Contents

Mercantilist Country Analysis 5

Appendix 2: Detailed Indicator Values and Scores for All Countries 28

The second Trump administration has taken workplace seeking to put U.S. commerce relations on a extra equitable footing with the remainder of the world. President Trump has railed that different nations “are profiting from us” and vowed to make sure that U.S. firms are handled pretty in worldwide markets. As Secretary of State Marco Rubio just lately instructed U.S. allies, “I do know you’ve gotten used to a overseas coverage during which you act within the nationwide curiosity of your nation, and we type of act within the curiosity of the globe or world order. However we’re led by a distinct particular person now.”[1]

To enact the president’s imaginative and prescient, the White Home has instructed the Workplace of the US Commerce Consultant (USTR), in coordination with the departments of Commerce and Treasury, to determine “any unfair commerce practices by different international locations and suggest applicable actions to treatment such practices” by April 1, 2025.[2]

In the meantime, the president has already educated his fireplace at a number of nations within the opening weeks of his administration—notably Canada, China, Colombia, and Mexico—however the to-do record is lengthy, as an rising variety of international locations around the globe have adopted mercantilist commerce practices in current many years.[3] Towards that backdrop, the administration ought to deal with international locations the place systematically unfair, mercantilist commerce insurance policies are inflicting probably the most vital injury on the U.S. economic system and U.S. firms (massive and small alike), and the place the US stands to achieve probably the most by restoring balanced commerce. Accordingly, the Data Expertise and Innovation Basis (ITIF) has developed the “Commerce Imbalance Index” described on this report. It evaluates 48 international locations (15 of that are included within the “European Union” bloc) on 11 measures to establish that are the most important commerce mercantilists or scofflaws and the place the Trump administration ought to focus its consideration because it seeks to advance a commerce coverage that extra successfully defends U.S. pursuits and ensures extra balanced commerce relations.

This report evaluates the most important 48 international locations by gross home product (GDP) on 11 indicators protecting 4 classes.[4] (See Appendix 1 for the complete methodology.) In short, the classes and indicators are as follows:

▪ Commerce stability in items and knowledge providers: This class considers U.S. commerce balances in items and knowledge providers. ITIF used the uncooked values of the commerce balances fairly than the relative values (e.g., commerce stability as a share of GDP) to raised measure the general hurt a nation has on the US when it runs a surplus. In different phrases, a nation with which the US has a excessive deficit would trigger extra hurt to the US even when the deficit have been small when in comparison with its GDP.[5]

▪ Commerce restrictions: These contain a easy imply tariff price throughout all product classes, the prevalence of non-tariff commerce obstacles (NTBs), and the nation’s Companies Commerce Restrictiveness Index rating.[6]

▪ Taxes and rules: These cowl the extent of a rustic’s Digital Markets Act (DMA) rules, extent of digital providers taxes (DSTs), extent of pharmaceutical value controls, the presence of antitrust fines, and the presence of noncompetition fines on the digital economic system. [7]

▪ Mental property (IP): This class contains the 2024 USTR Part 301 Watch Checklist and the nation’s rating on the U.S. Chamber of Commerce Worldwide IP Index.[8]

As a result of we consider that America’s bilateral commerce stability with a given nation just isn’t an important think about figuring out whether or not the Trump administration ought to prioritize that nation for a commerce response, the trade-balance indicator accounts for less than one-quarter of the entire weighted rating in our index. Finally extra necessary than bilateral commerce balances are the underlying elements affecting U.S. commerce with a given nation. So even when a rustic runs a commerce deficit with the US, there could also be motive for the Trump administration to confront it if the nation employs a major quantity or diploma of unfair buying and selling practices.

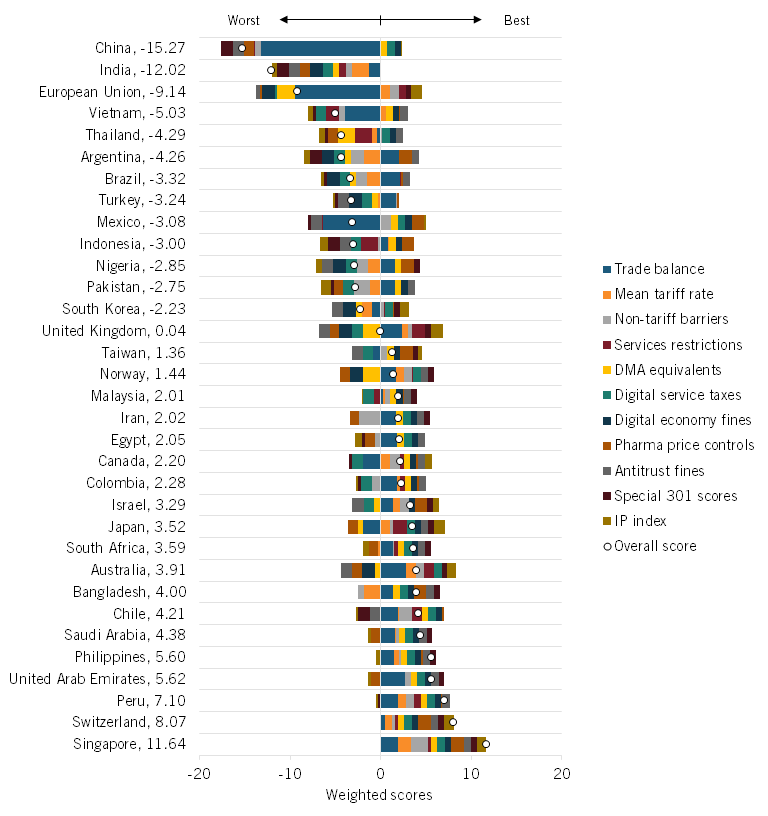

Weighing these issues, China, India, the European Union, Vietnam, and Argentina rank because the 5 worst offenders in ITIF’s index. (On this research, “European Union” refers back to the 15 largest EU members, besides within the trade-balance indicator the place it refers back to the complete bloc.)[9]

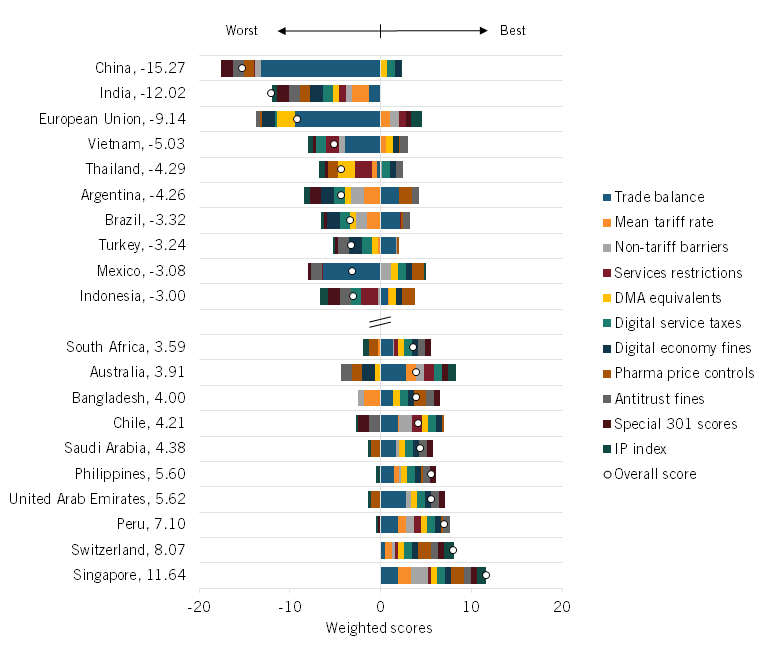

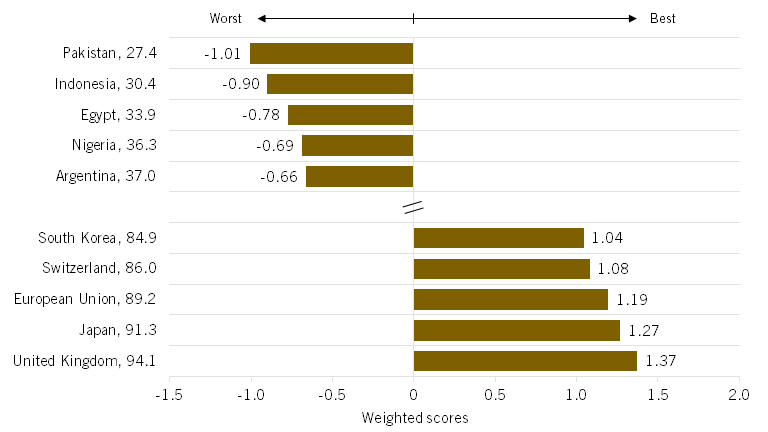

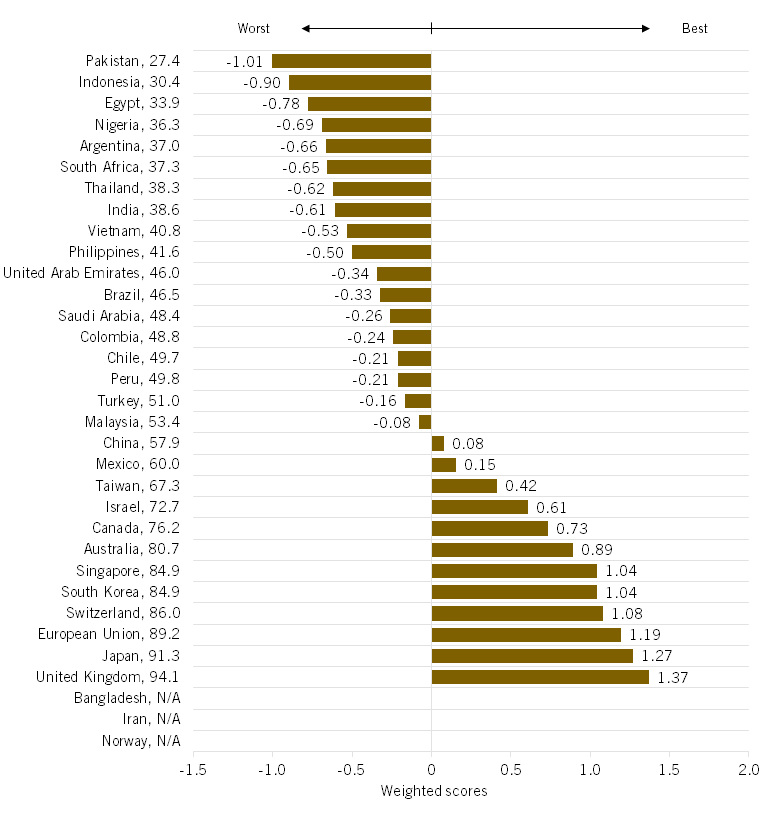

Determine 1 exhibits the worst- and best-performing international locations’ weighted total scores in ITIF’s index. (See Appendix 2 for full scores.) The extra unfavorable the rating, the extra the Trump administration ought to prioritize that nation for a commerce response. The ten worst-performing nations with unfavorable scores (from worst to finest) are China, India, the European Union, Vietnam, Argentina, Thailand, Brazil, Turkey, Mexico, and Indonesia. In distinction, the nations that needs to be least more likely to face retaliatory measures from the Trump administration embody Singapore, Switzerland, Peru, the United Arab Emirates, and the Philippines.

Determine 1: General scores of the worst- and best-performing nations in ITIF’s Commerce Imbalance Index

This report begins by providing an in-depth evaluation of the problematic commerce and financial insurance policies of the highest three most problematic nations (or areas within the European Union case). It then analyzes how international locations fared on every of the person indicators within the report. Lastly, it provides commerce coverage suggestions for the Trump administration and Congress to responsibly handle the mercantilist practices of overseas international locations.

