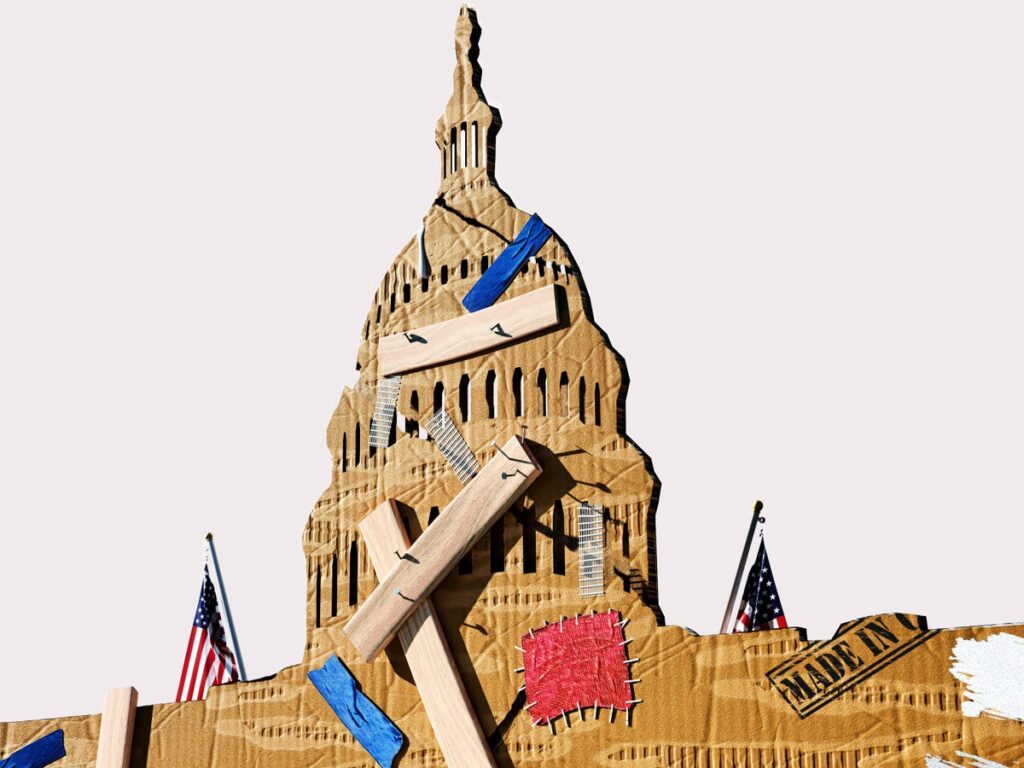

Draw back dangers to the US economic system are stirring. The job market is not as foolproof because it as soon as was: The charges of individuals getting hired or quitting their jobs stay beneath the place they stood earlier than the pandemic, whereas layoffs have been ticking up on the margin. Past that, the sources of development have narrowed, and the housing market is at a standstill. The shifting political winds in Washington have additionally added uncertainty to the outlook. All this provides as much as a extra sluggish outlook for 2025 — even when many economists and analysts are reluctant to confess it.

To stem the economic system’s deterioration, the Federal Reserve could be pressured to hasten its coverage easing, backstopping exercise by cutting interest rates extra aggressively than its members or buyers at present anticipate. Primarily based on the inferred possibilities from markets, buyers anticipate to see two cuts from the Fed in 2025. However because the true image of the economic system comes into view, I’d anticipate a pair greater than that earlier than the yr is out.

After years of warning {that a} crash was simply across the nook, economists and Wall Road analysts have largely deserted the idea of a recession or a significant development slowdown hitting the US. However because the core components of the engine gradual and the Fed sits again and does nothing, the probabilities of a noticeably weaker economic system are rising.

Any cheap learn of the info factors to a transparent cooling of the US economic system. Certain, GDP development in 2024 got here in at a decent 2.5%, however that is down from 3% in 2023. And the way in which that the US arrived at that development was not particularly encouraging. Family consumption and authorities funding accounted for the lion’s share of development final yr, whereas gross personal home funding — which tracks corporations placing cash into their companies and the quantity spent on constructing new properties, flats, and different constructions — was a modest drag. Given the slender composition of development, it stands to motive that if shopper spending and authorities funding average, the economic system will, too. The case for a slowdown in each classes is robust.

The outlook for consumption boils right down to incomes — folks can spend more cash provided that they’ve more cash coming in. And it is clear that earnings development is easing because the labor markets cool. The proportion of people quitting their jobs hit contemporary lows on the finish of 2024, and as quits decline, so too does wage development. This is sensible: When employees are much less more likely to go away their jobs, employers really feel much less have to give them raises to maintain them round, which shifts energy from staff to employers. And as incomes gradual, so will consumption. In reality, we have already seen a few of this decline: Inflation-adjusted incomes internet of switch funds — a proxy for folks’s paychecks with authorities funds like Social Safety and Medicaid stripped out — was a full share level beneath the tempo of consumption. On the similar time, the private financial savings price (a measure of the share that individuals are setting apart) fell to three.8% from 4.4% in 2023, suggesting that People have been dipping into their reserves to maintain the spending going. However there is a restrict to how a lot shoppers can draw down their financial savings to gas shopping for.

The opposite pillar of US development, authorities spending, can be displaying indicators of pressure — and it isn’t simply from the DOGE cuts championed by Elon Musk. States obtained big money will increase in the course of the pandemic years, however these surpluses are quickly fading. State and native authorities building spending rose 4.4% in 2024, down from 19.7% in 2023. Hiring by state and native governments is reducing as effectively. A current report from Pew stated: “State budgets are anticipated to shrink considerably in fiscal yr 2025 because the post-pandemic period of surging income, file spending, and historic tax cuts involves a detailed. Based on new information launched by the Nationwide Affiliation of State Finances Officers (NASBO), total general fund spending is expected to decline to $1.22 trillion, a greater than 6% drop from estimated ranges in fiscal 2024, which ended for many states on June 30.”

