Steep competitors within the meals fast commerce companies and large money burns by Zomato and Swiggy are worrisome.

Steep competitors within the meals fast commerce companies and large money burns by Zomato and Swiggy are worrisome.

Picture: Amit Verma

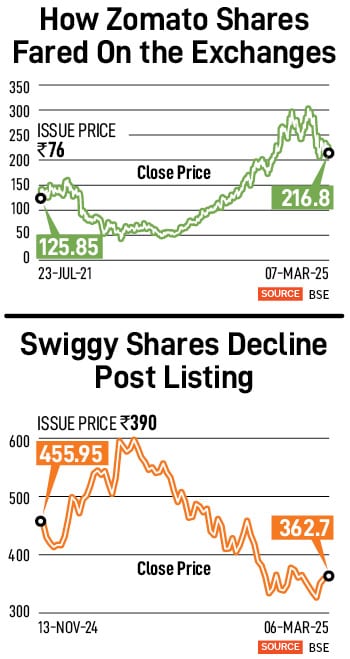

Shares of Zomato have slumped almost 30 % from the document highs touched on December 5, 2024, (at ₹304.5). The general market sentiment has been weak in the previous few months and, due to this fact, most shares are below strain. Nonetheless, the difficulty of such heavy sell-off in Zomato’s and rival Swiggy’s shares is sector-specific.

Steep competitors within the meals fast commerce companies and large money burns by Zomato and Swiggy are worrisome. Some analysts even name the sharp reductions provided by Zomato and Swiggy ‘irrational’. In the previous few months, competitors within the area has heated up with beginner Zepto providing increased reductions with an purpose to extend market share following aggressive retailer expansions.

The consequence on Zomato shares? Buyers shortly dumped the inventory. To date, this yr, the inventory has misplaced 22 % beginning January. Nonetheless, it has been rewarding for individuals who purchased its shares throughout its preliminary public providing in July 2021. At present fee, Zomato’s shares have surged 185 % from its concern worth of ₹76 apiece.

Abhisek Banerjee, analyst at ICICI Securities, nevertheless, thinks that considerations of excessive money burns have been over-baked into the inventory costs for each Swiggy and Zomato. “We expect Swiggy (consolidated) is now buying and selling at 30 % low cost to par worth for the meals supply enterprise, implying detrimental worth for the optionality of success in fast commerce. Zomato, however, is buying and selling at a price that ascribes nothing to fast commerce. We expect this anomaly is unlikely to maintain lengthy, particularly given a sturdy outlook for discretionary consumption from Might,” he says.

(This story seems within the 21 March, 2025 concern

of Forbes India. To go to our Archives, click here.)