(Bloomberg) — Equities declined on Monday as rising considerations about financial development within the US weigh on buyers and China’s inflation dipped beneath zero for the primary time in a 12 months.

Most Learn from Bloomberg

Benchmarks in Japan and South Korea declined, dragging a gauge of Asian equities decrease. Contracts for the S&P 500 declined as a lot as 1.1% in early buying and selling whereas these for the tech-heavy Nasdaq 100 sank much more. Treasury yields slipped throughout maturities.

Oil fell on Monday after posting a seventh weekly loss, and Bitcoin prolonged its drop to a fifth session. A gauge of the greenback declined for a sixth consecutive day, the longest shedding streak in a 12 months.

A myriad of headlines across the economic system, tariffs and geopolitical developments mixed for a roller-coaster week for markets. Bond merchants are signaling an rising threat that the US economic system will stall as President Donald Trump’s chaotic tariff rollouts and federal-workforce cuts threaten to additional restrain the tempo of development. The president stated the economic system faces “a interval of transition.”

“It’s getting more durable to make out the form of the economic system by the fog of Trump 2.0’s firings and tariffs,” stated Ed Yardeni, president of Yardeni Analysis. “No marvel the inventory market’s default place is risk-off and shares have been correcting.”

Merchants have been piling into short-dated Treasuries, pulling the two-year yield down sharply since mid-February, on expectations the Federal Reserve will resume slicing rates of interest as quickly as Could to maintain the economic system from deteriorating. The motion marks an abrupt about-face for the Treasuries market, the place the dominant driver of the previous few years had been the shocking resilience of the US economic system whilst development weakened abroad.

Federal Reserve Financial institution of San Francisco President Mary Daly stated rising uncertainty amongst companies might gradual demand within the US economic system however doesn’t require a change in rates of interest. Fed Chair Powell additionally acknowledged an increase in uncertainty for the US financial outlook on Friday. Moreover, he anticipated the trail to 2% inflation to proceed, suggesting value hikes from tariffs could also be momentary.

“We flip tactically cautious on threat belongings,” JPMorgan Chase & Co analysts led by Fabio Bassi wrote. “The rise in coverage uncertainty over the previous couple of weeks, the volatility round a possible Russia/Ukraine ceasefire, and the unprecedented new info across the German/EU fiscal plans triggered an especially unstable fortnight with abrupt adjustment of positions.”

US job development steadied final month whereas the unemployment fee rose — a combined snapshot of the labor market. Nonfarm payrolls elevated 151,000 in February after a downward revision to the prior month. The unemployment fee climbed to 4.1%.

“Friday’s jobs report was weaker than anticipated, which is regarding as a result of this report doesn’t account for the latest authorities job cuts from DOGE,” stated Glen Smith, chief funding officer at GDS Wealth Administration. He added that the report “instructed that companies are taking a pause on hiring till there’s extra certainty about tariff coverage and the financial outlook.”

