ECONOMYNEXT – Sri Lanka is presenting a funds which can assist move a assessment of the Worldwide Financial Fund program, the place automobile imports are anticipated to assist enhance the income to gross home product ratio.

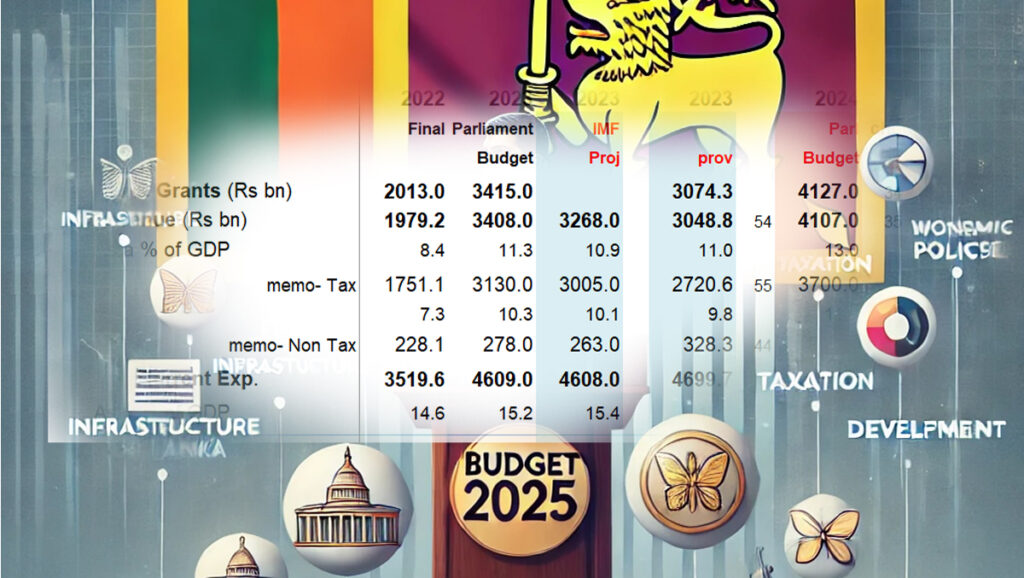

Sri Lanka has earned tax revenues of three,708 billion rupees, and non-tax revenues of 353 billion rupees, in line with preliminary information in 2024.

The gathering is about 100 billion rupees beneath the goal of three,820 billion rupees, however would carry revenues to projected GDP by two p.c from 9.8 p.c of GDP to about 11.8 p.c. With non-tax incomes revenues of 13 p.c of GDP was aimed for in 2024.

Beneath an IMF program Sri Lanka is making an attempt to lift revenues to round 15 p.c of GDP. The nationwide debt, nevertheless is pushed by the general deficit.

Sri Lanka’s President Anura Kumara Dissanayake has promised to lift the brink for private revenue tax to 150,000 rupees a month from 100,000. Welfare spending below the Aswesuma scheme is to be elevated.

Taxes are additionally being spent on farmers for fertilizer subsidies.

In 2024 PAYE taxes earned 180 billion rupees, in comparison with 144 billion rupees in 2024.

Tighter tax administration and removing of exemptions amongst choices. Inventory market traders are additionally awaiting readability of taxes.

Car imports are anticipated to be a significant contributor to the trail to lift revenues to fifteen p.c however extraordinarily excessive taxes have been imposed on vehicles to scale back demand.

Sri Lanka’s coverage makers have fears over imports, because of steadiness of funds troubles coming from mis-targeting charges by a flawed working framework of the central financial institution, which set off foreign exchange shortages when personal credit score picks up.

Banning vehicles and ‘non-essential imports’, which have excessive price charges is a ‘cascading coverage error’ that reduces taxes and worsens foreign money crises after the unique price cuts set off exterior crises, analysts have identified.

Different cascading coverage error recognized by analysts embrace foreign exchange give up guidelines, banning ahead gross sales and trimming in a single day internet open positions of banks, which reduces the depth of the market and its capability to match foreign exchange flows for brief time period variations in mortgage disbursements.

Sri Lanka’s central financial institution has printed cash for numerous motives over its historical past, inflating reserve cash and triggering depreciation, making it virtually inconceivable to handle budgets.

The lack to handle budgets grew to become acute from round 1980, after the IMF’s Second Modification to its articles left the central financial institution with out a credible anchor cash and persistent depreciation began.

Since 2015, cash has been printed to set off 5 p.c inflation, by suppressing charges to the center of the hall, and pushing up extra liquidity by an ample reserves regime, analysts have proven.

The casual mid-corridor extra liquidity regime just lately grew to become a proper ‘single coverage price’.

In December 2024 imports surged to 1.9 billion US {dollars}, with out automobile imports after the central financial institution printed 100 billion rupees by open market operations and saved the cash sloshing across the banking system all through the final quarter of 2024.

The surplus liquidity has since been withdrawn.

Analysts have warned that the follow would result in a second sovereign default, no matter fiscal efficiency as occurs in Latin American nations like Argentina, the place revenues to GDP exceeds 20 p.c.

Obtain Sri Lanka-2024 fourth quarter authorities monetary report from here

Sri Lanka’s funds needs to be in line with a workers degree settlement with the Worldwide Financial Fund, struck after aggressive macro-economic coverage involving sweeping price cuts on high of tax cuts, led to a lack of market entry and sovereign default.

‘

.

.