As famous, China, India, and the European Union rating lowest in ITIF’s index and stand out because the nations the place the Trump administration ought to focus the best consideration on rebalancing commerce and financial relations.

China

China’s rating first within the research is not any shock. The nation has persistently failed to stick to the commitments it made to the US, and different worldwide commerce companions, when it joined the World Commerce Group (WTO), as ITIF has documented throughout quite a few studies.[10] Over the previous decade, the nation has recorded a virtually $3.5 trillion commerce surplus in manufactured items with the US.[11] In 2023, China’s items commerce surplus with the US reached $279 billion, with this quantity rising to $295 billion in 2024. And that determine represented about one-third of China’s practically $1 trillion commerce surplus with the world final yr as its exports swamped the globe.[12] China’s 2022 easy imply tariff price stood at 6.5 p.c.

USTR recognized China as a Precedence Watch Checklist nation in 2024 for its continued infringements on U.S. IP rights. The report notes that “long-standing points [remain] together with expertise switch, commerce secrets and techniques, counterfeiting, on-line piracy, copyright legislation, and patent and associated insurance policies.”[13] The Fee on the Theft of American Mental Property has estimated that China’s IP theft might price the U.S. economic system as a lot as $600 billion yearly.[14] A 2019 CNBC World CFO Council report discovered that one in 5 North American firms had their IP stolen in China in 2018.[15] In ITIF’s collection of “How Modern Is China in Excessive-Tech Industries” studies, ITIF documented quite a few instances of IP theft in sectors starting from electrical automobiles and nuclear expertise to semiconductors and digital shows.[16] China additionally continues to be the world’s main supply of counterfeit and pirated items.[17] The nation additional imposes extra obstacles to cross-border knowledge flows than another nation on the earth.[18]

China’s rampant IP theft might price the U.S. economic system as a lot as $600 billion yearly, with high-tech sectors most in danger.

China has opened specious antitrust investigations into U.S. tech firms together with Google and NVIDIA and up to now imposed unjustified antitrust fines on U.S. tech firms, such because the $1 billion effective it imposed on Qualcomm in 2015.[19] With regard to prescribed drugs, China imposes steep drug value controls and favors Chinese language companies in nationwide drug choice.[20]

Pressured switch of expertise or IP as a situation of Chinese language market entry—or necessities to fabricate regionally as a situation of entry to Chinese language markets—stays a perennial problem. Certainly, China calls this technique “buying and selling expertise for market.” Nonetheless, now that China has sufficiently aggressive high-tech companies in a wide range of sectors, it’s more and more shifting from a method of “compulsion” to one in all “expulsion.”

As an illustration, on April 12, 2024, The Wall Avenue Journal reported that “China’s push to exchange overseas expertise is now targeted on chopping American [chipmakers] in another country’s telecommunications techniques.”[21] The transfer would impression a wide range of U.S. semiconductor firms, together with AMD and Intel. The article notes that “[Chinese] officers earlier this yr directed the nation’s largest telecom carriers to part out overseas processors which are core to their networks by 2027.”[22] The trouble is just like one articulated in Doc 79, which requires state-owned enterprises in finance, power, and different sectors to exchange overseas software program of their data expertise (IT) techniques by 2027.[23]

Elsewhere, the Chinese language authorities has requested electrical automobile makers from BYD to Geely to sharply improve their purchases from native auto chipmakers, a part of a marketing campaign to scale back reliance on Western imports and enhance China’s home semiconductor business.[24] China’s Ministry of Trade and Data Expertise has instantly instructed Chinese language automakers to keep away from overseas semiconductors if in any respect potential.[25] Such measures go away little doubt that import substitution and reaching self-sufficiency symbolize a vital objective of China’s aggressive technique in a variety of high-tech industries from autos to semiconductors. Such a method is instantly antithetical to and contravenes the commitments China made to world commerce companions in becoming a member of the WTO. China is certainly the world’s primary mercantilist.

India

India ranks second on this index. In 2024, India recorded a $45.7 billion commerce surplus with the US. That was atop a $43.3 billion commerce surplus the yr earlier than.[26] India’s easy imply tariff price is 14.3 p.c, whereas on a trade-weighted foundation, India’s price is about 12 p.c in contrast with America’s price of two.2 p.c.[27] Of the international locations assessed on this report, India scores fourth worst with regard to its providers commerce restrictiveness. India continues to keep up excessive customs duties on IP-intensive items resembling IT merchandise, photo voltaic power tools, medical gadgets, prescribed drugs, and capital items.[28]

In 2016, India carried out an equalization levy (EL) of 6 p.c on nonresidents engaged in on-line commercial and associated actions with Indian prospects. India’s Finance Act of 2020 expanded the EL to introduce a levy on e-commerce provide or providers equal to 2 p.c of gross earnings facilitated by a nonresident e-commerce operator.[29] On March 12, 2024, the Indian Ministry of Company Affairs launched a draft report of the Committee on Digital Competitors Legislation together with a draft invoice on the Digital Competitors Act that “bears a putting resemblance” to the EU’s problematic Digital Markets Act.[30] The laws embraces an ex ante regulatory mannequin and follows the trail of overbearing competitors coverage taken by the EU.[31]

U.S. firms have additionally been the goal of great antitrust fines levied by Indian authorities. India’s Competitors Fee fined Meta $24.5 million for its knowledge sharing practices, contending that the corporate abused its dominance and “coerced” WhatsApp customers into accepting a 2021 privateness coverage that allegedly expanded consumer knowledge assortment and sharing, giving it an unfair benefit over rivals.[32] The fee additionally fined Google $154 million for practices associated to its Android working system.[33] General, India is closely scrutinizing American tech firms and following a European strategy.

India stays on USTR’s Particular 301 Precedence Watch Checklist, as “there continues to be a scarcity of progress on many long-standing IP considerations raised in prior Particular 301 Studies. India stays one of many world’s most difficult main economies with respect to safety and enforcement of IP.”[34] India continues to position elevated restrictions on patent subject material eligibility that exceeds the required novelty, creative step, and industrial applicability necessities. Beneath Part 3(d) of the Indian Patent Act, there exists a further “fourth hurdle” concerning the creative step and enhanced efficacy that limits patentability for sure varieties of pharmaceutical innovations and chemical compounds.[35] India ranks forty second out of 55 international locations on the World Innovation Coverage Heart’s Worldwide IP Index. Elsewhere, India’s pirating of movie and audiovisual content material by illicit video recording stays a serious problem.

On February 13, 2025, Indian Prime Minister Narendra Modi visited president Trump in Washington, D.C. He appeared to return ready to supply sure tariff concessions on some merchandise, together with cars and electronics, to the US.[36] Popping out of these conferences, Indian and U.S. officers agreed to begin creating “broad contours of [a] proposed commerce settlement” between the 2 international locations, which clearly has vital potential to handle a few of these commerce irritants and considerably enhance the India-U.S. commerce relationship.[37]

The European Union

The EU ranks third on this index, because it’s among the many main practitioners of discriminatory commerce insurance policies focusing on U.S. enterprises, significantly these in digital industries, thanks particularly to its DMA and Digital Companies Act (DSA). Actually, there are over 100 digital rules in drive throughout the EU, enforced by not less than 270 companies.[38] European policymakers ostensibly designed the DMA to create a fairer digital market by stopping massive on-line platforms, which the EU calls “gatekeepers,” from abusing their market energy and guaranteeing extra competitors for smaller firms and shoppers in digital industries. Its sister laws, the 2022 DSA, addresses unlawful content material, clear promoting, and disinformation.

However as ITIF has written, the laws ought to actually have been referred to as the “U.S. Tech Corporations Act,” because the laws deliberately singles out U.S. tech firms.[39] As an illustration, the European Parliament rapporteur for the DMA, Andreas Schwab, instructed that the DMA ought to unquestionably goal solely the 5 greatest U.S. digital companies (Google, Amazon, Apple, Fb, and Microsoft).[40] Mainly, the DMA and DSA have been designed to cowl, nearly completely, U.S. companies and never their European or Chinese language rivals that provide comparable providers.[41] A leaked draft of the proposed EU DSA was fairly clear on this intent: “Uneven guidelines will be certain that smaller rising rivals are boosted, serving to competitiveness, innovation, and funding in digital providers.”[42] Certainly, the European Fee has opened non-compliance investigations towards Alphabet, Apple and Meta below its DMA.[43]

The DMA ought to actually have been referred to as the “U.S. Tech Corporations Act,” because the laws has nearly completely singled out U.S. tech firms.

Sure European international locations have used their laws to impose punitive antitrust fines on U.S. firms. As an illustration, Apple confronted a £1.5 billion ($1.9 billion) class motion lawsuit in the UK for allegedly overcharging software program builders by the App Retailer.[44] The case claims that Apple abused its market dominance by imposing a 30 p.c fee on app purchases. Additional, the UK’s Competitors and Markets Authority (CMA) has indicated potential investigations into Amazon’s and Microsoft’s dominance in cloud computing, following alleged considerations about anticompetitive habits within the sector.[45]

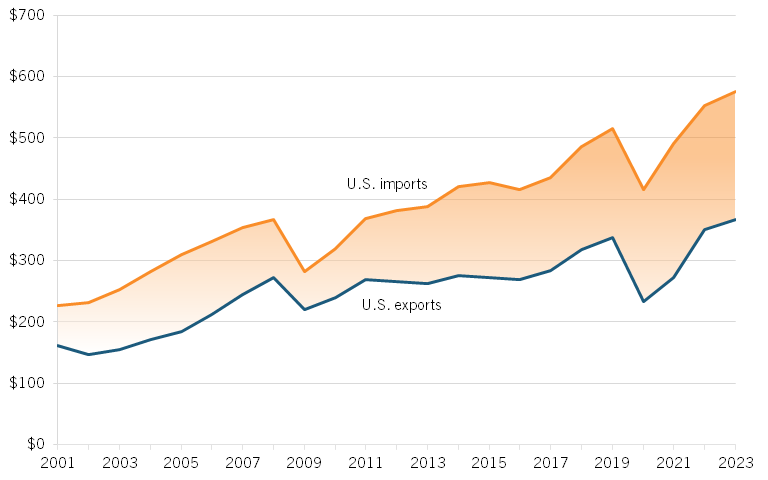

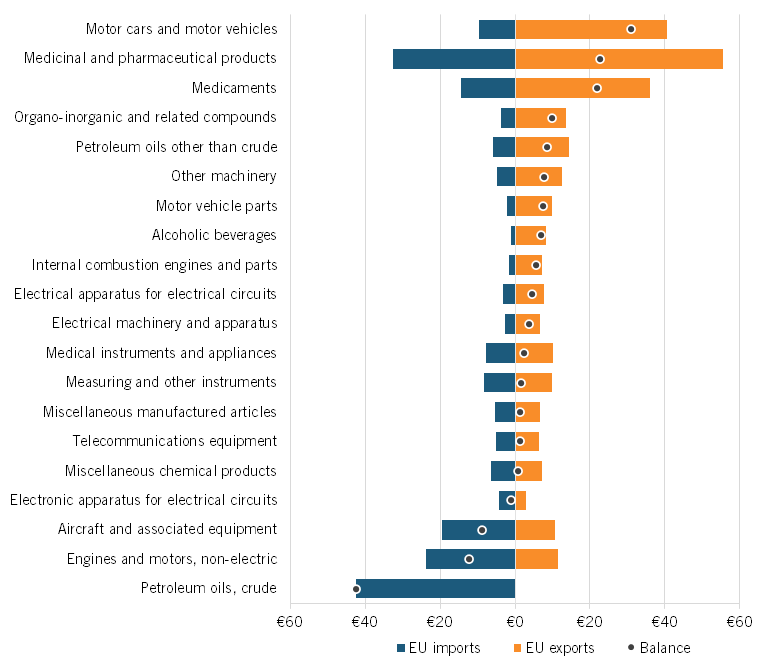

In 2023, the EU ran a commerce surplus of $208.7 billion with the US. (See determine 2.) The EU runs vital commerce surpluses with the US throughout plenty of advanced-technology industries, together with prescribed drugs and medical gadgets, motor automobiles and components, electrical items, telecommunication items, chemical substances, and devices. (See determine 3.) Europe’s massive commerce surplus with the US in prescribed drugs stems largely from the intensive drug value controls carried out by most international locations on the continent and their failure to pay enough costs for progressive medicines.[46] Of the 27 EU nations, all however 7 (Malta, Luxemburg, Croatia, Lithuania, Belgium, Spain, and the Netherlands) run commerce surpluses in items with the US. And the nation whose officers complain the loudest of U.S. “digital dominance”—Germany—runs the most important commerce surplus.[47]

