Skip to content

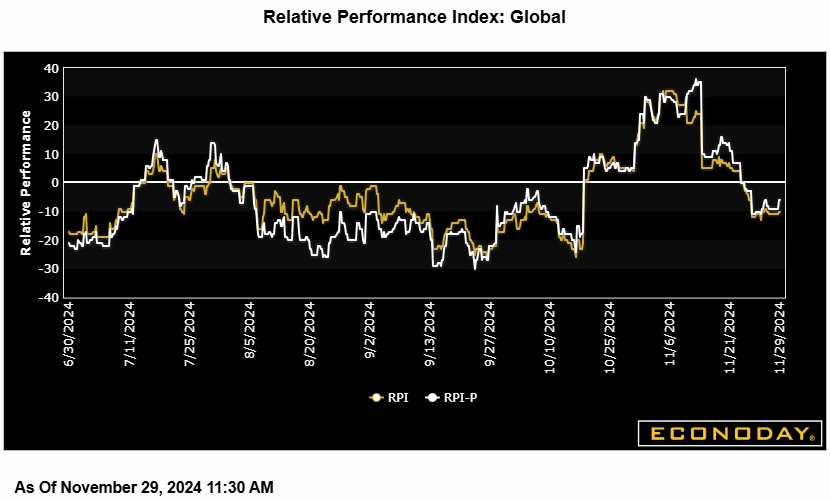

Econoday’s Relative Financial Efficiency Index (RPI) misplaced some floor final week and, at minus 10, exhibits latest world exercise working a bit cooler than anticipated. The dip primarily displays a change to modest draw back surprises within the U.S. knowledge however the Eurozone, UK and Japan are additionally underperforming by various levels. China remains to be matching forecasts whereas Canada has edged barely forward.

Within the U.S., a really blended interval for financial information was, on steadiness, smooth sufficient to trim the RPI to minus 6 and the RPI-P to minus 8. Nonetheless, neither studying is way sufficient under zero to sign any significant shortfall in exercise versus forecasts and importantly, core PCE inflation matched the consensus. Accordingly, most buyers nonetheless see the Federal Reserve easing by an extra 25 foundation factors later this month.

In Canada, third quarter GDP progress was sluggish however consistent with the market name. This left each the RPI (8) and RPI-P (1) unchanged on the week, signalling total financial exercise simply marginally firmer than anticipated. The Financial institution of Canada is broadly seen chopping key rates of interest subsequent week.

Within the Eurozone, additional indicators of surprisingly poor progress this quarter contrasted with a a lot as forecast pick-up in inflation to go away the area’s RPI at minus 23 and the RPI-P at minus 18. The persistent weak point of the true financial system continues to name for one more reduce in ECB rates of interest subsequent week however the stickiness of costs additionally argues towards something greater than 25 foundation factors.

Within the UK, the RPI (minus 25) and RPI-P (minus 35) had been little modified over the week and so nonetheless level to unexpectedly smooth financial exercise usually. October’s surprisingly agency inflation report has in all probability dominated out a discount in Financial institution Fee this month however any determination to maintain coverage on maintain is prone to masks a cut up vote.

In Switzerland, financial information was extra upbeat than anticipated and agency sufficient to elevate the RPI-P to precisely zero. Even so, at minus 7, the RPI-P exhibits latest inflation surprises have remained on the draw back and with items exports slumping final quarter, the Swiss Nationwide Financial institution will likely be all of the extra anxious in regards to the excessive degree of the Swiss franc. No less than a 25 foundation level reduce within the coverage charge subsequent week appears a executed deal.

In Japan, draw back shocks on output and demand greater than offset surprisingly agency Tokyo inflation to pull down the RPI to minus 36 and the RPI-P to a lowly minus 65. Nonetheless, with buyers focussed on inflation, it’s the leap right here that has given a contemporary increase to hypothesis about one other hike in Financial institution of Japan rates of interest subsequent week.

In China, one other largely clean knowledge calendar for key indicators made for no change in both the RPI (zero) or the RPI-P (20).

Econoday’s RPI gives a helpful abstract measure of how an financial system has just lately been evolving relative to market expectations.

A studying above zero implies that the financial system usually has been performing extra strongly than anticipated and vice versa for a studying under zero. The nearer is the worth to the utmost (+100) or minimal (-100) ranges, the larger is the diploma to which markets have been under- or over-estimating financial exercise. A zero outturn would suggest that, on common, the market consensus has been appropriate. Be aware too that the index is sensitized to position further weight upon these indicators that buyers take into account to be crucial.

Share This Story, Select Your Platform!