Skip to content

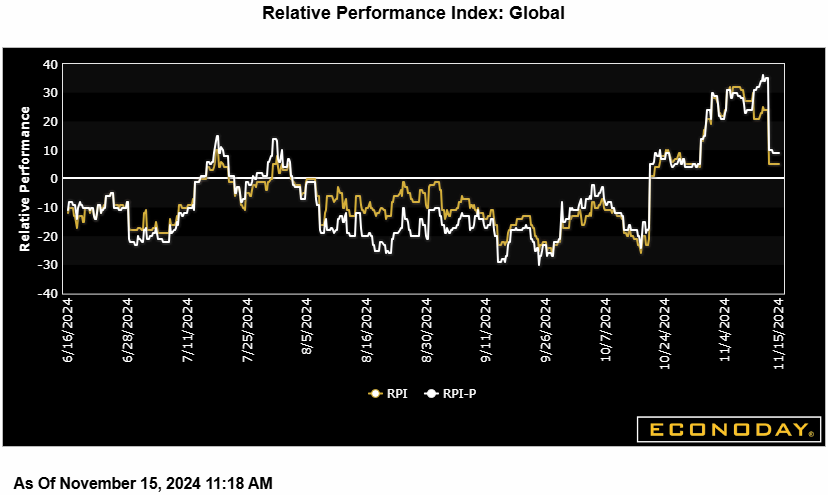

Econoday’s Relative Financial Efficiency Index (RPI) misplaced some floor final week however, at 8, nonetheless reveals international financial exercise working just a little forward of market forecasts. The U.S., Eurozone and Japan are all modestly outperforming expectations whereas the UK, Canada and Switzerland wrestle to maintain up.

Within the U.S., October inflation provided no surprises however the RPI (19) and RPI-P (20) each edged just a little larger. Financial exercise on the whole continues to outpace expectations, prompting forecasters to undertake a extra cautious view of future Federal Reserve easing.

In Canada, September manufacturing gross sales fell by lower than anticipated. Nevertheless, at minus 17, each the RPI and RPI-P stay in destructive shock territory and go away financial fundamentals nonetheless pointing to a different minimize in Financial institution of Canada rates of interest in December.

Within the Eurozone, the RPI (13) and RPI-P (1) held above zero however, courtesy of recent weak point in manufacturing exercise, solely simply. That stated, whereas the true economic system is basically matching expectations, current inflation information have stunned on the upside, making a 25 foundation level minimize by the European Central Financial institution subsequent month extra doubtless than a 50 foundation level transfer.

Within the UK, third quarter output was surprisingly mushy, leaving each the RPI (minus 20) and RPI-P (minus 24) sub-zero for a 3rd straight week. This retains alive the potential for one other discount in Financial institution Fee in December however Wednesday’s October CPI replace will likely be extra necessary.

In Switzerland, the Swiss Nationwide Financial institution identified that additional financial easing will not be a achieved deal. Nevertheless, with the RPI sliding to minus 35, the RPI-P to minus 25 and the newest inflation information once more unexpectedly mushy, one other minimize within the coverage fee in December will likely be onerous to keep away from.

In Japan, third quarter progress matched expectations however October pipeline inflation was unexpectedly agency and the RPI (16) and RPI-P (12) each ended the interval exhibiting total financial exercise barely stronger than anticipated. With forecasters nonetheless unsure concerning the timing of the following central financial institution tightening, Financial institution of Japan Governor Kazuo Ueda’s handle on Monday will likely be a key market focus this week.

In China, following a month of knowledge surpassing expectations, the RPI eased to precisely zero, which means that forecasters have caught up with current indicators of tentative financial restoration. As a part of a broader easing package deal, the Individuals’s Financial institution of China minimize its prime mortgage charges aggressively earlier this month and traders will likely be trying carefully for extra indicators that financial exercise on the whole, and costs specifically, at the moment are on the best way up.

Econoday’s RPI supplies a helpful abstract measure of how an economic system has just lately been evolving relative to market expectations.

A studying above zero signifies that the economic system on the whole has been performing extra strongly than anticipated and vice versa for a studying under zero. The nearer is the worth to the utmost (+100) or minimal (-100) ranges, the higher is the diploma to which markets have been under- or over-estimating financial exercise. A zero outturn would indicate that, on common, the market consensus has been appropriate. Word too that the index is sensitized to put further weight upon these indicators that traders take into account to be crucial.

Share This Story, Select Your Platform!