Determine 2: U.S. commerce deficit with the EU (billions)[48]

Determine 3: EU commerce stability with the US in items industries, 2023 (billions)[49]

Whereas the European Union applies a comparatively low easy imply tariff price, this obscures a wide range of value-added taxes and different charges that make U.S. merchandise dearer in Europe. For instance, the EU levies a ten p.c tariff on U.S. automotive imports, whereas the US imposes a 2.5 p.c responsibility.[50] And as president Trump has noticed, when Europe’s value-added taxes (VAT) are added in, U.S. automotive exports to Europe may be tariffed and taxed as excessive as 30 p.c.[51]

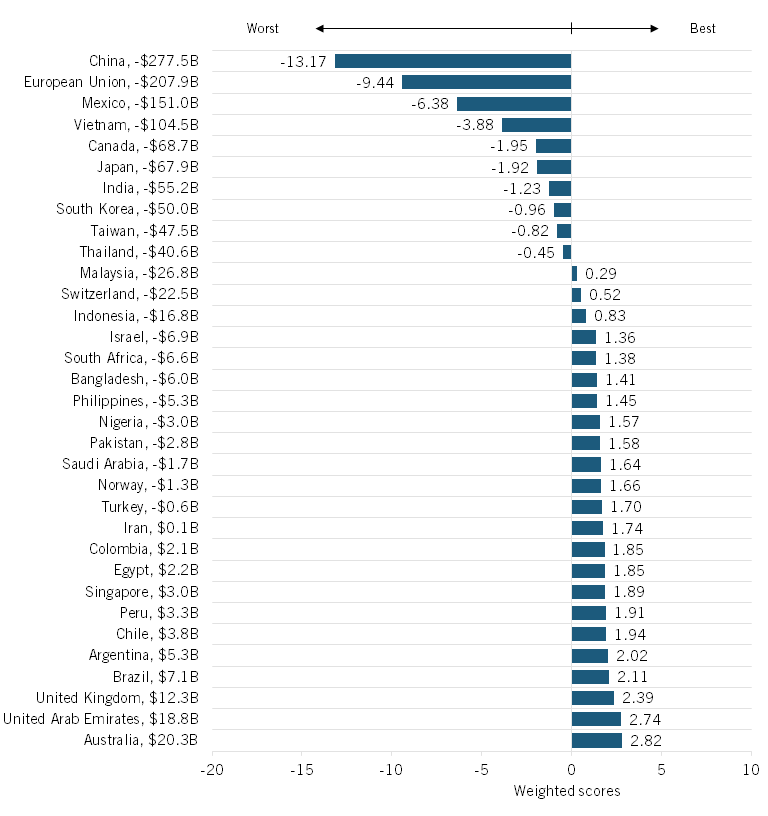

Commerce Steadiness in Items and Data Companies

The Commerce Steadiness in Items and Data Companies indicator gives a standardized rating for every nation based mostly on its commerce surplus or deficit in items and knowledge providers with the US in 2023, as measured by the U.S. Census Bureau’s “USA Commerce” and the Group of Financial Cooperation and Growth (OECD).[52] International locations with massive commerce surpluses towards the US obtain a low standardized rating, these with average surpluses obtain a mid-range rating, and people with commerce deficits or balanced commerce obtain a excessive rating.

This indicator is included within the index as a result of vital commerce imbalances are sometimes perceived as proof of unfair commerce practices, foreign money manipulation, or inadequate market entry for U.S. items. ITIF makes use of the commerce stability in items and knowledge providers measure right here (versus commerce stability in items as a share of GDP measure), recognizing that the Trump administration locations a major deal with the general hurt a big commerce deficit has on the US. In different phrases, the administration is extra involved with a nation with a big deficit than one with a big deficit relative to its GDP. As such, below the Trump administration, international locations with low scores needs to be extra more likely to face retaliatory measures resembling tariffs, stricter commerce insurance policies, or efforts to renegotiate commerce agreements.

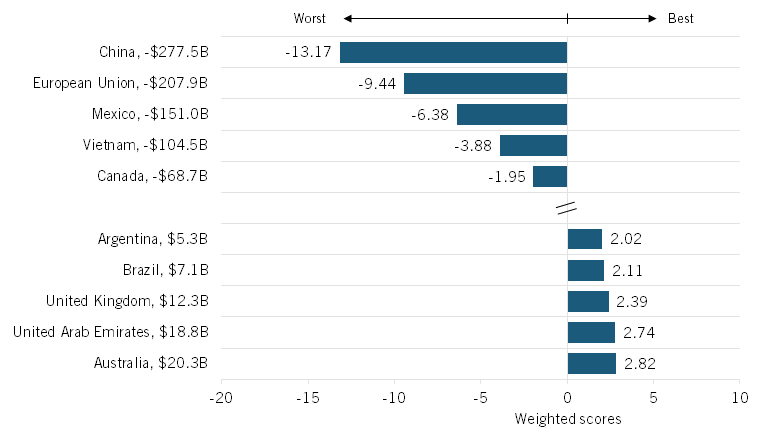

Determine 4 highlights the nations with the most important items and knowledge providers commerce surpluses and deficits with the US. (See the complete record of nations within the appendix, determine 16.) China, the European Union, Mexico, and Vietnam all might change into prime targets for commerce restrictions or renegotiations based mostly on their substantial surpluses. For instance, China has the very best surplus at $277.5 billion. The European Union runs a surplus of $208 billion, whereas Mexico runs a surplus of $151 billion and Vietnam enjoys a $104 billion surplus. In the meantime, Australia, the United Arab Emirates, and the UK preserve a extra balanced commerce relationship with the US, all operating a deficit that exceeds $10 billion, making them much less more likely to face financial pushback from the administration on account of commerce balances.

Determine 4: Commerce stability of products and IT providers (2023) and weighted standardized scores (weight = 3.5)[53]

Commerce Restrictions

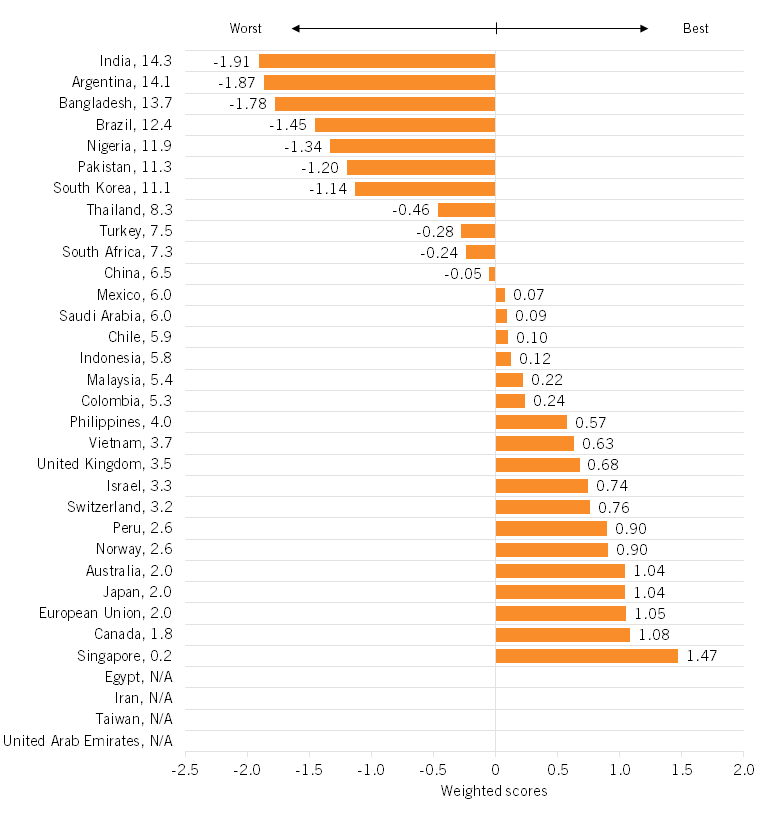

Easy Imply Tariff Charge for All Merchandise

The Easy Imply Tariff Charge for All Merchandise indicator gives a standardized rating for every nation based mostly on its unweighted common of easy imply tariff charges throughout all traded merchandise for 2022, as measured by the World Financial institution’s World Growth Indicators.[54] International locations with excessive easy imply tariff charges obtain a low standardized rating, these with average tariffs obtain a mid-range rating, and people with low or near-zero tariffs obtain a excessive rating.

This indicator is included within the index as a result of excessive tariff charges create vital obstacles for U.S. exports, elevating prices for American companies and lowering market entry. Protectionist tariff insurance policies can stifle competitors, inflate client costs, and disrupt world provide chains, making it more durable for U.S. companies to compete internationally. Decrease-scoring international locations ought to legitimately face extra commerce scrutiny from the Trump administration.

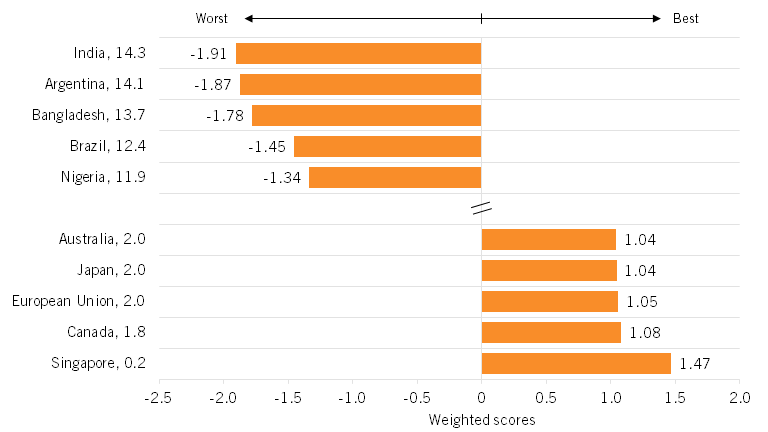

Determine 5 highlights the worst offenders: India, Argentina, Bangladesh, Brazil, and Nigeria, all of which preserve steep tariffs that inhibit U.S. exports. These nations all have easy imply tariff charges that exceed 10 p.c—India has a price of 14.3, Argentina has a 14.1 price, and Bangladesh has a 13.7 price—and will discover themselves within the crosshairs of the Trump administration’s commerce agenda. In the meantime, Singapore and Canada exhibit a number of the lowest tariff charges on the earth. (See the complete record of nations within the appendix, determine 17.)

