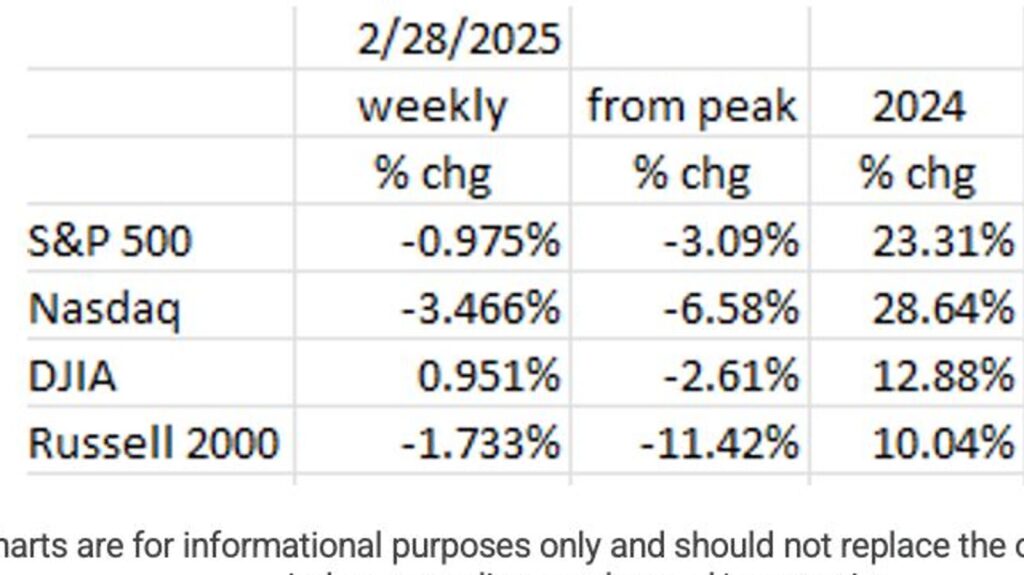

Fairness markets have been down for the week (once more). However it may have been a lot worse, because the closing outcomes have been a lot improved from Friday’s lows at about 1 pm Japanese Time. The S&P 500, for instance, completed the day with a +2% acquire as markets rallied into the shut.[1] As proven within the desk, 2025 has been combined with the S&P 500 and the DJIA constructive whereas the tech heavy Nasdaq and the small-cap Russell 2000 are unfavourable for the yr.

Fairness Market

Uncertainty is clearly the order of the day (Trump vs Zelenskyy, DOGE’s actions to terminate hundreds of federal jobs, the imposition of tariffs starting March 5th). It has now appeared to have permeated and soured investor views. The volatility the markets simply skilled oftentimes marks a flip in investor attitudes. In response to Rosenberg Analysis, solely 29 different occasions during the last 9000+ buying and selling classes have we seen the intraday volatility that occurred on Friday (February 28th).[1] The opposite events occurred in 2022, 2020, 2018, 2008, 2002, 2001, 2000, 1999, and 1998. A few of these years have been years of Recession.

Magnificent 7

Regardless of exhibiting robust gross sales and earnings (+80%) and guiding increased, Nvidia’s inventory nonetheless bought pummeled, down -7% for the week and about the identical year-to-date.[1] It isn’t on daily basis {that a} tech titan is available in with such good numbers and its share value tanks. A take a look at the Magazine 7 in complete reveals decrease costs throughout the board for the week and for six out of the seven on a year-to-date foundation (Meta being the exception).

Might or not it’s that the markets see a slowing financial system? Or has the market simply run too far?

Housing

Thus far in 2025, all of the housing knowledge have tanked.

- January’s New Residence Gross sales have been off -10.5% from December;[2]

- Time in the marketplace for the New Residence section has gone from 2.5 months in November to over 3 months at present, an increase of 20%;[3]

- In response to Rosenberg Analysis (2/26/2025), New Residence costs have fallen -3.4% during the last 12 months. Whereas some could applaud the autumn in value, there isn’t a doubt that demand has weakened;

- Current Residence Gross sales have been additionally off almost -5% in January (-4.9%) with the West main the best way (-7.4%, maybe stoked by the LA fires!);[4]

- Pending Residence Gross sales, i.e., contracts signed however not but closed, fell -4.6% month/month in January, even worse than December’s terrible -4.2% quantity.[5] Such gross sales are off -5.2% from a yr in the past.[6] Worse, the Pending Residence Gross sales Index, at 70.6, is at an all-time low (index started in 2001).[7]

Pending Residence Gross sales

Most analysts blame these downtrends on excessive rates of interest. However, as proven within the chart beneath, mortgage charges have been at or close to 7% since late 2022; so, one thing else have to be at play. Maybe the slowdown within the basic financial system is the offender!

