Key Factors

- Airtel, Bajaj Finance workforce as much as launch India’s largest digital monetary platform, focusing on thousands and thousands with modern options.

- Partnership integrates Bajaj’s monetary merchandise with Airtel’s community, providing loans, EMI playing cards, and AI-driven efficiencies.

- New platform to spice up monetary inclusion, with six merchandise by 2025 and providers spanning 4,000 cities throughout India.

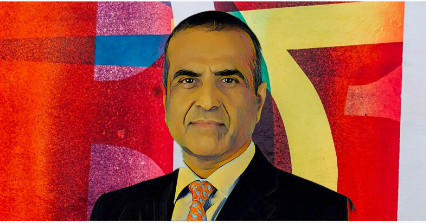

Airtel Africa Plc, the pan-African telecommunications supplier and a subsidiary of Bharti Airtel, the Indian telecom big led by billionaire Sunil Bharti Mittal, and Bajaj Finance, the nation’s largest private-sector Non-Banking Monetary Firm (NBFC), have joined forces to create one of many largest digital monetary platforms in India.

The collaboration goals to revolutionize last-mile supply of economic providers by leveraging their mixed scale and distribution attain.

This transfer unites Airtel’s 370-million-strong buyer base and expansive distribution community with Bajaj Finance’s portfolio of 27 diversified merchandise and 70,000 discipline brokers. By integrating Bajaj Finance’s retail monetary options into Airtel’s Thanks App and community of nationwide shops, the platform seeks to redefine seamless, safe monetary providers accessibility.

Powering monetary inclusion by means of digital innovation

“Airtel and Bajaj Finance share a imaginative and prescient of empowering thousands and thousands of Indians by bridging the hole in monetary providers supply,” stated Gopal Vittal, Vice Chairman and MD of Bharti Airtel. “We purpose to remodel Airtel Finance right into a strategic asset for the group and a one-stop store for our clients’ monetary wants. With over a million clients already trusting Airtel Finance, this partnership strengthens our basis for future development.”

Rajeev Jain, Managing Director of Bajaj Finance, emphasised the importance of India’s burgeoning digital ecosystem: “This partnership leverages India’s strong digital infrastructure to drive inclusive development, providing clients quick access to credit score and monetary options even in distant areas. Collectively, we purpose to raise buyer experiences by means of AI-driven efficiencies and modern monetary merchandise.”

Increasing product choices to thousands and thousands

The collaboration has piloted two merchandise, with 4 extra, together with Gold Loans, Enterprise Loans, and a co-branded Insta EMI Card, slated for launch by March 2025. By year-end, Airtel will host almost 10 Bajaj Finance merchandise on its platform.

The co-branded Airtel-Bajaj Finserv EMI Card gives versatile cost choices for over 1.5 lakh companion shops throughout 4,000 cities. Customers also can make the most of the cardboard for e-commerce transactions, enabling purchases of electronics, furnishings, groceries, and extra with tailor-made EMI plans.

A worldwide telecom powerhouse

Airtel Africa expands in key markets, whereas father or mother firm Bharti Airtel, led by billionaire Sunil Bharti Mittal, ranks because the world’s third-largest telecom operator, continues to command world affect. Mittal, 83rd on Bloomberg’s Billionaires Index with a $24.2 billion web value, owns a 28 % stake in Bharti Airtel.

The company posted $2.37 billion in revenue for H1 2024, marking a 9.65 % decline in reported foreign money phrases however a 19.9 % development in fixed foreign money. Airtel Africa has additionally boosted shareholder confidence with a $100 million share buyback and a $1.2 billion lease extension with American Tower Corp. masking over 7,000 websites throughout Nigeria, Uganda, Kenya, and Niger.

This partnership between Airtel and Bajaj Finance signifies a sturdy alignment of tech and finance to handle India’s monetary inclusion problem. As the businesses roll out their choices to thousands and thousands, they’re poised to turn out to be a dominant pressure in India’s evolving digital monetary panorama.