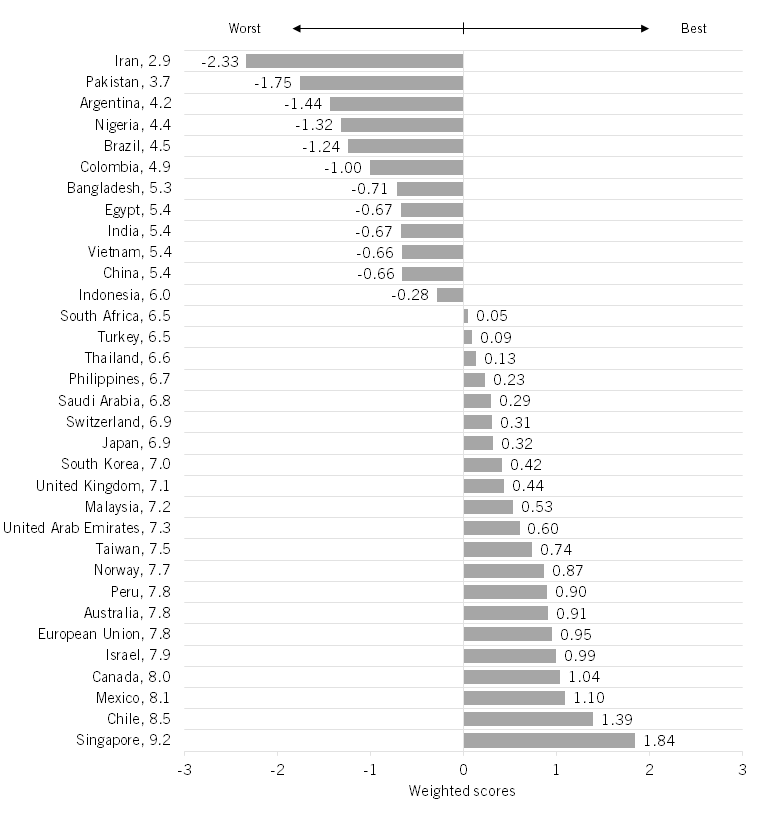

Determine 5: Easy imply tariff charges for all merchandise (uncooked values and weighted standardized scores; weight = 1)[55]

Non-Tariff Commerce Obstacles

The Non-Tariff Commerce Barrier indicator gives a standardized rating for every nation based mostly on the prevalence of NTBs, as measured by the Fraser Institute’s Financial Freedom of the World 2024 index.[56] International locations with intensive NTBs obtain a low standardized rating, these with average restrictions obtain a mid-range rating, and people with minimal obstacles obtain a excessive rating.

This indicator is included within the index as a result of NTBs restrict market entry for U.S. companies, improve compliance prices, and scale back U.S. companies’ competitiveness within the world market.[57] As such, below the Trump administration, international locations with low scores usually tend to face countermeasures, resembling tariffs, commerce restrictions, or heightened regulatory scrutiny.

Determine 6 exhibits that Iran, Pakistan, Argentina, Nigeria, and Brazil are almost definitely to face commerce scrutiny from the Trump administration as a result of their low rating on this measure, which signifies that they’ve excessive commerce obstacles more likely to hurt U.S. firms. For instance, Argentina requires importers to request nonautomatic import licenses on about 1,500 merchandise and has diminished the validity of licenses from 180 days to 90 days.[58] Nigeria additionally employs NTBs which are detrimental to importers. As an illustration, it requires meals, medication, and cosmetics to be inspected however doesn’t have the capability to carry out these inspections in a well timed method.[59] In the meantime, Singapore and Chile make use of the fewest NTBs of countries on this research and are much less more likely to face sanctions for this specific motive. (See the complete record of nations within the appendix, determine 18.)

Determine 6: NTBs (uncooked values and weighted standardized scores; weight = 1)[60]

Companies Commerce Restrictiveness Index

The Companies Commerce Restrictiveness Index indicator gives a standardized rating for every nation based mostly on the extent of restrictions in its providers commerce sector, as measured by OECD’s Companies Commerce Restrictiveness Index in 2023.[61] International locations with extremely restrictive providers commerce insurance policies obtain a low standardized rating, these with average restrictions obtain a mid-range rating, and people with principally open providers commerce insurance policies obtain a excessive rating.

This indicator is included within the index as a result of restrictive providers commerce insurance policies can hinder U.S. firms working in sectors resembling finance, telecommunications, and digital providers. Excessive restrictions improve prices, restrict market entry, and scale back competitiveness for American companies. Furthermore, additionally they scale back provide and improve the price of providers for U.S. shoppers.

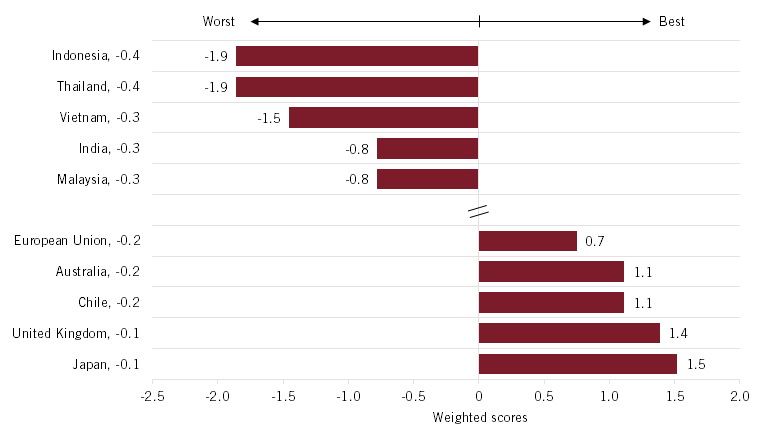

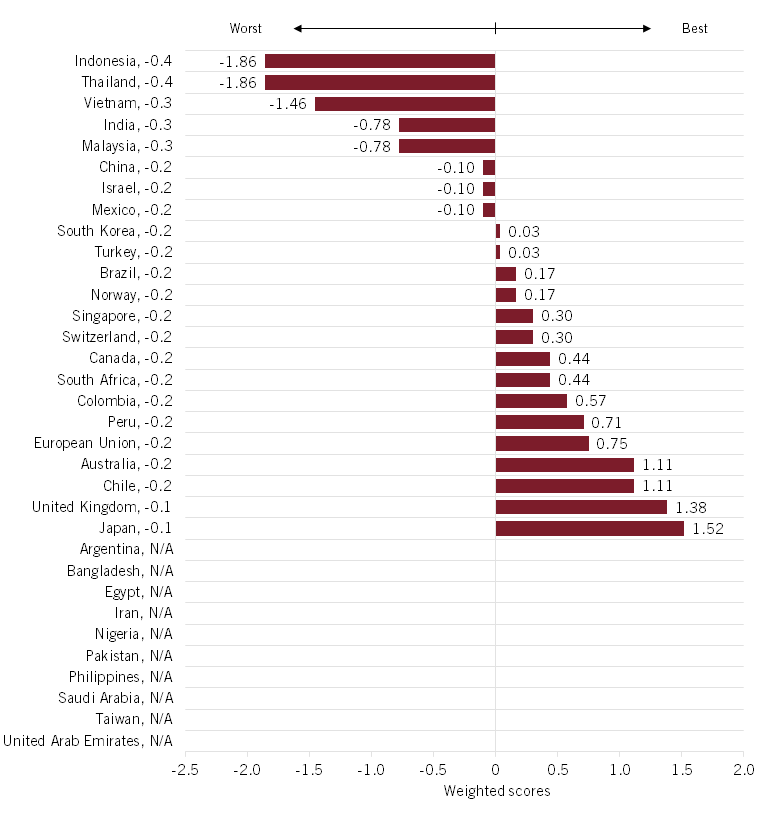

Determine 7 exhibits that Indonesia, Thailand, and Vietnam are almost definitely to face retaliatory commerce actions below the Trump administration as a result of their low rating, which signifies excessive restrictions on providers commerce that hurt U.S. firms. For instance, Indonesia is especially restrictive partly as a result of its restrictions in authorized providers, accounting providers, and telecommunications.[62] In the meantime, Thailand is sort of restrictive in providers commerce as a result of reforms that liberalize providers commerce have slowed lately.[63] In distinction, Japan, the UK, Chile, and Australia have probably the most open providers commerce insurance policies and are much less more likely to face pushback from the administration because of this. Japan notably has a steady regulatory atmosphere for providers and has reasonably liberalized its logistics and insurance coverage sectors.[64] (See the complete record of nations within the appendix, determine 19.)

Determine 7: Companies Commerce Restrictiveness Index (uncooked values and weighted standardized scores; weight = 1)[65]

Taxes and Laws

Digital Markets Act

The Digital Markets Act indicator gives a standardized rating for every nation based mostly on the presence or absence of a DMA or the same regulatory framework in a nation.[66] International locations which have carried out a DMA or comparable laws obtain a low standardized rating, these now creating such rules obtain a mid-range rating, and people with out such legal guidelines obtain a excessive rating.

This indicator is included within the index as a result of digital market rules, such because the DMA, impose restrictions on massive expertise companies, a lot of that are U.S.-based. These rules can restrict companies’ revenues, prohibit enterprise practices, and improve compliance prices, probably lowering profitability and innovation. The Trump administration ought to scrutinize international locations that area anticompetitive DMA legal guidelines.

