Skip to content

After the discharge of the annual revisions and January payroll numbers on Friday, February 7, curiosity will shift to the value stability facet of the Fed’s twin mandate. In the mean time the labor market appears to be like stable and an unemployment price of 4.0 p.c is according to most employment.

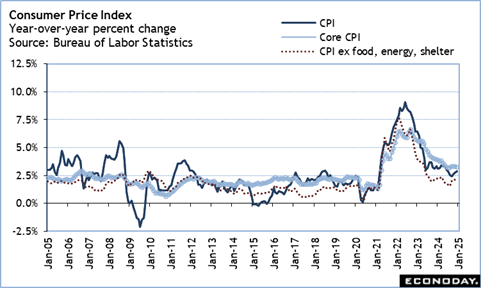

The BLS will launch the annual revisions to the CPI together with the January report at 8:30 ET on Wednesday. The revisions sometimes return 5 years. The revisions additionally sometimes replicate solely small adjustments in any given month and don’t alter the general image of adjustments in client costs. The query is that if the tempo of the year-over-year CPI displays progress in disinflation on the all-items and core ranges that’s ample to get Fed policymakers eager about a price lower once more. That is unlikely within the close to time period with commodities prices rising and companies costs falling solely incrementally.

The BLS will launch the annual revisions to the final-demand PPI on Thursday at 8:30 ET together with the January report. The report may present if producers are starting to really feel the pinch of upper enter prices.

Lastly, the report on import and export costs indexes for January is ready for launch at 8:30 ET on Friday. These indexes are unadjusted and subsequently don’t get annual revision. The firming within the worth of the US greenback versus main currencies in the previous few months means imports are going to be pricier and a contributing think about upward value pressures.

Share This Story, Select Your Platform!