Key Factors

- UBA launches N239.4bn($144.2 million) rights concern to fulfill CBN’s capital necessities.

- Proceeds will assist lending, digital infrastructure, and African growth.

- Q3 2024 outcomes present 83.2% development in earnings and 54% asset development.

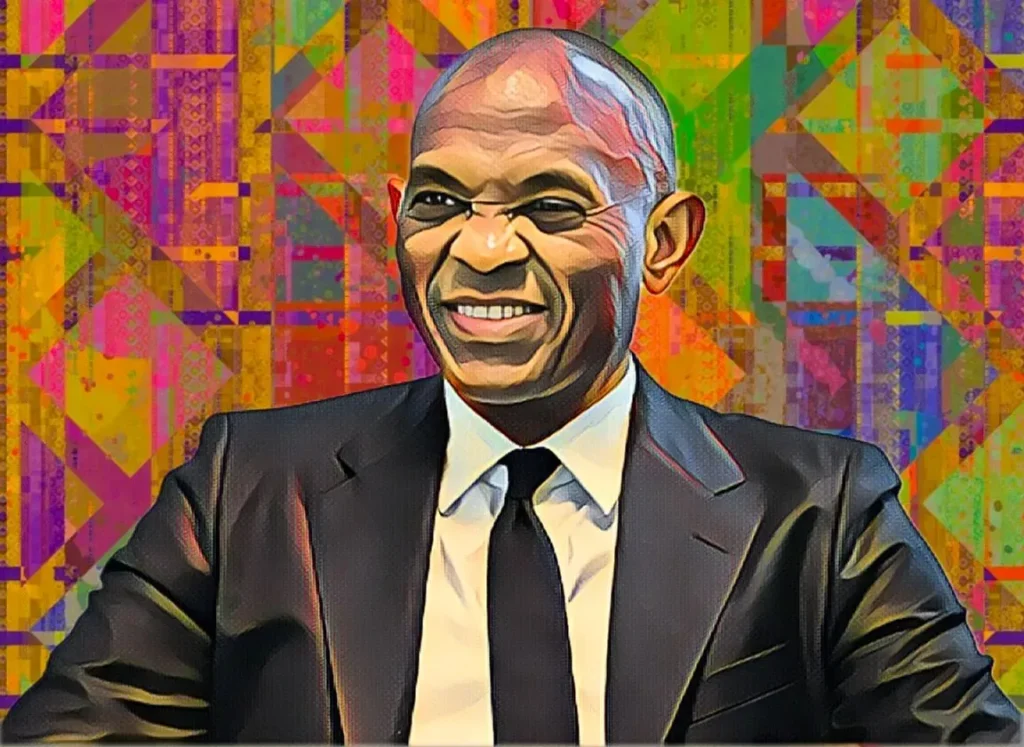

United Financial institution for Africa (UBA), led by Nigerian businessman Tony Elumelu, is about to lift N239.4 billion ($144.2 million) by a rights concern, providing 6.8 billion bizarre shares at N35 per share. This initiative follows the Central Financial institution of Nigeria’s (CBN) introduction of stricter capital necessities for banks, prompting UBA to bolster its capital base.

The rights concern, accepted by shareholders in Might 2024 as a part of a N400-billion ($240 million) Fairness Shelf Programme, permits present shareholders to buy one new share for each 5 held as of Nov. 5, 2024. UBA Group Chairman Tony Elumelu defined, “This rights concern goals to bolster our capability to grab development alternatives and keep management within the banking sector.”

The financial institution plans to allocate the funds towards regulatory compliance, increasing lending capability, investing in digital transformation, supporting sustainability initiatives, and scaling its African operations. Elumelu highlighted UBA’s dedication to fostering financial development throughout Africa, citing the financial institution’s $6-billion pledge to assist SMEs beneath the Africa Continental Free Commerce Space initiative.

Shareholder accessibility and software course of

The provide, accessible solely by the NGX e-offer portal, additionally gives shareholders the choice to use for added shares past their allocation. UBA clients can handle their rights conveniently by way of the financial institution’s web and cellular banking platforms, guaranteeing broad accessibility for buyers.

Spectacular monetary momentum helps capital technique

UBA’s third-quarter monetary outcomes for 2024 underscore its sturdy operational basis. Gross earnings soared by 83.2 p.c year-on-year to N2.39 trillion ($1.44 billion), whereas revenue earlier than tax elevated by 20.2 p.c to N603.48 billion ($3.63 billion). Revenue after tax climbed 16.9 p.c to N525.31 billion ($3.16 billion).

Whole belongings surged by 54 p.c to N31.80 trillion ($19.14 billion), reflecting UBA’s sturdy market place and talent to fund development initiatives.

With this rights concern, UBA is poised to boost its monetary resilience, meet regulatory calls for, and additional its ambitions as a number one pan-African monetary establishment.