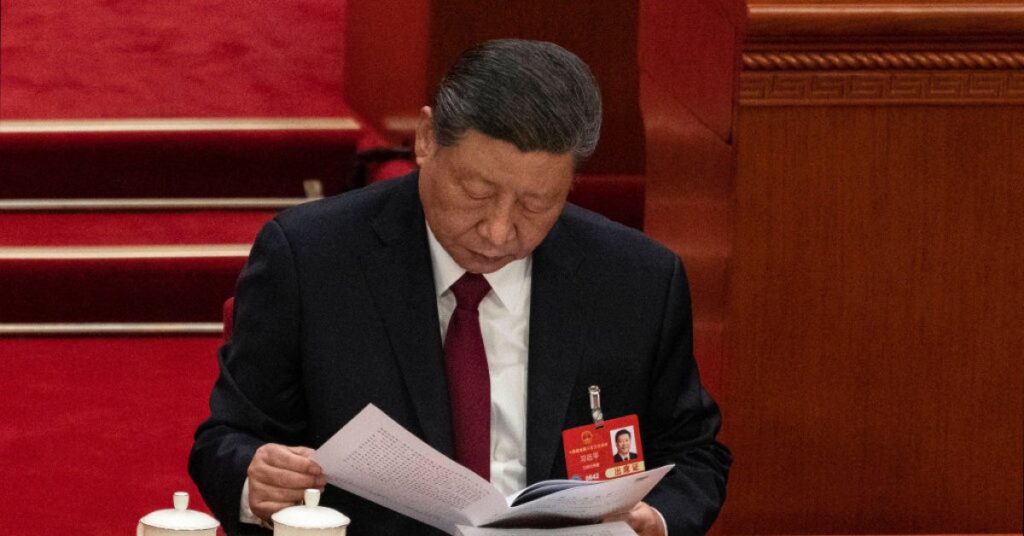

On Jan. 1, Quishi, the official ideological journal of the Chinese language Communist Celebration (CCP), printed a speech by President Xi Jinping. In it, China’s strongest chief since Mao Zedong known as for a interval of protracted “wrestle” to take care of political safety, obtain self-reliance, and show the prevalence of “Chinese language-style” modernization over that touted within the West.

“Historical past has repeatedly confirmed that striving for safety by way of wrestle brings real safety,” Xi mentioned, “whereas in search of safety by way of weak spot and concession in the end results in insecurity.”

It appeared like a rallying cry in response to current challenges, together with report youth unemployment, deflationary pressures, stock market crash, burst housing bubble, and spiraling debt—to not point out the return to the White Home of Donald Trump, who has made good on his election promise of the world’s prime financial system mountaineering tariffs on the world’s prime exporting nation.

Nevertheless, Xi’s speech had really been delivered at a CCP examine session approach again in February 2023. By lastly publishing it within the celebration’s flagship journal, the inference is that not one of the intervening turmoil has made China’s management alter course one iota.

“The final 23 months have been horrible for China’s financial system, horrible for households,” Jacob Gunter, a lead financial system analyst on the Berlin-based Mercator Institute for China Research, instructed a media briefing in late February. The truth that this speech was simply printed, provides Gunter, “says lots that this is the trail, and we should always not anticipate deviation from it.”

Which is one other approach of claiming don’t anticipate any massive splashes as China’s Nationwide Individuals’s Congress (NPC)—its annual rubberstamp parliament—kicks off on Wednesday. In opening the week-long assembly, Chinese language Premier Li Qiang issued his annual Work Report, or fiscal well being test, which repeated 2024’s progress goal of “round 5%” for the approaching 12 months and revealed navy spending will rise by 7.2%, which can be roughly the identical.

“Reaching this 12 months’s targets won’t be straightforward, and we should make arduous efforts to satisfy them,” Li cautioned an viewers of three,000 cadres crammed into Beijing’s cavernous Nice Corridor of the Individuals.

In fact, that nothing a lot will change was largely self-evident by the truth that this NPC follows on the heels of final July’s third CCP plenum, the place long-term targets had been laid out: bolstering party-state capitalism, countering U.S. containment, boosting innovation, and entrenching loyalty to Xi. Because the NPC is a state organ and thus downstream from the apex CCP, drastic course corrections in the end fall exterior its remit.

