—now pervasive with 40% of staff in hybrid or totally distant working preparations, experiences the Australian Bureau of Statistics—is quietly pushing small and medium-sized enterprises (SMEs) to the brink.

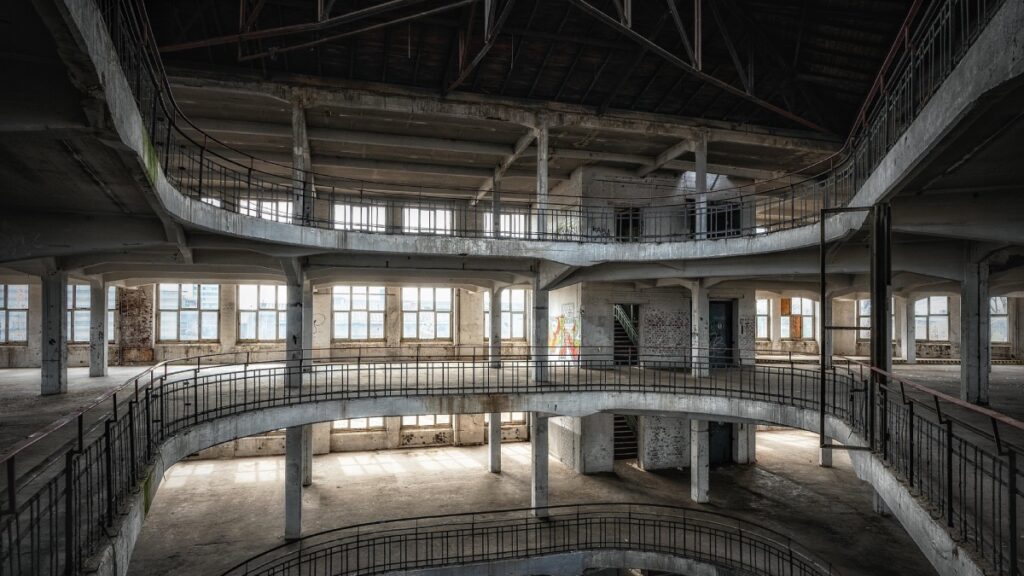

The newest CreditorWatch Enterprise Danger Index for February 2025 reveals a grim actuality: whereas rising prices hammer profitability, it’s the abandoned Central Enterprise Districts (CBDs), deserted by telecommuting staff, which might be delivering a devastating blow. Hospitality closures have soared to a file 9.3% nationwide—one in 11 companies shuttered up to now 12 months—up from 7.1% in 2024, with insolvencies climbing throughout the nation. This transformation, as soon as hailed as a agile future, is proving to be a quiet killer for city foot-traffic-reliant SMEs, and one which poses determined questions on their sustainability in an financial system that has develop into remote-first.

ACT’s ‘recession-proof’ status unfolds

The Australian Capital Territory (ACT), lengthy considered recession-proof due to its steady public sector jobs, has confirmed to be an surprising casualty. CreditorWatch statistics present the ACT surpassed Victoria in February 2025 insolvency ranges, a shock given Victoria’s weaker financial efficiency, the Nationwide Australia Financial institution (NAB) Enterprise Confidence Survey (March 2025) reported. Why? Authorities staff, the majority of the ACT’s workforce, have decreased CBD foot visitors with their shift to distant work. The ABS notes that public administration and security staff, a key ACT cohort, have shifted closely to distant setups, with 45% working from house at the least part-time in 2024—up from 20% pre-pandemic.

This exodus has hit SMEs arduous. Hospitality closures within the ACT reached 9.3% within the 12 months to February 2025, with meals and beverage companies bearing the brunt. ABS Shopper Worth Index information present meals costs rose 3.5% year-on-year, and the Reserve Financial institution of Australia (RBA) experiences discretionary shopper spending declined 4% since 2023 resulting from cost-of-living pressures. In Canberra’s Civic precinct, cafes and lunch spots that after trusted workplace staff now have empty tables. The CreditorWatch report says this isn’t simply confined to the ACT—that is additionally being skilled in Sydney and Melbourne CBDs—however the overreliance of the ACT on one workforce makes the hit worse.