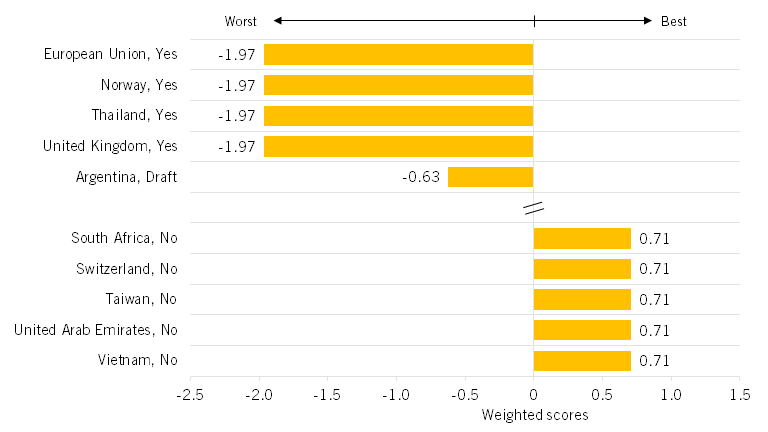

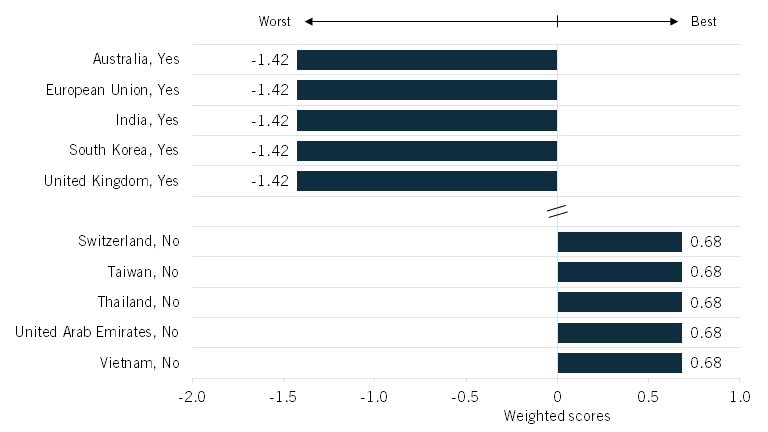

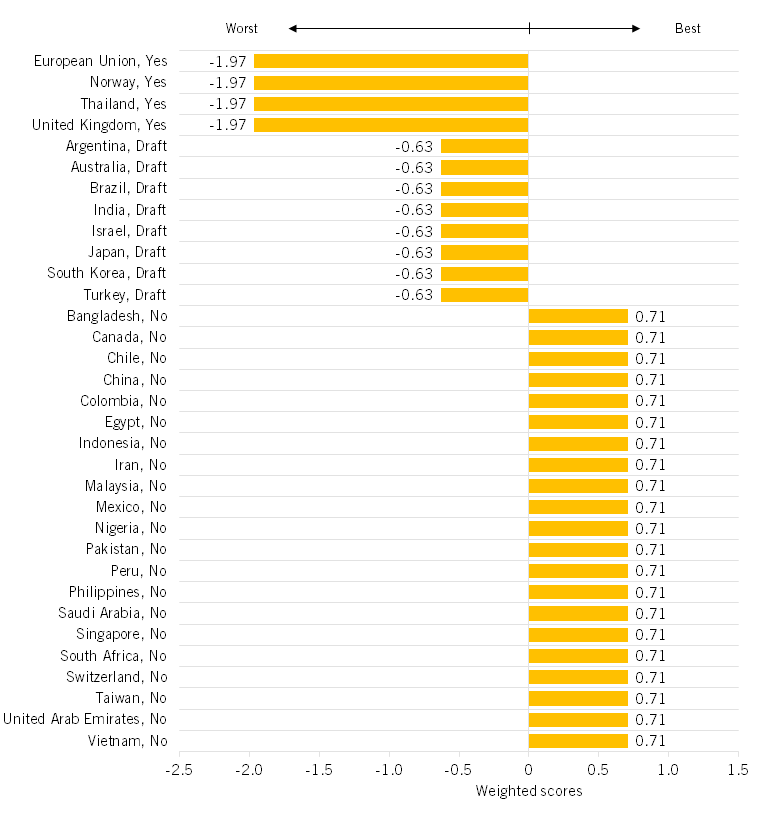

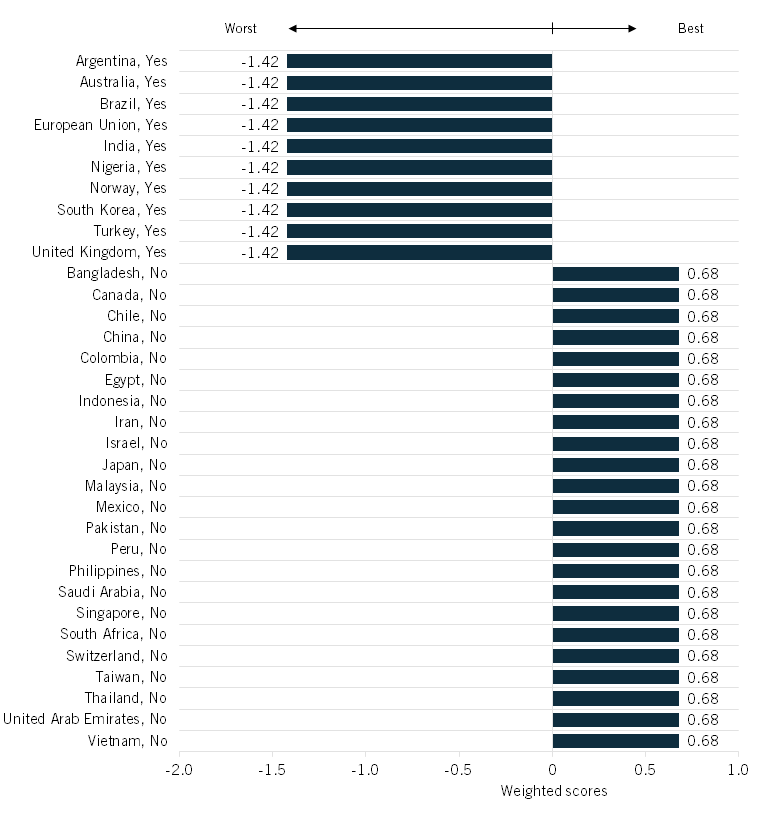

Determine 8 exhibits that the European Union, Norway, Thailand, and the UK are among the many almost definitely to face retaliation from the Trump administration if focused based mostly on the presence of a DMA or associated legislation. It’s because these nations both have a DMA or comparable legislation themselves or are topic to at least one as a part of a regional entity (e.g., their EU membership.) As an illustration, Thailand has adopted the Platform Financial system Act, laws that represents a mix of the DMA and the DSA. Equally, the UK has the Digital Markets, Competitors, and Client Act of 2024, a DMA-like laws that imposes restrictions on digital companies. Twenty nations with a standardized rating of 0.7 are the least more likely to face retaliation based mostly on this measure, as they haven’t adopted a DMA-like legislation. These nations embody, amongst others, Singapore, South Africa, Taiwan, the United Arab Emirates, and Vietnam. (See the complete record of nations within the appendix, determine 20.)

Determine 8: DMA or comparable legislation (standing and weighted standardized scores; weight = 1)[67]

Digital Companies Tax

The Digital Companies Tax indicator gives a standardized rating to every nation based mostly on whether or not it imposes a DST on companies’ revenues utilizing knowledge from the Digital Companies Taxes DST—World Tracker and Digital Coverage Alert’s Digital Companies Taxes Tracker.[68] International locations which have absolutely carried out a DST obtain a low standardized rating, whereas these with out such a tax obtain a excessive rating. This indicator is included within the index as a result of DSTs can improve operational prices, scale back profitability, and hurt U.S. expertise firms’ competitiveness.

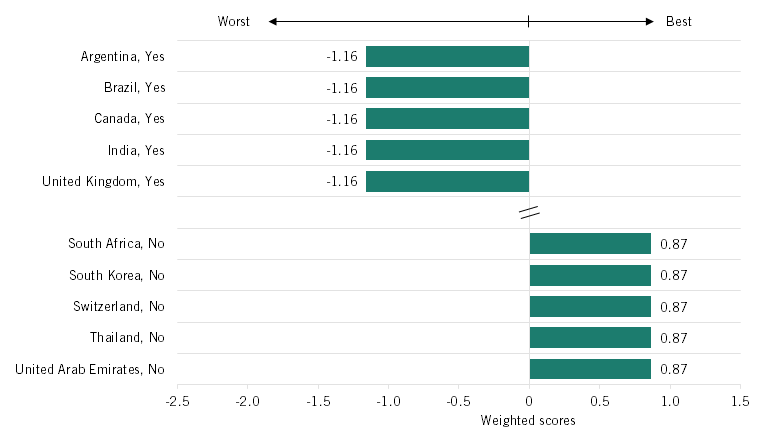

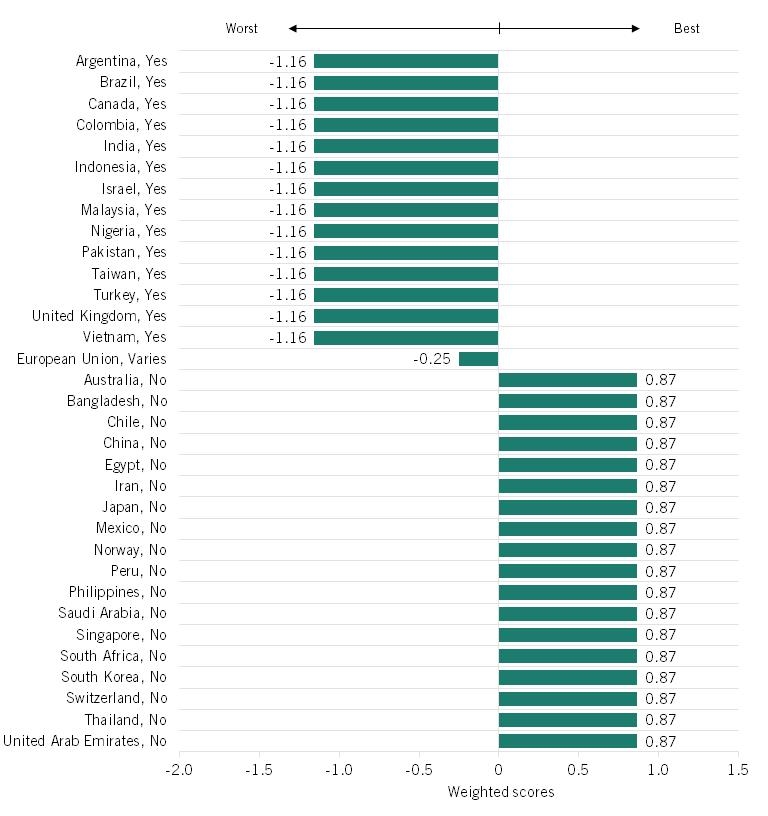

Determine 9 exhibits that Argentina, Brazil, Canada, India, and the UK are among the many 14 international locations which will face penalties by the Trump administration as a result of their low rating, which signifies the presence of DSTs on companies. The UK is more likely to face repercussions as a result of its 2 p.c tax on marketplaces, social media platforms, and search engines like google and yahoo that exceed an annual world sale of £500 million ($635 million) and an in-country gross sales threshold of £25 million ($31.8 million).[69] Canada imposes a 3 p.c tax on digital service firms with greater than CA$20 million of income from Canadian sources.[70] Equally, India imposes a 6 p.c tax on promoting and a 2 p.c tax on items and digital providers.[71] Lastly, 18 nations are unlikely to face penalties by the Trump administration because of this, as they don’t impose DSTs. These nations embody Australia, Japan, Mexico, South Korea, and Switzerland. (See the complete record of nations within the appendix, determine 21.)

Determine 9: DST (standing and weighted standardized scores; weight = 1)[72]

Presence of Digital Financial system Fines on U.S. Corporations

The Presence of Digital Financial system Fines on U.S. Corporations indicator gives a standardized rating that displays whether or not U.S. companies have been subjected to digital economy-related fines by overseas governments, as tracked by the Digital Coverage Alert’s Exercise Tracker.[73] International locations which have imposed a effective on U.S. firms obtain the bottom scores, whereas these with no such penalties obtain greater scores. ITIF contains this indicator as a result of it highlights regulatory environments which will disproportionately goal U.S. companies, harming their competitiveness within the world economic system.

Determine 10 lists 5 of the ten nations which are most vulnerable to Trump retaliatory measures as a result of presence of digital economic system fines on U.S.-based firms. These nations embody Australia, a number of European Union nations, India, South Korea, and the UK. As an illustration, Argentina’s Company for Entry to Public Data fined Google 180,000 Argentine pesos for refusing to provide a person entry to her private knowledge.[74] In the meantime, the Reserve Financial institution of India fined Amazon Pay 30.6 million Indian rupees for failing to adjust to “Grasp Instructions on Pay as you go Cost Devices” and the “Grasp Route – Know Your Buyer Route” provisions.[75] In distinction, 23 nations, together with Canada, Japan, Mexico, Switzerland, Taiwan, Thailand, and Vietnam are unlikely to face retaliatory measures. (See the complete record of nations within the appendix, determine 22.)

Determine 10: Presence of digital economic system fines on U.S.-based firms (standing and weighted standardized scores; weight = 1)[76]

Extent of Pharmaceutical Worth Controls

The Extent of Pharmaceutical Worth Controls indicator gives a standardized rating for every nation based mostly on its rating in ITIF’s report “Contributors and Detractors: Rating International locations’ Affect on World Innovation” and different outdoors sources.[77] Nations with a low standardized rating exhibit a excessive diploma of pharmaceutical value controls, these with a mid-range rating have a average degree of controls, and people with a excessive rating impose minimal value controls.

This indicator is included within the index as a result of stringent pharmaceutical value controls scale back income for U.S. pharmaceutical firms, limiting their capacity to put money into analysis and improvement (R&D). This, in flip, can hinder the event of next-generation medication, probably impacting public well being in the US. Certainly, as ITIF defined, “Pharmaceutical companies view present drug value rules as more likely to proceed, lowering their potential income whereas disincentivizing their funding in R&D.”[78] In consequence, international locations with low scores could also be extra more likely to face retaliatory measures below the Trump administration.