30 Yr Mortgage Price

The weakening financial system, excessive mortgage charges, and the notion by customers that inflation will proceed to be a difficulty, has taken its toll. The chart reveals that buyers nonetheless see many hurdles to beat within the house shopping for course of.

Shopping for Situations for Homes

Unemployment

Preliminary Claims for Unemployment Insurance coverage rose +22K within the week ended February 22nd to 242K from 220K the prior week.[1] Persevering with Claims, at 2,234K are almost +101K increased than a yr in the past.[2] Because of the DOGE purges in D.C., these numbers will definitely rise sharply over the following few months. Relying on how quickly the financial system slows, we count on the U3 unemployment charge to rise to someplace between 4.5% and 5.0% over the following six months.

Inflation

Inflation is a course of. It isn’t “excessive costs.” These “excessive costs” are the results of inflation. One reason for inflation that economists and the parents who run the Fed fear about is one thing known as the “wage-price” spiral. Merely put, that is the place rising wages trigger companies to boost costs which in flip results in calls for for increased wages.

Wage Progress & The Quits Price

The chart reveals the yr/yr wage and wage progress charge (blue line) and a smoothed model of the JOLTS “Quits Price.” Observe the robust relationship. When the Quits Price falls, so does the speed of wage progress. That appears logical. The Quits Price falls when employers reduce on hiring and jobs change into tougher to seek out. The Convention Board’s newest Client Confidence Survey enhances this chart, exhibiting an increase within the shopper view that jobs are actually tougher to get than they have been just some months in the past. Additionally in that Survey, the view that there will likely be fewer jobs over the following six months hit a 12-year excessive. Usually, we discover such views in a slowing financial system. Therefore, our view that inflation will likely be at or beneath the Fed’s goal by mid-year.

Client Confidence

The College of Michigan’s most up-to-date Client Sentiment Survey hit its lowest degree since November ’23. Inflation expectations over the following 12 months spiked to three.5% in December.[1] That is the very best degree for this indicator since April 1995!! Little doubt the tariff threats from the Trump Administration performed a key position. Only for readability, the tariffs may have an preliminary impression on inflation, however economists consider that it’s a one-time adjustment and doesn’t feed the inflation course of. It is a downside the Fed goes to must cope with and it’s doubtless why markets don’t see any charge decreases for a number of months.

Last Ideas

Coverage uncertainty has had a big impression on the fairness markets. “Tariffs On,” “Tariffs Off.” Which is able to or not it’s? March 5th seems to be the future date. If the tariffs are literally imposed, count on extra fairness market volatility as that will likely be one other hurdle for the financial system.

There is no such thing as a doubt that the U.S. financial system is slowing. This seems to be a worldwide phenomenon because the economies of China and people in Europe are slowing too. Within the U.S., we’ve lately seen a decline in Retail Gross sales, and we all know that it isn’t a one-off as a result of Walmart gave very mushy steering.

Housing is the poster baby for the financial slowdown. The most recent housing knowledge screams Recession. And the most recent shopper confidence surveys have all turned unfavourable.

Excessive rates of interest are killing the housing sector. New and Current Residence Gross sales proceed to sluggish. As a result of inflation expectations are caught at ranges increased than the Fed’s goal charges, the prospect of a lot wanted rate of interest aid nonetheless seems to be a number of months away.

Our view is that the Fed is already behind the curve, and in the event that they wait till the inflation indexes truly hit their 2% aim earlier than granting charge aid, the financial system will already be in Recession. Keep in mind, rates of interest impression the financial system with lengthy and variable lags. This Fed’s mindset: “No charge aid till the inflation numbers yield.” But when they wait for much longer, it will likely be too late. In truth, they could have already waited too lengthy.

(Joshua Barone and Eugene Hoover contributed to this weblog.)