Inventory pickers are usually searching for shares that can outperform the broader market. Shopping for under-rated companies is one path to extra returns. For instance, the Yangzhou Yangjie Digital Know-how Co., Ltd. (SZSE:300373) share worth is up 78% within the final 5 years, clearly besting the market return of round 13% (ignoring dividends). Nevertheless, more moderen returns have not been as spectacular as that, with the inventory returning simply 19% within the final yr, together with dividends.

On the again of a strong 7-day efficiency, let’s verify what function the corporate’s fundamentals have performed in driving long run shareholder returns.

See our latest analysis for Yangzhou Yangjie Electronic Technology

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share costs don’t all the time rationally replicate the worth of a enterprise. One imperfect however easy method to take into account how the market notion of an organization has shifted is to check the change within the earnings per share (EPS) with the share worth motion.

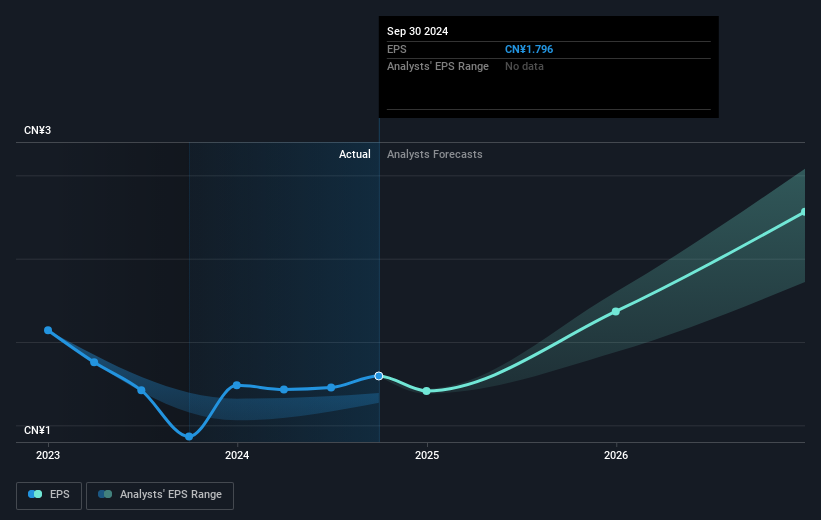

Over half a decade, Yangzhou Yangjie Digital Know-how managed to develop its earnings per share at 53% a yr. This EPS progress is increased than the 12% common annual improve within the share worth. So it appears the market is not so enthusiastic concerning the inventory nowadays.

The picture under exhibits how EPS has tracked over time (in the event you click on on the picture you’ll be able to see higher element).

We all know that Yangzhou Yangjie Digital Know-how has improved its backside line currently, however is it going to develop income? Verify if analysts suppose Yangzhou Yangjie Digital Know-how will grow revenue in the future.

What About Dividends?

When taking a look at funding returns, it is very important take into account the distinction between complete shareholder return (TSR) and share worth return. The TSR incorporates the worth of any spin-offs or discounted capital raisings, together with any dividends, based mostly on the belief that the dividends are reinvested. So for corporations that pay a beneficiant dividend, the TSR is usually rather a lot increased than the share worth return. Within the case of Yangzhou Yangjie Digital Know-how, it has a TSR of 86% for the final 5 years. That exceeds its share worth return that we beforehand talked about. And there is no prize for guessing that the dividend funds largely clarify the divergence!

A Totally different Perspective

Yangzhou Yangjie Digital Know-how’s TSR for the yr was broadly in step with the market common, at 19%. Most can be proud of a achieve, and it helps that the yr’s return is definitely higher than the common return over 5 years, which was 13%. Even when the share worth progress slows down from right here, there is a good likelihood that that is enterprise value watching in the long run. Whereas it’s properly value contemplating the completely different impacts that market situations can have on the share worth, there are different elements which might be much more essential. Even so, bear in mind that Yangzhou Yangjie Electronic Technology is showing 2 warning signs in our investment analysis , it’s best to learn about…

When you would like to take a look at one other firm — one with doubtlessly superior financials — then don’t miss this free list of companies that have proven they can grow earnings.

Please be aware, the market returns quoted on this article replicate the market weighted common returns of shares that presently commerce on Chinese language exchanges.

When you’re seeking to commerce Yangzhou Yangjie Digital Know-how, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With shoppers in over 200 nations and territories, and entry to 160 markets, IBKR permits you to commerce shares, choices, futures, foreign exchange, bonds and funds from a single built-in account.

Get pleasure from no hidden charges, no account minimums, and FX conversion charges as little as 0.03%, much better than what most brokers provide.

Sponsored Content material

New: Handle All Your Inventory Portfolios in One Place

We have created the final portfolio companion for inventory buyers, and it is free.

• Join a limiteless variety of Portfolios and see your complete in a single forex

• Be alerted to new Warning Indicators or Dangers by way of e-mail or cell

• Monitor the Honest Worth of your shares

Have suggestions on this text? Involved concerning the content material? Get in touch with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles will not be meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We goal to convey you long-term centered evaluation pushed by basic knowledge. Notice that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.