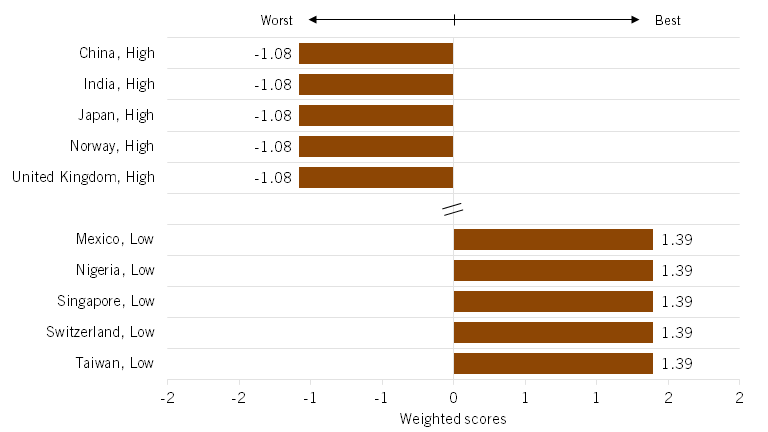

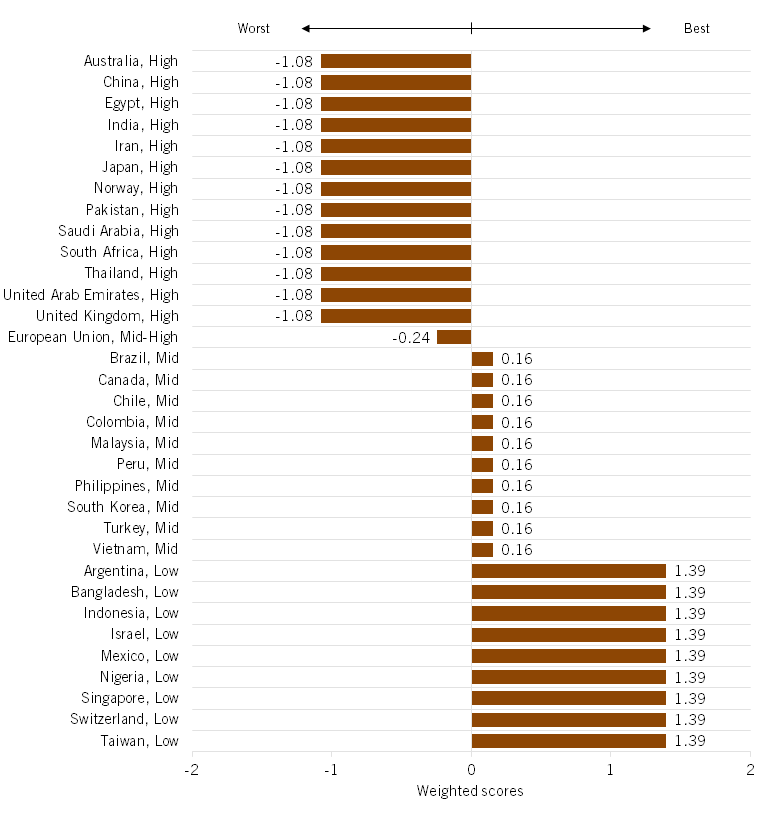

Determine 11 exhibits that China, India, Japan, Norway, and the UK are among the many 13 nations almost definitely to face retaliatory measures from the Trump administration if it bases them on the extent of a rustic’s pharmaceutical value controls. Identical to in Europe, Japan’s intensive drug value controls have decimated the nation’s biopharmaceutical business, as Japan’s share of worldwide worth added within the pharmaceutical business declined by 70 p.c, from 18.5 to five.5 p.c, from 1995 to 2018.[79] Furthermore, an ITIF report finds that, after adjusting for GDP per capita, prescription drug costs in the UK are 53 p.c of these in the US. In different phrases, for each $100 spent on prescribed drugs in the US, the UK spent solely $53.[80] In the meantime, Taiwan, Switzerland, Singapore, and 6 different nations are least more likely to face commerce scrutiny because of this, as their pharmaceutical value controls are comparatively minimal. (See the complete record of nations within the appendix, determine 23.)

Determine 11: Extent of pharmaceutical value controls (standing and weighted standardized scores; weight = 1)[81]

Antitrust Fines

The Antitrust Fines indicator gives a standardized rating for every nation based mostly on the presence of antitrust fines imposed on firms. International locations with no antitrust fines obtain a excessive standardized rating whereas people who have imposed fines obtain a low one.

This indicator is included within the index as a result of aggressive antitrust enforcement can create regulatory uncertainty, improve compliance prices, and disproportionately impression massive U.S.-based companies, impeding U.S. companies’ competitiveness. Excessive antitrust fines may be seen as a instrument of protectionism, focusing on profitable overseas firms whereas shielding home rivals.

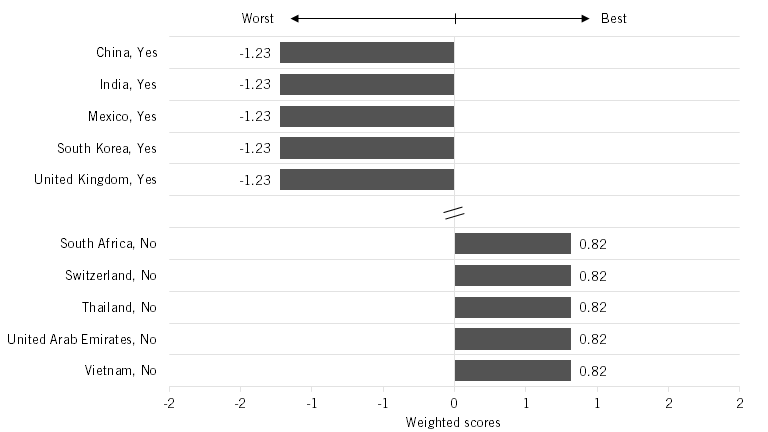

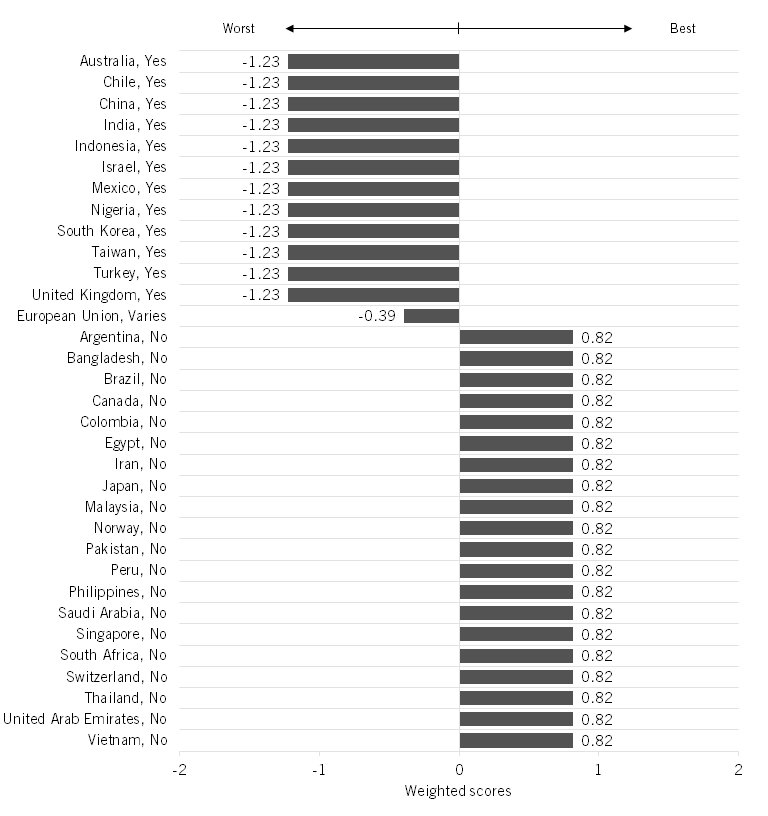

Determine 12 exhibits that China, India, Mexico, South Korea, and the UK are among the many 12 worst offenders, scoring poorly at -1.2 as a result of presence of antitrust fines. China stands out as one of many worst offenders on this indicator, marred by its unfounded fining of Qualcomm for $975 million in 2015 and its subsequent baseless bulletins of antitrust investigations towards Google and NVIDIA.[82] Elsewhere, Australia has fined Google over what it deems misrepresentation of client knowledge assortment.[83] The utmost effective per violation is now the larger of $50 million or 30 p.c of an organization’s Australian turnover throughout the infringement interval. In January 2025, Apple confronted a £1.5 billion ($1.9 billion) class motion lawsuit in the UK for allegedly overcharging software program builders by the App Retailer.[84] In the meantime, the Mexican competitors authority has fined the Mexican unit of Walmart, Walmex, for alleged anticompetitive practices.[85] It has additionally fined HP up to now for not acquiring applicable consent for a merger with Plantronics.[86]

In the meantime, 20 nations rating nicely at 0.8, signaling a extra business-friendly strategy. These nations embody Canada, Brazil, and Japan along with the international locations listed under. The EU, recognized for its stringent competitors insurance policies and main fines on U.S. tech giants, stands within the center vary with a rating of -0.4. (See the complete record of nations within the appendix, determine 24.)

Determine 12: Presence of antitrust fines (standing and weighted standardized scores; weight = 1)[87]

Mental Property

USTR Particular 301 Watch Checklist

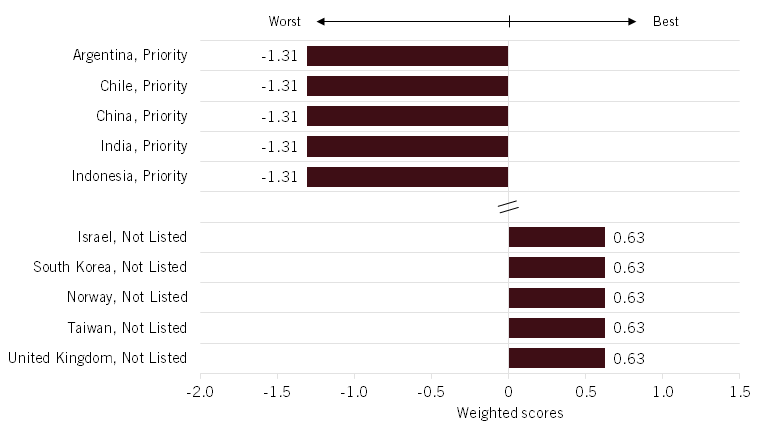

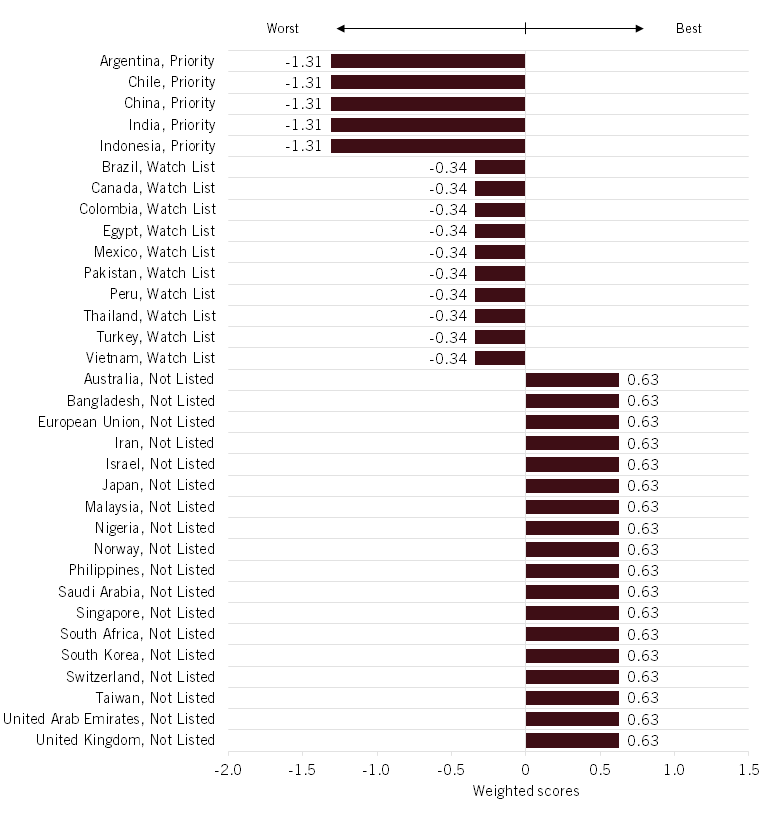

The 2024 USTR Particular 301 Watch Checklist indicator gives a standardized rating for every nation based mostly on its inclusion in USTR’s Particular 301 Report, which catalogs the nations that almost all extensively infringe on the pursuits of U.S. IP rightsholders.[88] International locations on USTR’s Precedence Watch Checklist (i.e., probably the most intensive IP-infringing international locations) obtain the bottom rating, these on the Watch Checklist obtain a mid-range rating, and people not listed within the Particular 301 report obtained the very best rating. ITIF contains this indicator as a result of the Particular 301 Report assesses the adequacy and effectiveness of U.S. buying and selling companions’ safety and enforcement of IP rights. Nations with decrease scores typically exhibit weaker IP protections and are subsequently extra vulnerable to dealing with retaliatory measures from the Trump administration, as insufficient IP insurance policies or enforcement will increase the chance of U.S. IP theft.

