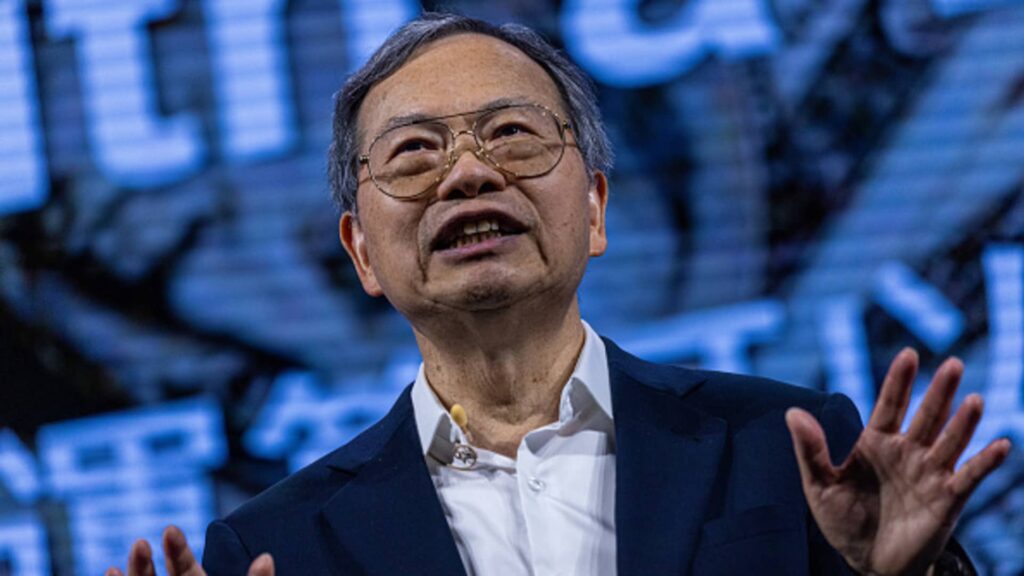

Charles Liang, chief govt officer of Tremendous Micro Laptop Inc., through the Computex convention in Taipei, Taiwan, on Wednesday, June 5, 2024. The commerce present runs by means of June 7.

Annabelle Chih | Bloomberg | Getty Photographs

Embattled server maker Super Micro Computer mentioned on Monday that it is employed BDO as its new auditor and submitted a plan to Nasdaq detailing its efforts to regain compliance with the alternate. The shares jumped 37% in prolonged buying and selling.

“This is a vital subsequent step to deliver our monetary statements present, an effort we’re pursuing with each diligence and urgency,” Tremendous Micro CEO Charles Liang mentioned in a statement.

Tremendous Micro is late in submitting its 2024 year-end report with the SEC, and mentioned earlier this month that it was on the lookout for a brand new accountant after its earlier auditor, Ernst & Younger, stepped down in October. Ernst & Younger was new to the job, having just replaced Deloitte & Touche as Tremendous Micro’s accounting agency in March 2023.

Tremendous Micro mentioned it informed Nasdaq that it believes it will likely be capable of file its annual report for the 12 months ended June 30, and quarterly report for the interval ended Sept. 30. The corporate mentioned it should stay listed on the Nasdaq pending the alternate’s “overview of the compliance plan.”

Shares of Tremendous Micro soared greater than twentyfold over a two 12 months interval from early 2022 till their peak in March of this 12 months. However the inventory has been hammered on troubling information about its compliance with Nasdaq. As soon as valued at about $70 billion, the corporate’s market cap was at $12.6 billion on the shut on Monday, following a 16% rally throughout common buying and selling.

Tremendous Micro has been one of many main beneficiaries of the unreal intelligence increase, because of its relationship with Nvidia. Gross sales final fiscal 12 months greater than doubled to $15 billion.

On Monday, Tremendous Micro introduced that it was promoting merchandise that includes Nvidia’s next-generation AI chip referred to as Blackwell. The corporate competes with distributors like Dell and Hewlett Packard Enterprise in packaging up Nvidia AI chips for different firms to entry.

Tremendous Micro was added to the S&P 500 in March, reflecting its quickly rising enterprise and then-soaring inventory worth. Lower than two weeks after the index adjustments had been introduced, Tremendous Micro reached its closing excessive of $118.81.

The troubles started inside months. In August, Tremendous Micro mentioned it would not file its annual report with the SEC on time. Famous brief vendor Hindenburg Analysis then disclosed a brief place within the firm, and mentioned in a report that it recognized “contemporary proof of accounting manipulation.” The Wall Avenue Journal later reported that the Division of Justice was on the early phases of a probe into the corporate.

The month after saying its report delay, Super Micro said it had obtained a notification from the Nasdaq, indicating that the delay within the submitting of its annual report meant the corporate wasn’t in compliance with the alternate’s itemizing guidelines. Tremendous Micro mentioned the Nasdaq’s guidelines allowed the corporate 60 days to file its report or submit a plan to regain compliance. Based mostly on that timeframe, the deadline was Monday.

WATCH: Super Micro is a sell due to accounting irregularities