Skip to content

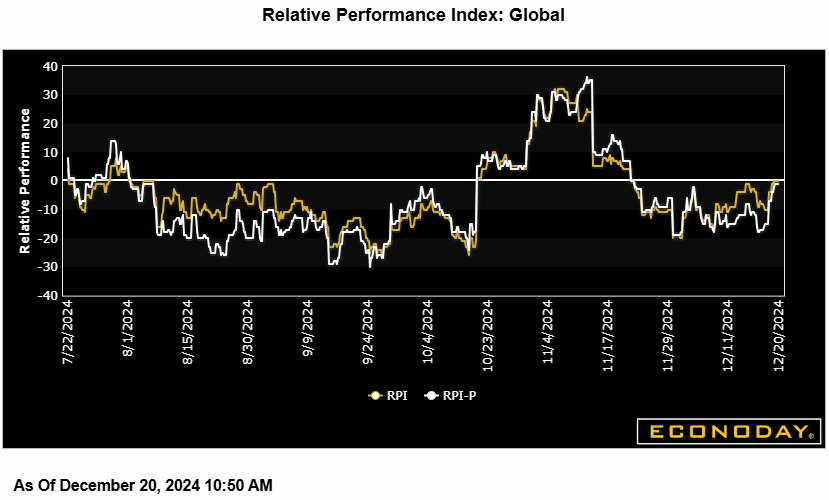

Econoday’s Relative Financial Efficiency Index (RPI) edged as much as precisely zero final week, exhibiting latest world financial exercise matching market forecasts. Nevertheless, inside the combine, China continues to underperform alongside Canada and Switzerland and the Eurozone is barely nearly on observe. Against this, the U.S. remains to be working marginally hotter than anticipated and Japan now considerably so.

Within the U.S., a really blended week for information noticed the RPI finish the interval at 8 and the RPI-P at 14. Accordingly, general financial exercise is behaving just a little stronger than anticipated, supporting the Federal Reserve’s extra cautious angle in the direction of rate of interest cuts in 2025.

In Canada, one other draw back shock on inflation in November offered additional ammunition to justify the Financial institution of Canada’s newest 50 foundation level ease. It additionally helped to push the RPI (minus 16) additional beneath zero. With the RPI-P (minus 13) additionally decrease on the week, one other, albeit in all probability much less aggressive, reduce is probably going not too far-off.

Within the Eurozone, higher, albeit removed from robust, information on the economic system in December helped to carry the RPI to minus 2 and the RPI-P to minus 7. Nevertheless, even when forecasters at the moment are nearly in tune with latest exercise, development may be very sluggish and the European Central Financial institution will be anticipated to ship rates of interest cuts moderately sooner than most subsequent yr.

Within the UK, no change from the Financial institution of England final Thursday was broadly anticipated. Nevertheless, following almost two months of unbroken destructive RPI and RPI-P readings, the financial institution was obliged to downgrade its fourth quarter development forecast. That stated, each measures (RPI at 8 and RPI-P at 9) a minimum of ended the week exhibiting very latest financial exercise shifting marginally forward of forecasts.

In Switzerland, inflation gauges proceed to shock on the draw back and trimmed the RPI and RPI-P to minus 13 and minus 8 respectively. Sluggish financial exercise, weak costs and a robust native forex go away the door huge open to a destructive Swiss Nationwide Financial institution coverage fee in 2025.

In Japan, the Financial institution of Japan’s determination to go away coverage on maintain final week was not anticipated by some however was nonetheless per a really blended general financial efficiency in latest weeks. Nonetheless, with early indicators of surprisingly robust December inflation boosting the RPI to 56, market hypothesis concerning the subsequent tightening will rapidly swap to the central financial institution’s subsequent assembly in January.

In China, an basically empty information calendar left each the RPI (minus 21) and RPI-P (minus 30) exhibiting financial exercise nonetheless undershooting forecasts and buyers ready for a contemporary spherical of financial easing.

Econoday’s RPI gives a helpful abstract measure of how an economic system has not too long ago been evolving relative to market expectations.

A studying above zero signifies that the economic system generally has been performing extra strongly than anticipated and vice versa for a studying beneath zero. The nearer is the worth to the utmost (+100) or minimal (-100) ranges, the better is the diploma to which markets have been under- or over-estimating financial exercise. A zero outturn would suggest that, on common, the market consensus has been appropriate. Word too that the index is sensitized to position further weight upon these indicators that buyers take into account to be crucial.

Share This Story, Select Your Platform!