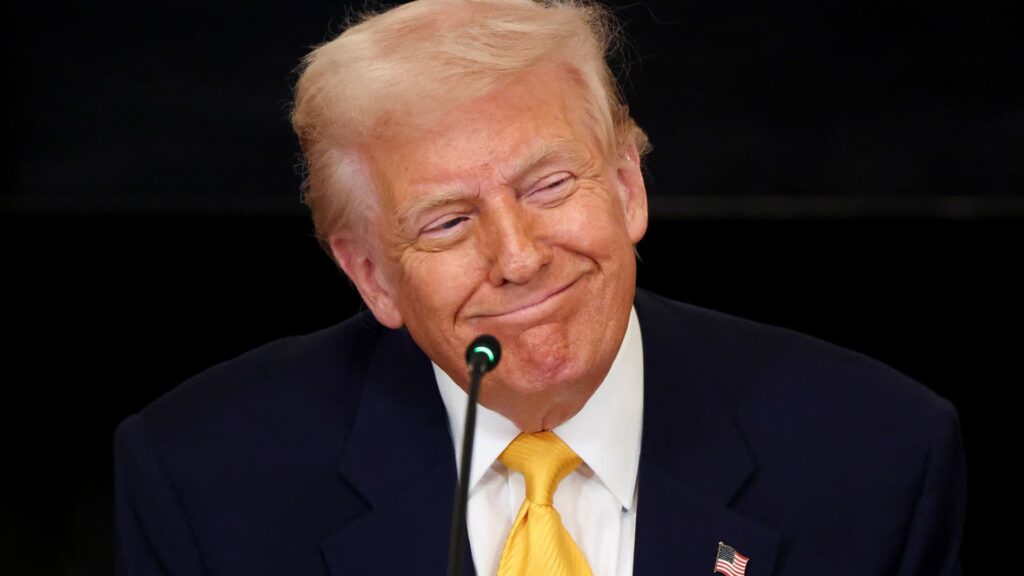

U.S. President Donald Trump attends the White Home Crypto Summit on the White Home in Washington, D.C., U.S., March 7, 2025.

Evelyn Hockstein | Reuters

World market volatility and geopolitical turbulence within the wake of President Donald Trump’s return to the White Home have led to warnings that the U.S. economy could be heading for a recession — however economists say {that a} downturn is not within the playing cards simply but.

“I do not assume we’ll discuss a U.S. recession. The useconomy is resilient, I might say, largely regardless of Donald Trump,” Holger Schmieding, chief economist at Berenberg Financial institution, instructed CNBC’s “Squawk Field Europe” on Monday.

Dubbing Trump an “agent of chaos and confusion,” Schmieding mentioned the president’s “zigzagging on tariffs reveals that he has little concept of the potential penalties of his tariff insurance policies.”

Nonetheless, “U.S. customers have cash to spend, [and] they most likely will. The labor market within the U.S. stays fairly agency, and with power costs coming down a bit and doubtless some tax cuts and deregulation coming, I do not assume there’s an imminent recession threat,” in response to Schmieding.

“However what’s turning into ever clearer in the long term, Trump is hurting U.S. development development, that’s development within the years past 2026. And he stands for greater costs for U.S. customers, which implies, for my part, the Fed [Federal Reserve] has no cause to chop charges with Trump as president, and Trump sowing chaos and confusion,” he famous.

CNBC has contacted the White Home for a response and is awaiting a reply.

Worldwide inventory markets have been rocked to their foundations in current weeks amid fears that Trump supposed to revive a world commerce warfare after saying hard-hitting import tariffs on items from China, Mexico and Canada.

Confusion and uncertainty have adopted, because the president final Friday introduced that there can be a reprieve and delay to April 2 on some tariffs on the U.S.’ neighbors and closest trading partners.

Trump’s unconventional strategy to commerce and worldwide diplomacy has left markets unimpressed, with U.S. indices whipsawing, whereas strategists warned that negative market sentiment was bound to continue in the Trump 2.0 era. U.S. inventory futures fell earlier Monday morning, indicating one other rocky trip for American markets firstly of the brand new buying and selling week.

Enterprise leaders and economists have voiced issues that tariffs will result in additional inflationary pressures on the U.S., with customers prone to bear the brunt of upper costs on imported items.