Determine 13 enumerates nations’ scores from lowest to highest. Argentina, Chile, China, India, and Indonesia can be almost definitely to face retaliatory measures from the Trump administration if their actions are based mostly on infringement of U.S. IP rights. China represents a very seemingly goal, as it’s the world’s most important perpetrator of IP theft. Furthermore, the nation has not addressed U.S. considerations over compelled expertise transfers regardless of committing to the elimination of these insurance policies.[89] In the meantime, India would even be a first-rate goal for Trump administration scrutiny due to its presence on the precedence watch record. The nations with a rating of 0.6, together with Norway, Israel, Taiwan, and the UK, can be least more likely to face retaliatory measures because of this, as they weren’t listed on the 2024 Particular 301 watch record. (See the complete record of nations within the appendix, determine 25.)

Determine 13: 2024 USTR particular 301 watch record (standing and weighted standardized scores; weight = 0.75)[90]

Worldwide IP Index

The Worldwide IP Index indicator gives a standardized rating for every nation based mostly on the power of its IP rights framework, as measured by the U.S. Chamber of Commerce World Innovation Coverage Heart’s Worldwide IP Index 2024, Twelfth Version.[91] International locations with sturdy IP protections obtained a excessive standardized rating, these with average protections obtained a mid-range rating, and people with weak or insufficient protections obtained a low rating.

This indicator is included within the index as a result of strong IP protections profit U.S. firms—significantly in prescribed drugs, expertise, and leisure—by safeguarding patents, copyrights, logos, commerce secrets and techniques, and different types of IP. Weak IP protections can improve counterfeiting, piracy, and unfair competitors, harming U.S. companies. Beneath the Trump administration, international locations with low scores could also be extra more likely to face countermeasures resembling commerce sanctions, tariffs, or strain to strengthen their IP environments.

Desk 13 exhibits that Pakistan, Indonesia, and Egypt are almost definitely to face retaliatory commerce sanctions by the Trump administration as a result of their low scores, which point out weak IP protections that seemingly hurt U.S. firms. Certainly, based on the Worldwide IP Index, Pakistan ranks because the fifth-worst nation when it comes to patent rights and second worst for copyright protections.[92] In the meantime, Egypt was the sixth-worst nation for copyright-related rights and trademark-related rights.[93] In distinction, the UK, Japan, and the European Union have the strongest IP protections and are unlikely to face pushback from the administration because of this. Certainly, the UK ranked within the high 10 nations with one of the best patent rights, copyright-related rights, and trademark-related rights.[94] (See the complete record of nations within the appendix, determine 26.)

Determine 14: U.S. Chamber of Commerce’s Worldwide IP Index (uncooked values and weighted standardized scores; weight = 0.75)[95]

President Trump is actually right that, for too lengthy, too many countries have been profiting from unbalanced commerce relationships with the US. In too many instances, the US has prolonged decrease tariffs, imposed fewer NTBs, or supplied a extra protecting atmosphere for IP rights than has a associate commerce nation. The USA has additionally tolerated wildly unbalanced commerce flows with nations resembling China for a lot too lengthy. Reciprocal and equitable commerce relationships with associate nations are actually a compelling imaginative and prescient, and the Trump administration is actually justified in exploring coverage measures to make {that a} actuality.

That mentioned, tariffs will not be the unalloyed good the Trump administration seems to consider they’re. The Trump administration ought to actually not be implementing a common tariff on all nations. Likewise, blanket, world sectoral- or technology-based tariffs—such because the tariffs “within the neighborhood of 25 p.c” on imported automobiles, prescribed drugs, and semiconductors that president Trump proposed on February 18, 2025—are unjustified and would inflict great hurt on the U.S. (and world) economic system.[96] Tariffs on intermediate merchandise, such because the 25 p.c tariffs president Trump has proposed on metal and aluminum merchandise, are additionally sure to be counterproductive and deleterious to the U.S. economic system.[97]

Within the opening days of his administration, Trump threatened 25 p.c tariffs on Canada and Mexico (and 10 p.c on China) to create negotiating leverage to attract stronger motion from these nations to dramatically scale back the movement of unlawful immigration and fentanyl into the US. On March 4, 2025, president Trump proceeded with implementation of these 25 p.c tariffs on Canada and Mexico (on the 10 p.c degree for Canadian power imports) and 20 p.c for China.[98] The president has equally threatened tariffs on EU nations to win concessions from them concerning a number of of the unfair commerce practices documented on this report. It’s one factor for the Trump administration to threaten tariffs as a negotiating instrument, however when associate nations reply by assembly the Trump administration’s calls for—as, as an illustration, Canada and Mexico clearly have with their steps to boost border enforcement and interdict medication—then the Trump administration ought to take tariffs, or the menace thereof, off the desk. That is actually the case with Canada and Mexico, the place the Trump administration’s proposed tariffs would additionally place the US in clear contravention of its U.S.-Canada-Mexico (USMCA) free-trade settlement (FTA) commitments.

Reciprocal tariff relations amongst nations take advantage of sense when these tariffs are at zero.

China stands in a distinct class from just about all the opposite international locations assessed on this report. That’s true first as a result of China pursues basically mercantilist commerce and financial practices—what ITIF has recognized as “energy commerce”—in a way distinct from a lot of the different largely market-based, if sometimes protectionist, international locations on this report.[99] Second, because of this, China is unlikely to switch its basically mercantilist strategy in response to Trump administration strain, whereas different international locations might reply by dropping or modifying a few of their unfair commerce practices in response to such strain. And whereas tariffs on China might be justified as a result of its litany of unfair commerce practices starting from foreign money manipulation to huge industrial subsidization to rampant IP theft, tariffs alone shall be inadequate to handle the China problem.[100] Slightly, as ITIF has written, America should pursue a holistic technique to turbocharge its personal innovation-based financial progress whereas marshalling an allied coalition that pressures China to cease rigging markets and begin competing on honest phrases.[101] Successfully coping with the China problem would require a way more refined set of instruments than tariffs alone.

President Trump’s preoccupation with tariffs can be a effective factor if it have been targeted on eliminating them as broadly as potential, not on introducing new ones on commerce companions internationally. But, his intuition for reciprocal commerce relations is right. For that motive, the Trump administration ought to make it a serious initiative to increase the Data Expertise Settlement (ITA), a plurilateral WTO settlement that commits member nations to get rid of tariffs on commerce throughout lots of of data and communications expertise merchandise. Equally, the 1994 Settlement on Commerce in Pharmaceutical Merchandise—extra generally known as the “zero-for-zero initiative”—commits Canada, the European Union and its 28 member states, Japan, Norway, Switzerland, the US, and Macao (China) to reciprocal tariff elimination for pharmaceutical merchandise and for chemical intermediates used within the manufacturing of prescribed drugs.[102] As famous, if the Trump administration had actual ambition right here, it will roll up the ITA, the Pharmaceutical Items Settlement, and the proposed Environmental Items Settlement into an Innovation Expertise Settlement that pursued zero tariffs on items and their part inputs throughout all high-tech industries for taking part nations. Certainly, reciprocal tariff relations amongst nations take advantage of sense when these tariffs are at zero.

The Trump administration must also be certain that different nations pay their justifiable share for progressive medicines.[103] As H.E. Frech et al. have instructed, for instance, “US officers might increase these points at worldwide negotiations and advocate for greater costs than presently set in high-income ROW international locations. A multi-country settlement on this path would symbolize a severe effort to assist improved world well being.”[104] Within the absence of that, the US ought to file a WTO case based mostly on the criticism that value controls on the pharmaceutical sector violate IP rights as a result of they permit worldwide arbitrage by parallel buying and selling.

The U.S. Structure empowers Congress to set import tariffs, though Congress has largely delegated that energy to the manager department.[105] Nonetheless, Congress retains a vital voice in guiding U.S. tariff and commerce coverage. The Trump administration is invoking the Worldwide Emergency Financial Powers Act (IEEPA) as the idea for lots of the tariffs it has proposed, together with these on Canada and Mexico. However Congress meant IEEPA, initially enacted in 1977, for use solely in occasions of real nationwide emergency—resembling an precise conflict with the Soviet Union—and definitely not as a foundation for tariffs on FTA companions or as a catchall justification for blanket tariffs of the kind the Trump administration has proposed.

As such, Congress ought to go the Stopping Tariffs on Allies and Bolstering Legislative Train of Commerce Coverage Act (STABLE), proposed by Tim Kaine (D-VA) and Senators Chris Coons (D-DE), which might institute a requirement of congressional approval earlier than a president might impose new tariffs on U.S. allies and FTA companions.[106]

Congress might undertake some extra productive laws. Congress ought to cost USTR with working with prepared allied companions to develop a full “China Invoice of Particulars” report. As this report paperwork, China is the world’s most important commerce scofflaw. Accordingly, the US must spearhead improvement of a collaborative report with allies that comprehensively paperwork the extent of Chinese language mercantilist unfair commerce and home financial and expertise insurance policies. Many of those have been famous, albeit in a piecemeal method. Though it must also be famous that each one foreign-nation exporters into the EU would pay the same VAT.