Even spending on new housing, one of many weaker GDP elements from final yr, is about up for a worse 2025. Interest rates stay elevated as incomes gradual, creating an affordability problem that makes it more durable for folks to purchase a house and places upward stress on the variety of properties sitting in the marketplace because it takes longer for sellers to discover a purchaser. Redfin not too long ago stated: “The uptick in new listings, together with gradual gross sales, is contributing to a rising pool of provide for homebuyers to select from. It has additionally led to the everyday house promoting for two% below asking worth, the largest low cost in two years.”

This slowing of development would have critical penalties for People. One clear draw back is a possible rise within the variety of folks out of a job. Regardless of sturdy development in each 2023 and 2024, the unemployment price nonetheless rose 0.3 share factors in every of these years. If development is more likely to gradual in 2025, it isn’t a troublesome leap to imagine that unemployment will hold rising. If there’s extra slack within the job market, it isn’t laborious to see incomes slowing additional and a destructive suggestions loop kicking in, weighing on family spending and different components of the economic system.

There are, in fact, methods to blunt and even keep away from a few of the worst impacts of this slowing. One of the necessary routes to assist the economic system is for the Fed to start out chopping rates of interest. Making debt cheaper would encourage companies to take a position or rent, whereas offering some cushion for family steadiness sheets.

In any case, the Fed was already bringing down its key price on the finish of final yr in an effort to get in entrance of a deeper slowdown within the labor market. And the explanation the Fed hiked charges within the first place — inflation — can be displaying persevering with indicators of progress again towards the central financial institution’s aim of two% year-over-year development. Whereas the newest shopper worth index inflation studying was a bit of hotter than anticipated, the Fed’s most popular private consumption expenditures inflation gauge has given us higher information. Core PCE inflation, which is extra dependable as a result of it has a a lot bigger scope than core CPI, obtained again on monitor in November and December after two discouraging months. Many of the shortfall in core inflation, relative to the Fed’s goal, is in housing. Given the aforementioned slowdown in worth development within the housing market, it stands to motive this can proceed easing.

As a substitute of maintaining its price cuts, nevertheless, the Fed has changed course, preferring a extra reactive strategy to the info on the possibility inflation surprises us by shifting up. It is already silly to attend for permission from the info earlier than shifting charges because it raises the possibility that you simply fall behind, however the motive for the Fed’s worries about elevated inflation makes even much less sense as a result of it is clear that this all comes right down to hypothesis on what the brand new administration would possibly do.

Instantly following the election, Fed Chair Jerome Powell was fairly clear when he was requested in regards to the incoming administration’s insurance policies. “We do not guess, we do not speculate, and we do not assume,” Powell instructed reporters. A month later, Powell seemed to have changed his tune.

“Some folks did take a really preliminary step and begin to incorporate extremely conditional estimates of financial results of insurance policies into their forecast at this assembly and stated so within the assembly,” he stated throughout a press convention following the Fed’s December assembly. In different phrases, they do guess, speculate, and assume. How handy!

Let me deal with the elephant within the room: Donald Trump. In current weeks, many enterprise economists have highlighted the uncertainty coming from his administration, citing his chaotic strategy to commerce coverage. The on-again, off-again tariff threats are stated to freeze enterprise funding, and if applied, they might push inflation again up. That is, I believe, the supply of Powell’s wait-and-see pivot. However the proof for an actual impact from the president’s insurance policies is weak to this point.

There’s all the time some uncertainty when energy modifications palms in Washington. Take into account the choice. Had Kamala Harris received the election, there could be rather more doubt about whether or not the 2017 tax cuts, that are set to run out on the finish of the yr, could be prolonged or whether or not tax charges would go up for households and companies. If company taxes went up on the finish of the yr, a large physique of analysis means that these elevated taxes would doubtless be handed onto shoppers. Does anybody severely assume that the Fed would fear about upside dangers to inflation from company tax pass-through? No, the Fed would doubtless be eyeing rate of interest cuts as a option to stem any draw back development dangers from the decreased spending and funding. That is precisely why it’s so irresponsible to prejudge outcomes. Comply with the info, versus speculating over a collection of insurance policies that will not even take impact.

To me, it is clear that companies are keen to present the brand new administration the good thing about the doubt. Tariffs will not be the one dimension of coverage. Maybe companies are keen to tolerate some short-run uncertainty round tariffs if it implies an improved regulatory and tax backdrop down the street. Clearly, there’s enthusiasm, for instance, for a lighter-touch strategy to monetary regulation.

Trump can be not the one supply of uncertainty. If Congress fumbles the ball on laws, confidence may stall, particularly if the boldness relies on the Tax Cuts and Jobs Act being prolonged on the finish of the yr. That might be a a lot greater danger to the financial outlook than the specter of tariffs. The draw back state of affairs right here is apparent: Nothing of substance occurs, no less than not immediately, from both Congress or Trump, however the Fed, as a result of it’s involved about attainable insurance policies, decides to carry off doing something as nominal development continues to gradual. This may be a passive tightening of financial coverage, which has necessary implications for monetary market buyers. I anticipate a decline in longer-term rates of interest and a sell-off in fairness costs as danger urge for food wanes. For the economic system, anticipate circumstances to deteriorate within the job market.

The Fed will ultimately come round, chopping charges to assist development, however in case you are ready for the dangerous information to be apparent earlier than doing one thing, it often has a method of displaying up.

Neil Dutta is head of economics at Renaissance Macro Analysis.