ABS Counts of Australian Businesses identifies that the ACT is house to 29,000 SMEs, 60% of which function in service industries like hospitality and retail—sectors most affected by decreased bodily visitation. With CBD resurgence unimaginable within the occasion of hybrid work, ACT SMEs will seemingly look in direction of residential suburbs the place they’ll service distant staff by means of supply providers or pop-ups, or log on to faucet a broader market.

Rising defaults sign deeper financial pressure

The ripple impact of distant work extends effectively past the ACT, stretching SMEs nationwide. CreditorWatch experiences a 47% year-on-year enhance in business-to-business (B2B) bill fee defaults—a dire indicator of money circulation strain. Firms that default on funds see their insolvency threat rise by 0.7% to 7.9% over a 12-month interval, a development strengthened by the RBA’s Small Enterprise Financial and Monetary Circumstances Bulletin, which notes SMEs to have smaller monetary buffers than giant corporations. NSW additionally recorded higher insolvency ranges than Victoria in February, perhaps because of financial spill-over from the autumn in Victoria, whereas Western Australia’s financial system based mostly on mining continued its charges lowest, with a 2.1% unemployment fee (ABS, February 2025).

The transfer to distant working contributes to different pressures. Electrical energy costs have risen 10-15% every year, and rents close to CBDs are rising as landlords fill gaps—slapping SMEs that aren’t in a position to shift simply. The ATO Taxation Income report confirms that SMEs’ tax money owed have elevated by 15% since 2022, as nearly all of corporations are nonetheless repaying pandemic-related deferrals. Whereas workplace employees keep at house, metropolis SMEs are dealing with a two-way squeeze: much less clients and better payments. The RBA signifies that the hospitality and retail sectors that make use of 2.5 million Australians (ABS, 2024) are notably in danger, with insolvency charges in these sectors now above pre-pandemic ranges.

SMEs can resist this with credit score threat instruments—CreditorWatch’s system, as an example, tracks shopper fee data—or by negotiating extra stringent fee phrases. The ATO offers fee plans for tax debt, a final resort for struggling corporations, although take-up stays at 25% of qualifying companies (ATO, 2024).

Embracing the brand new actuality

Working from house is re-mapping Australia’s financial panorama, and SMEs should adapt or perish. Excessive-risk places like Western Sydney and South-East Queensland have an estimated 7.9% failure fee in areas like Bringelly-Inexperienced Valley, CreditorWatch experiences, based mostly on development issues and decrease incomes. Of the CBDs, Adelaide is lowest threat at 5.1%, adopted by Perth (5.2%), Melbourne and Brisbane (5.8%), and Sydney (6.2%). Adelaide’s SME base—much less office-based trade-oriented—is supported by regional stability, whereas Perth rides WA’s mining increase. Current reduction measures deliver a glimmer of optimism.

The RBA’s fee lower in February 2025—the primary since 2020—decreased borrowing prices, and mid-2024 tax cuts contributed 2-3% to household incomes. Storm clouds collect, although: mooted US tariffs would trim 1% from world development as per the International Monetary Fund, 2025, testing Australia’s export-driven financial system and doubtlessly nudging unemployment up from 4.1% to 4.5% by the top of the 12 months. With ATO tax liabilities a rising burden, SMEs face a grim alternative: evolve or develop into one of many 436,018 that departed in 2023-24.

Motion is what survival depends on. Diversifying income streams—e-commerce or suburban pop-ups, for instance—can offset CBD losses. Constructing money buffers, because the RBA suggests in its Monetary Stability Evaluate (March 2024), shields from shocks, with 25% more money than pre-pandemic SMEs being instructed to retain that edge. The ATO’s SME Restoration Mortgage Scheme (2023) affords low-interest loans, however solely 10% of eligible corporations have availed themselves of the provide (ATO, 2024)—a chance misplaced to bridge the hole.

Australia’s SMEs, with 2.6 million and using two-thirds of the nation’s workforce are the lifeblood of the financial system. Distant work’s quiet destruction—empty streets, unpaid invoices, and shuttered shopfronts—calls for a stable reconsideration.

Information Sources: CreditorWatch Enterprise Danger Index, ABS Labour Power Survey, ABS Counts of Australian Companies, RBA Bulletins, ATO Taxation Income, NAB Enterprise Confidence Survey

Maintain updated with our tales on LinkedIn, Twitter, Facebook and Instagram.