Congress ought to amend, and the administration ought to use, Part 301 of the Commerce Act of 1974 to focus on digital commerce points. Congress ought to amend a key U.S. commerce protection instrument—the Commerce Act of 1974—to reply to the digital obstacles central to fashionable commerce. The legislation ought to element the accountable company and course of (i.e., the actions, resembling licensing, certification, or authorized judgment) whereby the administration can impose particular retaliatory measures on a overseas service supplier. The administration additionally ought to use Part 301 of the Commerce Act to provoke an investigation of Europe’s DMA, which has been used to focus on and penalize U.S. tech companies. Part 301 can be utilized to enact tariffs, taxes, or restrictions on EU digital service firms doing enterprise in the US.[107]

Congress ought to amend the Inside Income Code to permit authorities to impose mirror taxes on international locations imposing Digital Service Taxes on U.S. companies. Part 891 of the Inside Income Code permits the president to retaliate towards overseas discriminatory or extraterritorial taxes by taxing overseas residents and companies. Congress might adapt this code by mandating a tax on the worldwide revenues of huge companies based mostly in international locations imposing DSTs, resembling Italy and France, as a retaliatory measure towards the discriminatory taxes positioned on American tech companies. These mirror taxes might be legislated to run out upon both of two occasions: agreed worldwide guidelines that topic tech giants to taxation in international locations reached by their platforms or, within the case of a person nation, repeal of its personal DST tax.[108]

Congress ought to require U.S. help to be contingent on international locations not participating in digital protectionism. Because the finish of WWII, U.S. overseas help applications have ignored overseas mercantilist practices that hurt U.S. techno-economic pursuits, and that’s now not acceptable. Congress, with its oversight of varied federal help applications, ought to examine and require that these companies restrict funding to international locations participating in digital mercantilism or IP theft. Particularly, improvement help by the InterAmerican Growth Financial institution or the World Financial institution needs to be contingent on nations limiting digital protectionism wherever potential.[109]

The Trump administration has made it clear to world commerce companions that sustained unfair commerce practices deleteriously impacting U.S. enterprises and industries will now not be tolerated. The rising world proliferation of mercantilist practices actually gives the Trump administration with a “target-rich” atmosphere of commerce scofflaws. However the administration ought to focus probably the most consideration on international locations the place U.S. industries face the worst commerce distortions and imbalances, and the place motion can most importantly advance U.S. financial pursuits. As such, this report shines a lightweight on the international locations—China, India, and the European Union—that the Trump administration ought to first prioritize in rebalancing U.S. commerce and financial pursuits.

The nation index scores have been calculated by taking the uncooked rating of every of the 11 indicators for the highest 48 nations with the very best GDP. The uncooked scores originated from numerous sources, together with the Chamber of Commerce, the U.S. Census Bureau, and the World Financial institution. (See every indicator for particular particulars.) The imply and normal deviations have been then calculated utilizing every indicator’s uncooked rating earlier than the uncooked scores of every nation have been standardized to discover a z-score. The z-scores point out the variety of normal deviations an indicator’s uncooked rating is in contrast with its imply worth. The z-scores for every indicator have been then weighted. Lastly, the weighted z-scores have been summed collectively to acquire an total rating for every nation.

The 15 European Union nations within the high 48 nations with the very best GDP have been mixed right into a collective nation variable of European Union. The European Union variable was calculated by taking the share of GDP every nation contributed to the general European Union’s GDP after which weighing the indicator rating for every nation by these weights. Lastly, the weighted indicator scores for these nations have been summed collectively. As famous, Russia was excluded from the report on the quantity of trivial two-way commerce (simply $3.5 billion in 2024) occurring between Russia and the US within the wake of the Russia-Ukraine conflict.

ITIF weighed every indicator’s standardized scores to mirror their significance. The USTR 301 Watch Checklist and Worldwide IP Index indicators had a weight of 0.75. The extent of pharmaceutical value controls, DMA legislation, DST, NTBs, Companies Commerce Restrictiveness Index, easy imply tariff charges for all merchandise, antitrust fines, and digital economic system fines on U.S.-based firms (noncompetition) indicators had a weight of 1. The 2023 commerce stability of products and knowledge providers had a weight of three.5. (See desk 1.)

Desk 1: Indicator weights in ITIF’s Commerce Imbalance Index

|

Indicator |

12 months |

Weight |

|

USTR 301 Watch Checklist |

2024 |

0.75 |

|

Worldwide IP Index |

2024 |

0.75 |

|

Extent of Pharmaceutical Worth Controls |

2016 |

1.00 |

|

DMA Legislation |

2025 |

1.00 |

|

Digital Companies Tax |

2024 |

1.00 |

|

Non-Tariff Commerce Obstacles |

2022 |

1.00 |

|

Companies Commerce Restrictiveness Index, Avg. Throughout Sectors |

2023 |

1.00 |

|

Easy Imply, Tariff Charge, All Merchandise |

2022 |

1.00 |

|

Antitrust Fines |

2025 |

1.00 |

|

Digital economic system fines on US-based firms (noncompetition) |

2019–2025 |

1.00 |

|

Commerce Steadiness in Items and Data Companies |

2023 |

3.50 |

Determine 15: General scores in ITIF’s Commerce Imbalance Index

Determine 16: Commerce stability of products and IT providers (2023) and weighted standardized scores (weight = 3.5)

Determine 17: Easy imply tariff charges for all merchandise (uncooked values and weighted standardized scores; weight = 1)

Determine 18: NTBs (uncooked values and weighted standardized scores; weight = 1)

Determine 19: Companies Commerce Restrictiveness Index (uncooked values and weighted standardized scores; weight = 1)

Determine 20: DMA or comparable legislation (standing and weighted standardized scores; weight = 1)

Determine 21: DST (standing and weighted standardized scores; weight = 1)

Determine 22: Presence of digital economic system fines on U.S.-based firms (standing and weighted standardized scores; weight = 1)

Determine 23: Extent of pharmaceutical value controls (standing and weighted standardized scores; weight = 1)

Determine 24: Presence of antitrust fines (standing and weighted standardized scores; weight = 1)

Determine 25: 2024 USTR particular 301 watch record (standing and weighted standardized scores; weight = 0.75)

Determine 26: U.S. Chamber of Commerce’s Worldwide IP Index (uncooked values and weighted standardized scores; weight = 0.75)

Acknowledgments

The authors wish to thank Giorgio Castiglia and Lilla Nóra Kiss for his or her suggestions and enter on this report. Any errors or omissions are the authors’ personal.

In regards to the Authors

Stephen Ezell is vp for world innovation coverage on the Data Expertise and Innovation Basis (ITIF) and director of ITIF’s Heart for Life Sciences Innovation. He additionally leads the World Commerce and Innovation Coverage Alliance. His areas of experience embody science and expertise coverage, worldwide competitiveness, commerce, and manufacturing.

Trelysa Lengthy is a coverage analyst at ITIF. She was beforehand an financial coverage intern with the U.S. Chamber of Commerce. She earned her bachelor’s diploma in economics and political science from the College of California, Irvine.

Dr. Robert D. Atkinson (@RobAtkinsonITIF) is the founder and president of ITIF. His books embody Expertise Fears and Scapegoats: 40 Myths About Privateness, Jobs, AI and Right now’s Innovation Financial system (Palgrave McMillian, 2024), Huge Is Stunning: Debunking the Fantasy of Small Enterprise (MIT, 2018), Innovation Economics: The Race for World Benefit (Yale, 2012), Provide-Aspect Follies: Why Conservative Economics Fails, Liberal Economics Falters, and Innovation Economics Is the Reply (Rowman Littlefield, 2007), and The Previous and Way forward for America’s Financial system: Lengthy Waves of Innovation That Energy Cycles of Progress (Edward Elgar, 2005). He holds a Ph.D. in metropolis and regional planning from the College of North Carolina, Chapel Hill.

About ITIF

The Data Expertise and Innovation Basis (ITIF) is an impartial 501(c)(3) nonprofit, nonpartisan analysis and academic institute that has been acknowledged repeatedly because the world’s main suppose tank for science and expertise coverage. Its mission is to formulate, consider, and promote coverage options that speed up innovation and enhance productiveness to spur progress, alternative, and progress. For extra data, go to itif.org/about.

[4]. Notice that Russia was excluded from this evaluation as a result of commerce between the US and Russia has drastically diminished within the aftermath of the Russia-Ukraine conflict. Actually, in 2024, U.S. whole items commerce with Russia was estimated at simply $3.5 billion. United States Commerce Consultant’s Workplace (USTR), “Russia,” https://ustr.gov/countries-regions/europe-middle-east/russia-and-eurasia/russia.

[6]. World Financial institution, “World Growth Indicators” (Easy Imply, Tariff Charge, All Merchandise, accessed January 2025), https://databank.worldbank.org/source/world-development-indicators; USTR, “2024 Nationwide Commerce Estimate Report on International Commerce Obstacles” (USTR, 2024), https://ustr.gov/sites/default/files/2024%20NTE%20Report_1.pdf; Group for Financial Co-operation and Growth (OECD), “Service Commerce Restrictiveness Index,” https://www.oecd.org/en/topics/sub-issues/services-trade-restrictiveness-index.html.

[7]. Stephen Ezell, Adams Nager, and Robert Atkinson, “Contributors and Detractors: Rating International locations’ Affect on Globalization” (ITIF, January 2016), https://www2.itif.org/2016-contributors-and-detractors.pdf; Jacinta Caragher, “Digital Companies Taxes DST – world tracker,” VAT Calc, November 14, 2024, https://www.vatcalc.com/global/digital-services-taxes-dst-global-tracker/; Digital Coverage Alert, “Digital Companies Tax,” https://digitalpolicyalert.org/threads/Digital-Services-Taxes; James Gwartney et al., “Canadians have much less financial freedom at present than they did in late-Seventies due partly to progress of presidency” (Fraser Institute, October 16, 2024), https://www.fraserinstitute.org/studies/economic-freedom-of-the-world-2024-annual-report.

[9]. These 15 nations embody Germany, France, Italy, Spain, the Netherlands, Poland, Belgium, Sweden, Eire, Austria, Denmark, Romania, Czech Republic, Finland, and Portugal.

[13]. USTR, “2024 Particular 301 Report,” 44.

[17]. USTR, “2024 Particular 301 Report,” 46.

[19]. Liza Lin and Raffaele Huang, “China’s Technique in Commerce Conflict: Threaten U.S. Tech Corporations,” The Wall Avenue Journal, February 10, 2025, https://www.wsj.com/tech/china-trade-war-us-tech-03578671?mod=hp_lead_pos4; Matthew Miller and Michael Martina, “Unique: Qualcomm nears $1 billion deal resolving China antitrust dispute,” Reuters, February 9, 2015, https://www.reuters.com/article/business/exclusive-qualcomm-nears-1-billion-deal-resolving-china-antitrust-dispute-idUSKBN0LD0WS/.

[34]. USTR, “2024 Particular 301 Report,” 54.

[35]. World Innovation Coverage Heart, “Worldwide IP Index 2024, Twelfth Version,”189.

[51]. Fortnam, “Trump guarantees a raft of recent tariffs as Finance will get able to vote on Greer.”

[56]. Gwartney et al., “Canadians have much less financial freedom at present than they did in late-Seventies due partly to progress of presidency.”

[60]. Gwartney et al., “Canadians have much less financial freedom at present than they did in late-Seventies due partly to progress of presidency.”

[61]. OECD, “Service Commerce Restrictiveness Index.”

[65]. OECD, “Service Commerce Restrictiveness Index.”

[66]. Compiled by authors from numerous authorities paperwork and information articles.

[69]. Caragher, “Digital Companies Taxes DST – world tracker.”

[71]. Caragher, “Digital Companies Taxes DST – world tracker.”

[72]. Ibid.; Digital Coverage Alert, “Digital Companies Tax.”

[77]. Ezell, Nager, and Atkinson, “Contributors and Detractors: Rating International locations’ Affect on Globalization.”

[78]. Lengthy and Ezell, “The Hidden Toll of Drug Worth Controls: Fewer New Remedies and Greater Medical Prices for the World.”

[81]. Ezell, Nager, and Atkinson, “Contributors and Detractors: Rating International locations’ Affect on Globalization.”

[84]. Lawyer Month-to-month, “Apple Faces £1.5bn Class Motion in UK Over App Retailer Commissions.”

[87]. Compiled by authors from numerous authorities paperwork and information articles.

[88]. USTR, “2024 Specia 301 Report.”

[91]. GIPC, “Worldwide IP Index 2024 Twelfth Version.”

[100]. Ezell, “False Guarantees II: The Persevering with Hole Between China’s WTO Commitments and Its Practices.”

[103]. Lengthy and Ezell, “The Hidden Toll of Drug Worth Controls: Fewer New Remedies and Greater Medical Prices for the World.”