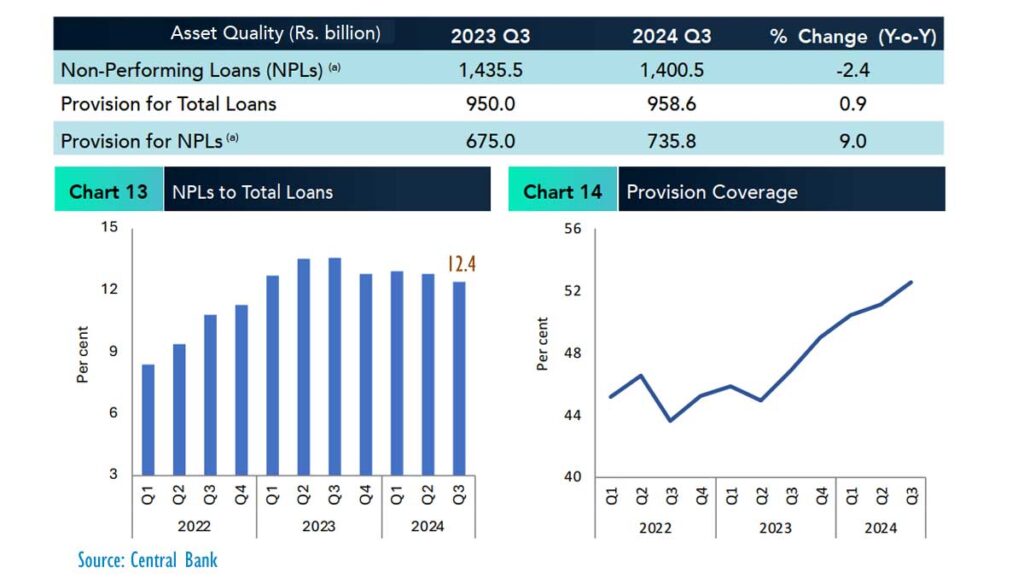

ECONOMYNEXT – Sri Lanka’s financial institution unhealthy loans fell to 12.4 p.c of loans within the third quarter of 2024 from 13.6 p.c a yr in the past, whereas capital adequacy has improved steadily a central financial institution report confirmed.

Non-performing loans additionally fell completely to 1,400 billion rupees by finish of the third quarter from 1,435 billion rupees a yr in the past. Provisions for NPLs elevated to 735.8 billion rupees from 675 billion rupees.

Loans grew 6.9 p.c to 21,204 billion rupees, and funding by 17.8 p.c to eight,145.8 billion rupees within the yr to the third quarter.

Following a forex disaster, banks often purchase authorities debt, lowering non-public credit score.

Authorities debt can be purchased from the central financial institution holdings (deflationary coverage), successfully permitting the central financial institution to ‘purchase’ deposits from banks, lowering home investments and imports, triggering a steadiness of funds surplus and permitting it to construct international reserves.

Within the final forex disaster, some banks didn’t purchase authorities debt as prior to now fearing a restructure of native debt.

They deposited massive volumes of cash within the central financial institution’s window in what’s known as a personal sector sterilization or a liquidity entice, which additionally has the identical impact.

Within the run as much as the disaster, the central financial institution buys Treasuries from previous deficits ins financial institution steadiness sheets to inject cash and lower charges, underneath versatile inflation or different framework and set off foreign exchange shortages.

As charges are hiked steeply to revive the damaged confidence within the change fee, often accompanied by a depreciating forex which slashes actual wages, consumption falls and lots of firms find yourself with unhealthy loans as they’re unable to service debt.

Financial institution capital adequacy has additionally improved. Along with earnings banks additionally raised capital from shareholders to spice up capital.

Capital permits banks to renew lending resulting in a restoration within the financial system.

Sri Lanka central financial institution and different officers averted a broad-based home debt restructuring restoring confidence in authorities securities permitting charges to fall and banks and different intermediaries to sturdy.

Fee fell quick and the central financial institution was additionally capable of conduct deflationary coverage extra successfully in contrast to in nations like Ghana the place each rates of interest and inflation are above 20 p.c.

Falling charges, along with lowering the price range deficit, additionally makes it simpler for debtors to repay loans.

There have been considerations earlier that tax payer funds must be injected to banks to spice up capital however profitability of banks have additionally improved.

State banks which gave loans to state enterprises nonetheless may have tax payer funds.

As much as the third quarter banks made earnings of 178.4 billion rupees, up from 144.3 billion rupees a yr earlier and paid company revenue taxes of 105 billion rupees, up from 77 billion rupees.

Financial institution additionally pay a so-called monetary VAT which has the identical impact as revenue tax on the steadiness sheet. (Colombo/Dec23/2024)