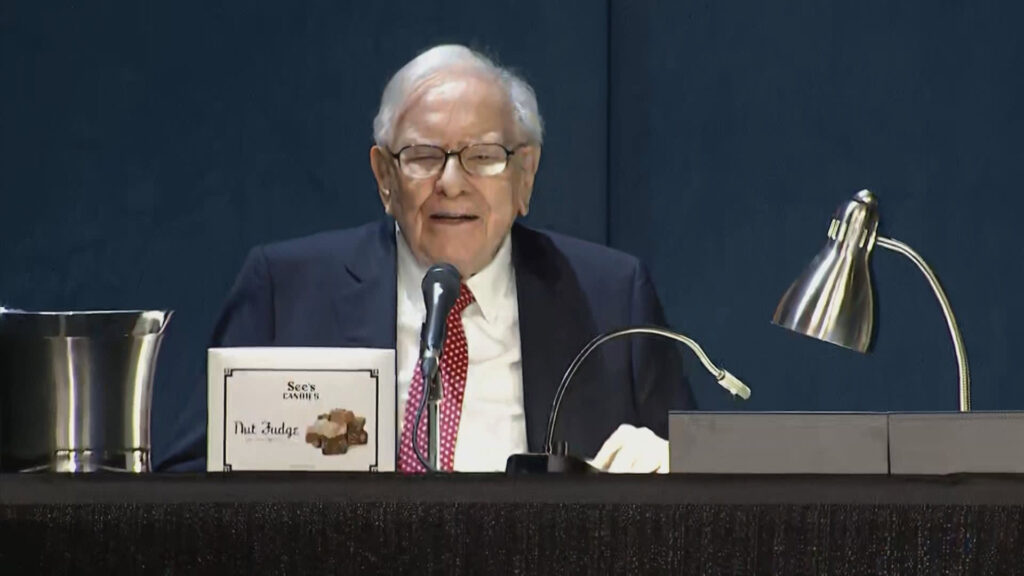

Warren Buffett speaks throughout the Berkshire Hathaway Annual Shareholders Assembly in Omaha, Nebraska on Might 4, 2024.

CNBC

(This text is from the Warren Buffett Watch publication. Sign up here.)

Warren Buffett has added round $6 billion to Berkshire Hathaway’s sizable money pile this summer time with a string of Bank of America inventory gross sales since mid-July.

In response to a new filing Friday, gross sales of 21.1 million shares on Wednesday, Thursday, and Friday generated $848.2 million, which is a median worth of $40.24.

Berkshire has offered Financial institution of America shares for six straight periods. Because it started to scale back its holding on July 17, it has offered shares throughout 21 of the previous 33 periods.

In whole, Berkshire has reduce its BofA holding by 14.5% with the sale of 150.1 million shares for $6.2 billion. That is a median of $41.33 per share.

BofA is Berkshire’s third largest equity holding, accounting for round 11% of its portfolio.

Berkshire stays Bank of America’s largest shareholder with a 11.4% stake of 882.7 million shares valued at almost $36 billion.

Because the gross sales proceed, nonetheless, it’s approaching the Vanguard Group’s 639 million shares.

Whereas there are several theories on why Berkshire is promoting a inventory that Buffett stated as recently as last year he didn’t want to sell, regardless of his considerations concerning the banking sector general, there’s been no rationalization from Omaha thus far.

Buffett turned 94 on Friday. As of June 30, Berkshire’s money pile stood at a file $277 billion.