Getty Photos

Getty PhotosThe federal government has introduced a collection of modifications to the welfare system geared toward saving £5bn in 2030 and getting extra individuals into work.

It will likely be tougher to assert a key incapacity profit known as Private Independence Cost (Pip) beneath the proposals.

In the meantime, the fundamental degree of common credit score – the most important working age profit – will rise, however these aged beneath 22 will not have the ability to declare incapacity profit on high.

What’s Pip and the way are the principles altering?

Pip is paid to greater than 3.6 million individuals who have issue finishing on a regular basis duties or getting round because of a long-term bodily or psychological well being situation.

There are two components – a each day dwelling part and a mobility part. Claimants could also be eligible for one or each.

Every day dwelling covers areas corresponding to requiring assist with making ready meals, washing, studying and managing your cash. The mobility factor contains bodily transferring round or getting out of your own home.

Candidates are scored on a factors system primarily based on their capability to hold out on a regular basis duties and on their mobility. Those that rating 8-11 factors in whole obtain the usual price of Pip, and those that rating 12 factors and over are eligible for the improved price.

From November 2026, the federal government says candidates might want to rating no less than 4 factors in a single exercise to obtain the each day dwelling part of Pip.

Eligibility for mobility funds won’t be affected.

The funds for each day dwelling are:

- An ordinary price of £72.65 per week

- An enhanced price of £108.55 per week

For mobility the funds are:

- An ordinary price of £28.70 per week

- An enhanced price of £75.75 per week

Pip is normally paid each 4 weeks and is tax-free. It doesn’t change relying in your financial savings or revenue and doesn’t rely as revenue affecting different advantages, or the benefit cap. You will get Pip in case you are working.

At current, the cost is made for a set time frame between one and 10 years, after which it’s reviewed. A reassessment might come earlier if your circumstances change.

Below the modifications introduced by the federal government, there might be extra frequent reassessments for many individuals claiming Pip. Many recipients could possibly be affected.

Nonetheless, these with the best ranges of a everlasting situation or incapacity will not face reassessment.

Initially, it was thought Pip funds won’t be elevated in step with inflation for a yr, however the authorities has stated they won’t be frozen or means examined.

Pip is paid in England, Wales and Northern Eire.

There’s a comparable however separate profit in Scotland known as the Grownup Incapacity Cost.

How is common credit score altering?

The federal government has additionally made modifications to common credit score, which is presently paid to 7.5 million individuals.

At current, greater than three million recipients don’t have any requirement to search out work, a quantity that has risen sharply.

The essential degree of common credit score is value £393.45 a month to a single one that is 25 or over.

However when you’ve got restricted capability to work due to a incapacity or long run situation, this cost greater than doubles, because of a high up of £416.19.

Below the proposals, claimants won’t be eligible to get this incapacity top-up till they’re aged 22 or over.

There will even be an “expectation to have interaction” for individuals who obtain the additional cash, involving personalised employment assist.

On the identical time, the fundamental cost degree will rise, reaching a £775 annual improve by the yr 2029-30.

Why is the federal government aiming to chop welfare spending?

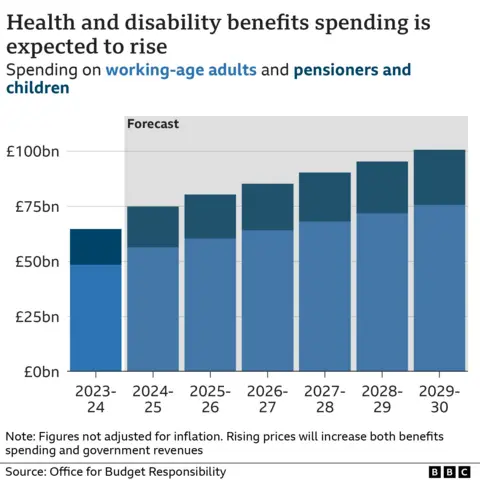

Total, the federal government presently spends £65bn a yr on well being and disability-related advantages. That is projected to extend to £100bn by 2029.

Pip is now the second-largest factor of the working-age welfare invoice, with spending anticipated to virtually double to £34bn by 2029-30.

When Pip was launched in 2013, the intention was to save lots of £1.4bn a yr by lowering the variety of individuals eligible for funds. Nonetheless, preliminary financial savings had been modest and the variety of claimants has risen.

About 1.3m individuals now declare incapacity advantages primarily for mental health or behavioural conditions corresponding to ADHD.

That’s 44% of all working age claimants, in accordance with the unbiased financial think-tank, the Institute for Fiscal Research (IFS).