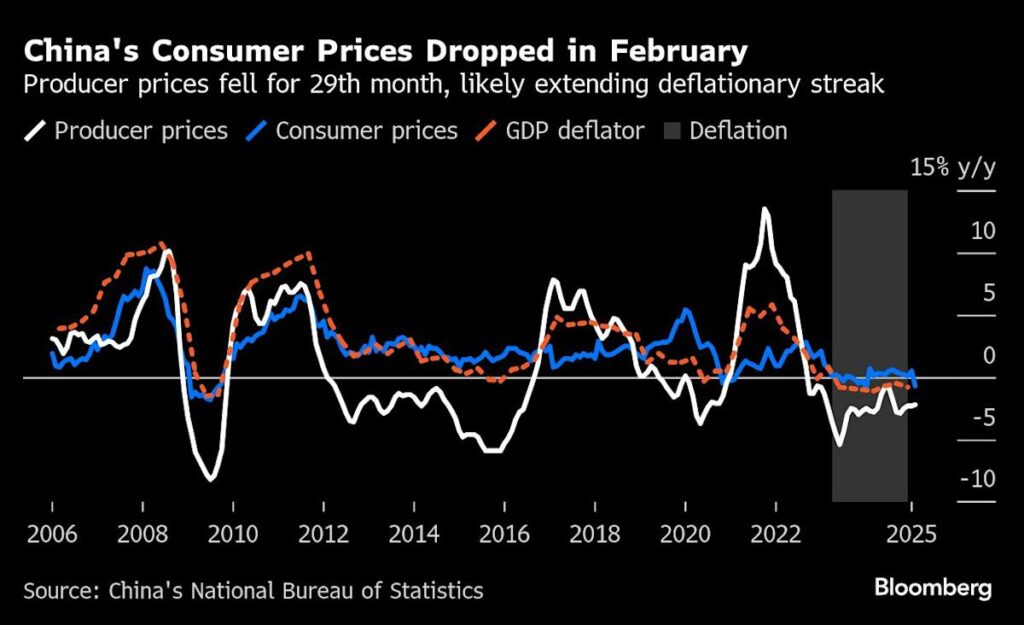

In Asia, China’s shopper inflation dropped excess of anticipated to fall beneath zero for the primary time in 13 months as deflationary pressures persevered within the economic system. Buyers will now be on the lookout for indicators that the federal government’s stimulus is translating into stronger home demand.

“China’s newest inflation information didn’t do market confidence any favors,” stated Tim Waterer, chief market analyst at KCM Commerce in Sydney. “Nevertheless, markets could take solace from the hope that it spur new stimulus” from the central financial institution, he stated.

Individually, China stated it should impose retaliatory tariffs on imports of rapeseed oil, pork and seafood from Canada because the commerce warfare escalated. Canola futures sank by the change restrict.

Even after the late rebound within the S&P 500 on Friday, the gauge wrapped up its worst week since September. The index has fallen nearly 7% from an all-time excessive in February, giving up all good points for the reason that presidential election. Huge Tech shares have borne the brunt of the selloff, with the Nasdaq 100 near a technical correction.

In Canada, Mark Carney gained the race to grow to be the nation’s subsequent prime minister.

Elsewhere in commodities, gold rose for the week as merchants sought haven from the market uncertainty.

Key occasions this week:

-

Germany industrial manufacturing, Monday

-

Japan present account, Monday

-

Pakistan fee choice, Monday

-

Australia shopper confidence, Tuesday

-

Japan GDP, family spending, cash inventory, Tuesday

-

US job openings, Tuesday

-

Canada fee choice, Wednesday

-

India industrial manufacturing, CPI, Wednesday

-

Japan PPI, Wednesday

-

Malaysia industrial manufacturing, Wednesday

-

South Korea jobless fee, Wednesday

-

US CPI, Wednesday

-

Eurozone industrial manufacturing, Thursday

-

US PPI, preliminary jobless claims, Thursday

-

France CPI, Friday

-

Germany CPI, Friday

-

New Zealand meals costs, BusinessNZ manufacturing PMI, Friday

-

UK industrial manufacturing, Friday

-

US College of Michigan shopper sentiment, Friday

Among the important strikes in markets:

Shares

-

S&P 500 futures fell 0.7% as of 9:10 a.m. Tokyo time

-

Hold Seng futures fell 0.4%

-

Japan’s Topix fell 0.1%

-

Australia’s S&P/ASX 200 rose 0.2%

-

Euro Stoxx 50 futures fell 1.2%

Currencies

-

The Bloomberg Greenback Spot Index was little modified

-

The euro rose 0.2% to $1.0855

-

The Japanese yen rose 0.3% to 147.53 per greenback

-

The offshore yuan was little modified at 7.2420 per greenback

Cryptocurrencies

-

Bitcoin fell 2.4% to $81,100.96

-

Ether fell 1.1% to $2,023.97

Bonds

Commodities

This story was produced with the help of Bloomberg Automation.

–With help from Toby Alder and Winnie Hsu.

Most Learn from Bloomberg Businessweek

©2025 Bloomberg L.P.