In addition they warn that funding, jobs and development may endure, as customers tighten their belts and hunker down to attend out a interval of financial unpredictability and potential “stagflation” marked by high inflation and high unemployment.

That will put stress on the Fed to maintain rates of interest on maintain, rather than cutting from their current benchmark rate in a range between 4.25%-4.5%, in a bid to stimulate the economic system. Decrease rates of interest can gasoline extra spending, and, in flip, inflation.

Fed Chairman Jerome Powell Friday mentioned that the central financial institution can wait to see how Trump’s aggressive coverage actions play out earlier than it strikes once more on rates of interest.

‘A interval of transition’

Current financial information exhibiting consumer confidence has taken a hit in February might be meals for thought for the Trump administration. The Federal Reserve Financial institution of Atlanta’s GDPNow tracker of incoming metrics additionally indicated final week that the U.S. gross home product may shrink by 2.4% for the interval between January and March. A technical recession is outlined as going down when at the least two consecutive quarters log adverse development.

Final week’s jobs information additionally confirmed that whereas the U.S. labor market remains to be increasing, indicators of weak point is also beginning to creep in. Nonfarm payrolls information indicated job development was weaker than anticipated in February and whereas jobs development remains to be secure, the information comes amid Trump’s efforts to chop the federal workforce.

Nonfarm payrolls elevated by a seasonally adjusted 151,000 on the month, exceeding the downwardly revised 125,000 of January, however coming in under the 170,000 consensus forecast from Dow Jones, the Labor Division’s Bureau of Labor Statistics reported Friday. The unemployment fee edged greater to 4.1%.

TS Lombard Chief U.S. Economist Steven Blitz mentioned the newest jobs information “inform us the economic system continues to develop” and didn’t sign “elevated recession dangers created by the array of Trump’s insurance policies.”

Nevertheless, he mentioned in a observe Friday that “the sum of Trump’s actions can but skew the economic system in any which approach, together with an implosion of capital spending.”

“Remember the fact that presidents have been identified to just accept downturns in 12 months one in all their presidency. It’s a free cross, they blame the earlier president and take credit score for the restoration. My base case remains to be development and the Fed holding nonetheless. My base concern comes from the capital markets facet, break commerce and you’ll break the capital inflows that assist the economic system,” Blitz mentioned.

U.S. President Donald Trump gestures as he walks to board Marine One, whereas departing the White Home en path to Florida, in Washington, D.C., U.S., March 7, 2025.

Evelyn Hockstein | Reuters

Trump has refused to rule out the opportunity of a recession this 12 months, however insisted this weekend that the economic system was in a “interval of transition.”

Requested concerning the Atlanta Fed’s warning of an financial contraction by Fox News Channel’s “Sunday Morning Futures,” Trump appeared to acknowledge that his tariff plans may have an effect on U.S. development.

“I hate to foretell issues like that,” he mentioned in an interview aired Sunday, when requested if the recession warning was a priority.

“There’s a interval of transition as a result of what we’re doing may be very massive. We’re bringing wealth again to America. That is a giant factor.” The White Home chief added, “It takes slightly time. It takes slightly time.”

JPMorgan’s U.S. Market Intelligence unit final week famous that the U.S. economic system was getting into “one other interval of uncertainty” given the unpredictable nature of tariffs. The analysts mentioned they have been taking a “bearish” place on U.S. shares, expecting markets to see more volatility and for U.S. growth to potentially “crater.”

“Now we have already seen the adverse affect that coverage/commerce uncertainty has had on each family and company spending, so it appears possible that we see a bigger magnitude of this over the following month. Regulate the unemployment fee, layoffs, WARN notices, and many others. If we begin to see the unemployment fee rising quickly, then that possible which push the market again into the ‘Recession Playbook,'” JPMorgan famous.

Whereas a U.S. recession was not the financial institution’s base case state of affairs, JPMorgan analysts warned that “the undetermined size of tariffs and the potential for the commerce warfare to see an acceleration in new tariffs [means] we expect shares might be challenged as U.S. GDP development estimates are reduce.”

“Given the shortage of a possible finish to this escalation, the expectation is that tariffs of those magnitude with drive each Canada and Mexico right into a recession. Search for U.S. GDP development expectations to crater and for earnings revisions to be materially decrease, forcing a re-think of year-end forecasts. With this in thoughts, we’re altering our view to Tactically Bearish,” they famous.