Nonetheless, the NPC’s intransigence does underscore Beijing’s capability to ignore short-term tribulations in favor of long-term targets. Even when, provides Gunter, “continuity contemplating the financial downturn and the inner and exterior struggles that China is coping with is definitely fairly outstanding.”

However whereas coverage bombshells are unlikely to drop on the NPC, the flurry of speeches and studies will flesh out what we already know: Boosting consumption and increasing home demand are prime of Beijing’s coverage agenda, in addition to stabilising the beleaguered property market, attracting overseas funding, and selling provide chain self-sufficiency.

As for U.S. tariffs, China at the moment enjoys the advantage of expertise from Trump’s first time period and is taking a extra sanguine strategy. On Tuesday, Trump added a further 10% tariff on all Chinese language imports on prime of the preliminary 10% he imposed Feb. 4. In response, Beijing introduced 15% tariffs on imports of American hen, wheat, corn and cotton, in addition to 10% on sorghum, soybeans, pork, beef, aquatic merchandise, fruits, greens, and dairy merchandise.

Learn Extra: American Farmers Fear More Pain From Trump’s Trade War

“The response from Beijing to date has been to go tit-for-tat however probably not make a giant concern out of it, most likely with the expectation that stepping into a giant spat would exacerbate issues,” says Chong Ja Ian, an knowledgeable on Chinese language politics and professor on the Nationwide College of Singapore.

How lengthy that composure can proceed is a giant query. In Trump’s speech before a joint session of Congress that started simply minutes after Li’s Work Report, the U.S. President doubled down on threats he would impose reciprocal tariffs on each nation from April 2. “We’ve been ripped off for many years by almost each nation on earth, and that won’t be allowed any longer,” he mentioned.

As such, Xi’s longstanding dedication to self-reliance is wanting more and more prescient. On Feb. 17, he welcomed a number of the greatest names in China’s expertise sector for a extremely choreographed assembly, the place he urged them to “present their expertise” and contribute to China’s progress. It marked an about-turn from Beijing’s heavy-handed regulatory crackdown 4 years in the past and displays the CCP management’s concern a couple of slowdown in progress amid American efforts to stymie China’s access to transformative technology.

The assembly confirmed “a recognition that the financial system was not doing properly,” says Steve Tsang, a professor on the College of London and director of its SOAS China Institute, “and a few high-profile gesture must be taken to point out Xi is critical about getting the financial system again on monitor.”

Certainly, efforts to realize self-sufficiency—beforehand enshrined in controversial insurance policies like Made in China 2025—look like paying dividends given current headline-grabbing tech breakthroughs, akin to drastically improved yield for Huawei’s latest semiconductor chips and the thrill round China’s generative AI platform DeepSeek, each of which contributed to a stock rally that added rally $4 trillion to markets in China and Hong Kong.

Nevertheless, sustaining this bull market and bettering China’s financial prospects extra broadly in the end rely upon boosting home consumption, which continues to lag. The problem, writes economist Michael Pettis, a nonresident senior fellow at Carnegie China, is whether or not weak spending is down merely to shopper confidence or engrained structural issues. “Whereas low confidence is actually among the many causes of China’s financial malaise, a lot, if not most, of the causality could also be structural,” he writes.

Li’s Work Report talked an excellent sport on attracting overseas funding, boosting meals safety, unleashing the creativity of “future industries,” and plowing $100 billion into new infrastructure initiatives. Moreover, China will concern 1.3 trillion rmb ($180 billion) in ultra-long particular treasury bonds, in addition to 4.4 trillion yuan ($600 billion) in native authorities special-purpose bonds to offset the detrimental results of falling tax revenues and depressed land gross sales.

However analysts doubt these measures instantly nor adequately tackle the underlying causes for lackluster consumption: public nervousness about future earnings amid a lethargic financial system and the falling values of actual property, which types the principal retailer of family wealth.

“Whereas they did ship some enhance in fiscal assist, the diploma of easing is extra modest than it would seem,” writes Julian Evans-Pritchard, Head of China economics at Capital Economics, in a briefing be aware. “We stay skeptical that will probably be adequate to forestall progress from slowing this 12 months.”

As such, Xi’s embrace of “wrestle” with out satisfactory examination of hardship’s trigger could portend extra ache forward.